Forex Broker Commission vs Spread Explained

With many markets there are a lot of trading costs associated with making and exiting trades.

With the stock market you will often have to pay both a commission and spread on your trades and will also be charged when entering and exiting.

With the Forex markets there are different pricing models. Often these charges are not at first clear, but in this lesson we will show you how Forex brokers charge you for your trading, and the best options for you.

How Brokers Make Money

To understand what price model you should use for your trading and if you should use spread or commission, we first have to take a look at how brokers make money.

Forex brokers make money one of two ways. The first way is by adding spreads and commissions onto a traders trade to make a profit.

The other way a broker makes profit is to make a market and profit from a trader losing. In other words; the broker takes the other side of a traders position and profits from their loss.

How brokers make money from spreads and commissions is through using what is known as Straight Through Processing (STP).

A STP broker takes your trades and automatically processes it through to their group of banks and liquidity providers.

The group of banks sends back a price, the broker adds a spread on top of the price and the broker profits from the spread they charge to traders.

With this model of broker you have a choice of not paying commissions and paying a slightly higher spread, or you can pay a commission on each trade and pay lower spreads.

The market maker does not operate this way. They take the retail traders trade that they have ordered, they will normally have a book of orders that they are trying to match because they are making a market and they are actively trading the other side.

The market maker can see the retail traders stops when they come through. They can see their targets and it is in the market makers best interests for those targets not to be hit and for the stops to always be hit because the market maker directly gains. There is a clear conflict of interest.

It is up to each individual trader which broker they go with, but there are some important factors that brokers should meet and these are discussed in our trading lesson here; Recommended Forex Broker & Charts for Traders which goes through exactly what brokers should provide you.

Different Trading Costs – Commission vs Spread

Spreads

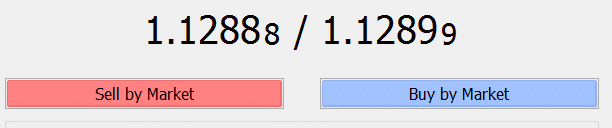

The spread is the difference between the bid and ask price. If you open your trading platform you will notice there is always a difference in the price you can buy and sell. This difference is the spread.

An example of this may be the EURUSD 1.1288 – 1.1289. The difference in price is the spread markup.

You will only pay the spread once per round trip; that is you only pay the spread once per completed trade.

Note; spreads can vary widely from Forex pair to Forex pair and when you are trading. The major pairs that are heavily traded will have the smallest spreads and the more exotic pairs will have far larger spreads.

You will often notice that when there is a large news announcement or market turbulence the spreads will greatly increase before again settling down.

Commissions

A lot of brokers will offer you the choice of paying no commissions and a slightly higher spread, or you can pay a commission on each trade and be offered smaller spreads.

These different accounts will often have different names and service levels and is something you will have to research to see what suits your style of trading best.

Recap

If you choose to go with an STP broker and pay a commission for each trade you will often be getting access to spreads that can start at 0.00.

Whilst you will have access to very tight spreads, be aware that whilst you only pay spreads once per round trip, commissions are charged for both entry and exit.

Spreads are very transparent in the Forex market. Make sure you do some quick math before working out what sort of account suits your trading style the best.