How to Find and Trade the False Breakout in Your Forex Trading

Do you often get faked out of the market or enter a trade just to watch it quickly turn into a false breakout?

Sometimes that is unavoidable, but often there is a price action clue and a footprint of where price is about to make it’s very next move if we know where to look and what to look for.

In this lesson, I am going to show you what ‘price action footprints’ you should be looking for, and why the false breakout is so powerful when you know how to use it correctly.

The Power of the False Breakout

The False Breakout is my favorite setup for a few reasons, but the two main ones are;

- it can be traded on many time frames

- it can be traded with many triggers as the major entry

So what exactly is the false break and why is it so powerful?

The False Break = FB is when price makes a move in a one direction – normally out of a major / or key level, and then snaps quickly back in the opposite direction.

It is what happens to the order flow and the traders in the marketplace that create the fast movement that we are interested in.

When price first starts it’s break in this example lower through the support, a large majority of the market start jumping on board to go short and to go with the breakout lower.

Then the snap back higher starts and all the people who are short start having their stops eaten.

This sees the market speed up even further as price moves back higher and the False Break is created.

This opens up a ton of potential high probability trading opportunities for you as long as you understand where you need to begin looking for them.

Checkout the charts I have attached for you below…

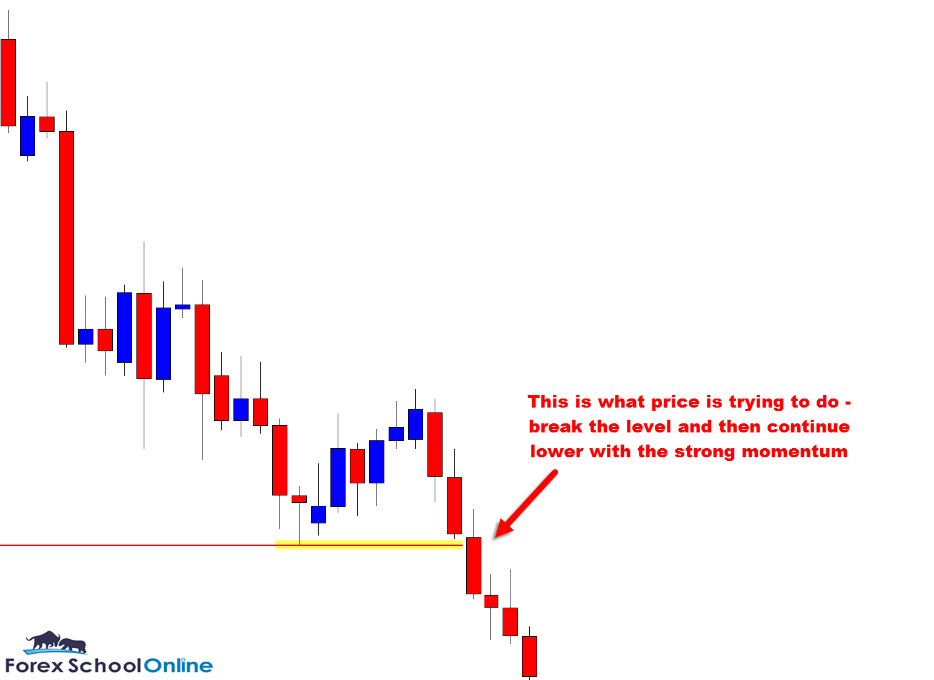

Chart 1 example:

This is what would happen if price did not create the false break and it did break lower. It is what price is attempting to try and do;

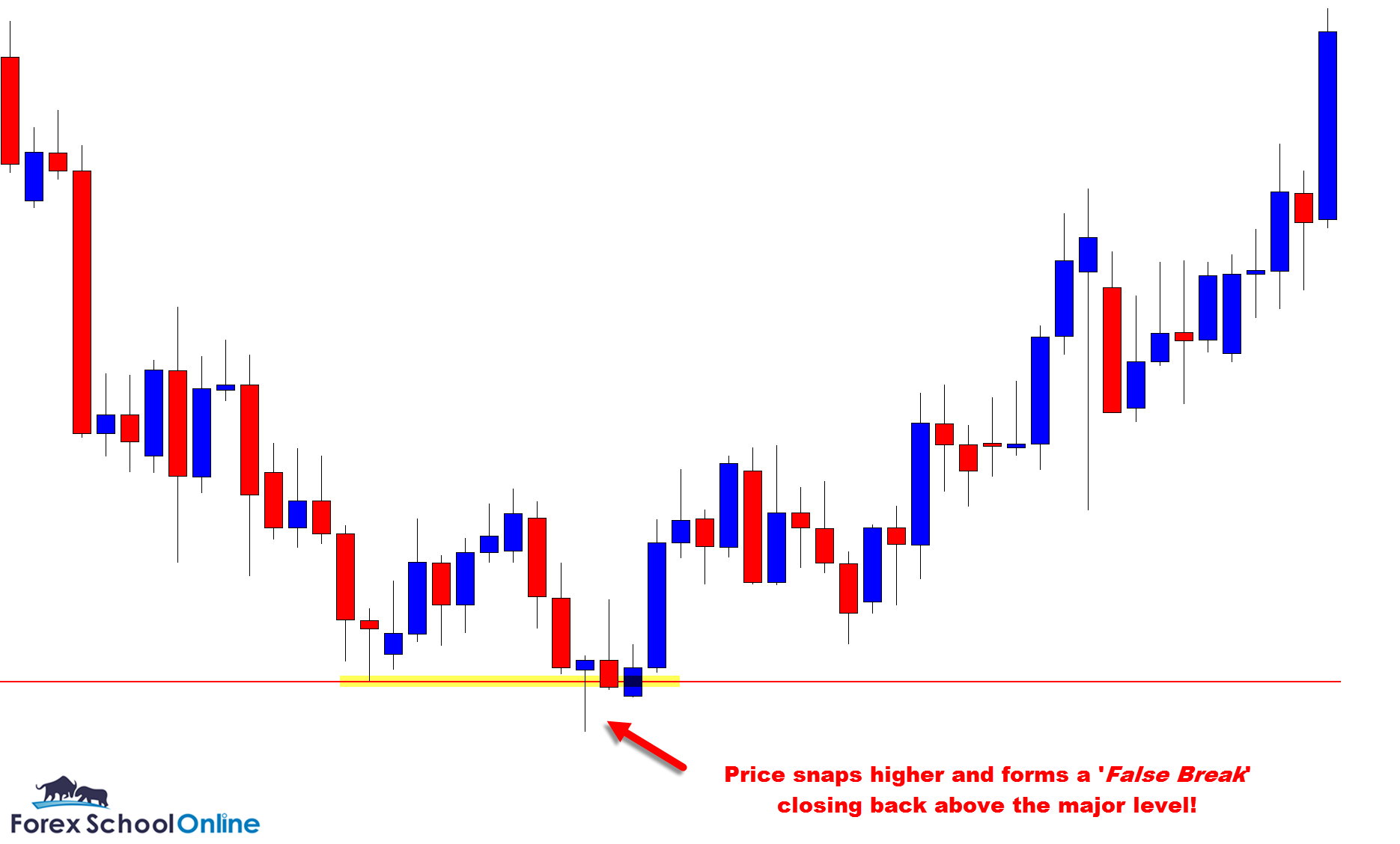

Chart Example 2:

However; price does snap back, rejecting the major level, closing back higher and creating the false break and pin bar reversal!

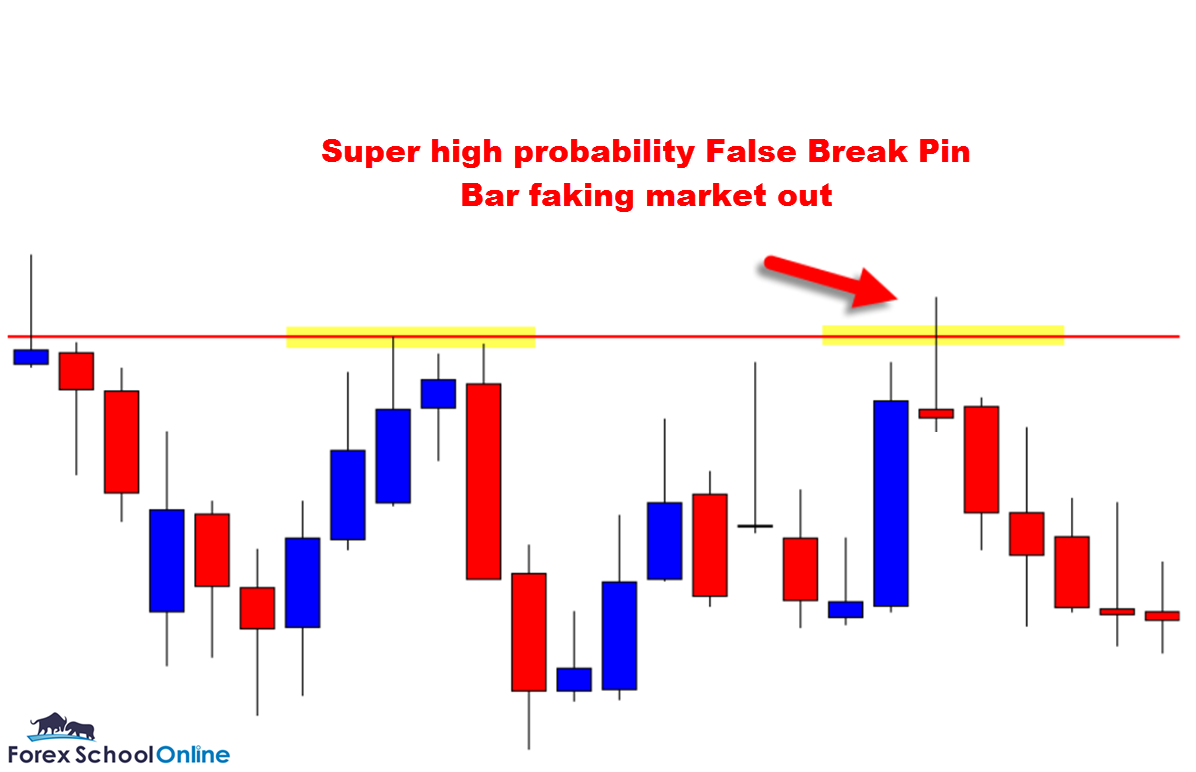

High Probability False Breakout Chart Example

The Pin Bar False Break Setup

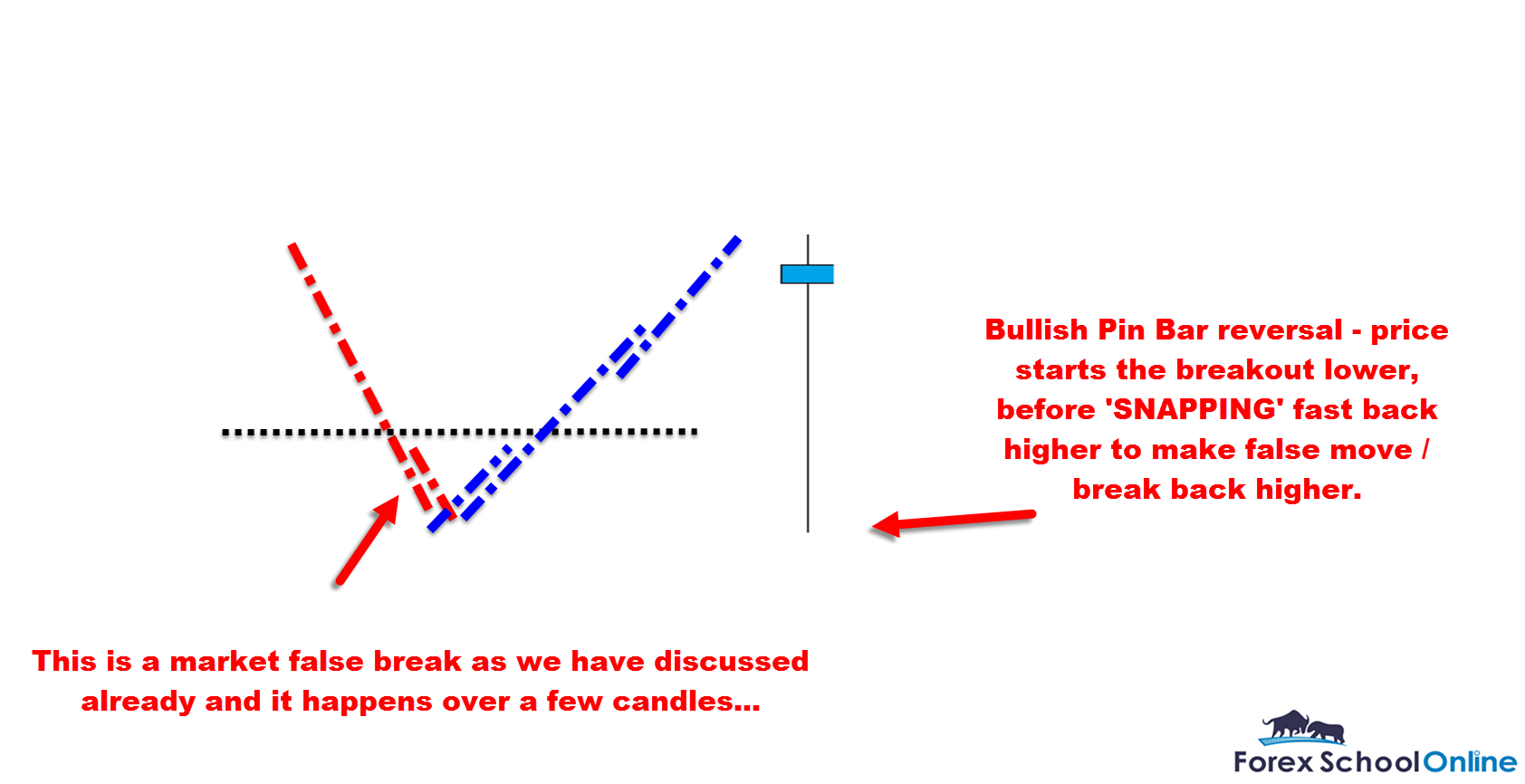

In this lesson, I am not going to go into how to play the false break, the ins and out of it and the advanced strategies what trigger to use to enter it etc, but the pin bar is basically a false break but just one time frame.

On the chart below, I show you how price quickly moves, then snaps back.

This is the same as what the false break does. Price gets the market moving in a certain direction, and then ‘tricks’ them or fakes them and moves them back the other way, catching them out!

Chart example;

Where You Need To Watch For False Breakouts…

You want to be on the right side of the market and making sure that when price snaps back you are ready to pounce and join the ride if it is a suitable trade setup.

The first thing you need to do is make sure you are not making trades into areas of concern, placing your stops at positions that will hurt you or managing your trades into places where price is about to snap and turn against you.

A lot of traders make entries into an area that make it hard for them to ever manage their trades successfully and then watch price quickly snap back against them.

Once we find a really high probability looking setup we need to fully assess it for how it will perform once we fully trade it and manage it. If this does not make sense or if you have questions, send me an email or LEAVE A QUESTION BELOW IN THE COMMENTS.

Placing a False Breakout Trade

When you make a trade and especially a false break trade your entry is all about entering with the strong MOMENTUM.

You are looking to enter with the market snapping back with your favor, quickly and strongly. I am going to continue using the same charts example to help you see the same images…

To increase your chance of making a winning trade, you want to enter your false break using a trigger signal, something like the pin bar we discussed above.

To enter this trigger, you are going to use confirmation because the last thing you want is have price false break you after it has just made a false break!

I recommend after this lesson taking a moment and reading the lesson;

Super High Probability Price Action Trigger Entries

This lesson will show you how you can take your entries with confirmation, in other words; enter once price has broken the high or low of the trigger signal to make sure the false break has definitely occurred.

It means you are trading with the strong momentum and confirmation – a lethal combination!

You can do this from the daily chart to as small of a time frame as you are comfortable and you are profitable trading.

Very Lastly a False Break is…

The last thing I want to leave you with in the quick price action lesson is that a false break is not always a huge market snap up and back or vice versa.

It can often be a trickle above the highs/lows and then the snap back the other way.

Or what is VERY COMMON… price forms a pin bar which you may have noticed because you have been in the trade yourself, and then price moves right up to the high or low of the nose of the pin bar, just past it, AND THEN – snap back!!

Why Does Price do That?

If price has formed a pin bar, it means it there was a rejection of a level and there were traders rejecting that certain level. It also means there is a high chance that if price moves back to that level that price could once again stop at that same level.

The false break is my favorite setup and has been for quite a number of years because if gives me a huge amount of flexibility and allows me to trade on a large variety of markets and time frames.

Like the highest probability of price action setups there are ‘key rules and steps’ you should follow step by step.

If you have any questions or comments please just post them below in the comments.

Safe trading,

Johnathon

Join The Telegram Group To Get Your Forex Trading

- Instant Access To The Beginners Course

- FREE Trading Signals

- Start Making 700 pips per week

Hi, Johnathan

What a marvelous and informative article, I must say not only the one dealing with false breaks but all your articles are well articulated and highly interesting.

Thanks very much for such good and valuable lessons!

Hi Jonathan,

I have been reading a bunch of your articles on ForexSchoolOnline and its really good – a lot of points have been covered which are not clearly articulated elsewhere.

Apologies but I feel you have not explained the “price action clue” and “a footprint of where the price is about to make its next move” in the article about how to find the the false break as per the following quoted from your article.. Could you elaborate on this please? Thanks and much appreciated!!

I quote :

“Sometimes that is unavoidable, but often there is a price action clue and a footprint of where price is about to make it’s very next move if we know where to look and what to look for.”

Unquote.

HI Sam,

understanding the breakout and reversal itself may help with this a little better. Checkout the video and lesson here; https://www.forexschoolonline.com//breakout-trading/ and here; https://www.forexschoolonline.com//read-price-action-market-reversal-take-advantage-happens/

Johnathon

Hi Johnathon,

Great article. Just one question, when trading false break, should it be in the market trend direction or against it?

Hi Shayan,

the false break is a reversal, meaning you can either look for play when price rotates higher or lower within the existing trend, or if more aggressive use it as a tool to make counter trend trades.

You can also use it to swing trade range markets, trading from the major highs and lows.

Safe trading,

Johnathon

Excellent article. I play false breaks all the time. Thanks for useful tips.

Heya Roy,

once of my fav setups and also one of the highest probability when done right.

Johnathon

Hi there Johnathon I want to be a member I am new to forex so I need guidance

i am from india and i am improving my learning from this article

It’s great to have you on the site Narendra!

Johnathon

I love this article very educating

Hey your welcome Taiwo – let me know if you get any questions.

Johnathon