Pin Bar Reversal

The Pin Bar reversal is without a doubt one of the most powerful and reliable price action trading signals that can be traded across many different markets and time frames.

It is very simple to identify and most new traders can very quickly learn how to spot this two candle formation.

NOTE: Not sure what the pin bar is or how to trade it? Watch two pin bar trading videos here;

False Break Pin Bar on the Daily Chart Time Frame

How to Trend Trade Using the Pin Bar (trade example)

The Pin Bar can be a super high probability trading signal once the trader has perfected and learned under which circumstances they should be trading it and MORE importantly; the other pin bars they should be avoiding and NOT trading which is what we will take a look at and help you learn today!

Pin Bar Pitfalls

I receive a lot of emails from traders discussing Pin Bar reversals or what they term Pin Bar reversals that are leading them to get into trouble.

There are major common problems with the Pin Bars they are entering which I have now realised is a really common pattern among traders trading Pin Bars in the trading community which has led to me make this article today to hopefully help some traders back on track with this super high probability price action signal.

The Three Major Problems I am Noticing:

- Trading Pin Bars that don’t meet the basic Pin Bar criteria.

- Trading Pin Bars from incorrect areas on the chart which is getting traders into trouble

- The Pin Bars are not sticking out and away from all other price and have no room to move

The best A+ high probability Pin Bar’s all have the same criteria, but to first qualify as a Pin Bar they must meet some very basic key points and form on New York close 5 day trading charts.

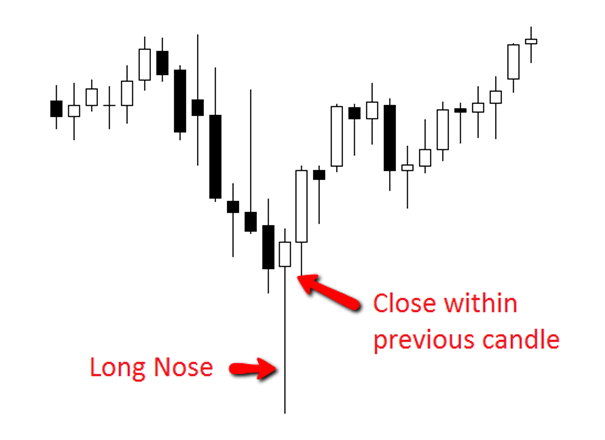

A Pin Bar must have:

– Open and close within previous candle

– Candle wick minimum 3 times the length of the candle body

– Long nose protruding from all other candles (must stick out from all other candles)

Bullish Pin Bar Example:

Trading Pin Bars When They Don’t Meet Basic Pin Bar Criteria

The criteria that the Pin Bar must meet is pretty simple, but what I am finding is people are trading what they are thinking are Pin Bars because they are unaware of what the true criteria for a pin bar is (hence my article). This is getting them into huge trouble time and again as it put them into super awkward positions in the price action story.

They have either been taught that way or they have watched other traders in forums do it that way or they have just picked it up along the way. They are then placing losing trades because of these false Pin Bars and wondering what the problem is.

The rules for a Pin Bar are clear-cut and they cannot be fudged. These are the types of rules your write down in your plan and follow and are very clear.

They either meet the criteria or they do not. For example; the price either opens or closes within the previous candle or it does not. There are no if’s or butts and this is exactly what traders need for their trading.

All traders need a clearly defined trading method that they can go into the markets with so they can clearly define whether it is or is not a signal that meets or does not meet their trading criteria.

Trading Pin Bars from Incorrect Areas on the Chart, Which is Getting Traders into Trouble

This is the most common and also the most misunderstood. This is also the major issue that gets traders into trouble the most and what costs traders the most losing trades.

If traders don’t fully understand this, they will continue go on struggling with the pin bar until they fully have a firm understanding of it. The first major point traders have to understand is;

– The Pin Bar is a reversal signal and NOT a continuation!

What this basically means is that the Pin Bar has to be used ONLY to pick price to reverse. It is a reversal signal, hence it’s full name is the “Pin Bar Reversal”.

This is CRUCIAL:

[dropshadowbox align=”center” effect=”raised” width=”auto” height=”” background_color=”#ffffff” border_width=”1″ border_color=”#dddddd” rounded_corners=”false” inside_shadow=”false” ]A major reason why traders get themselves into all sorts of pickles over and over again is because they try to play the pin bar as a continuation signal and it is not.[/dropshadowbox]

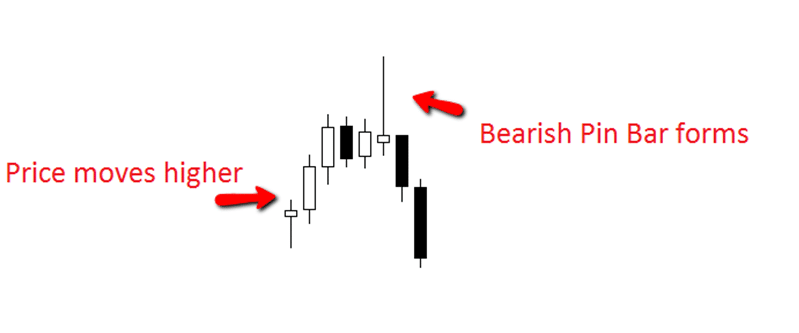

To play the pin bar as a reversal it means we have to pick price to reverse and from swing points. If we are to play a bearish pin bar and pick price to move lower we first need to have seen price moved higher so we can pick price to reverse.

We can’t play a bearish pin bar reversal signal if price has not first moved higher. An example of this scenario is below. You will notice how price first moves higher and then after this price forms a bearish Pin Bar. This pin bar is picking price to reverse lower.

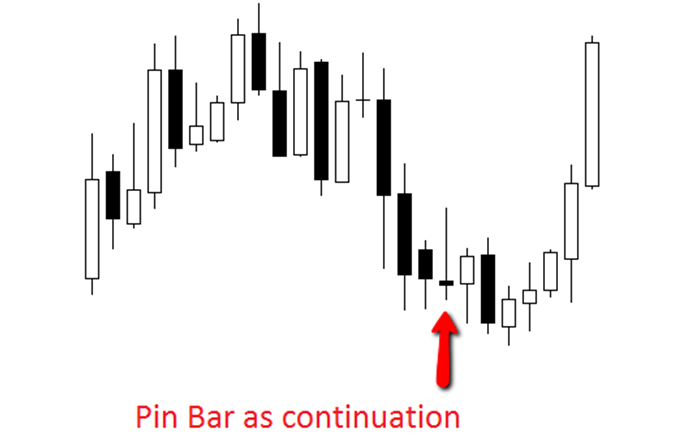

An example of what not to do and what I see a lot of is below. On this chart below the pin bar is traded as a continuation rather than as a reversal as all pin bars should be.

This pin bar is a bearish pin bar the same as the pin bar above, but unlike the pin bar above, this pin has not been played after price has made a move higher and picked to reverse price.

This pin bar has been played to see if price can continue to move lower. The trader who plays this pin bar will be selling low and hoping to buy back lower.

Forex is the same as in any business in life. To make money you must buy cheap and sell expensive or buy low and sell high and it is the same on the charts with Forex pairs.

Below is another example of what not to do, but this time with a bullish Pin Bar. The other problem that traders will encounter when they trade pin bars as continuations rather than as reversals is that they will nearly always be trading straight back into the recent support or resistance area and that is never a smart play.

Traders want to be trading away from support and resistance and not into them.

No Space / Traffic!

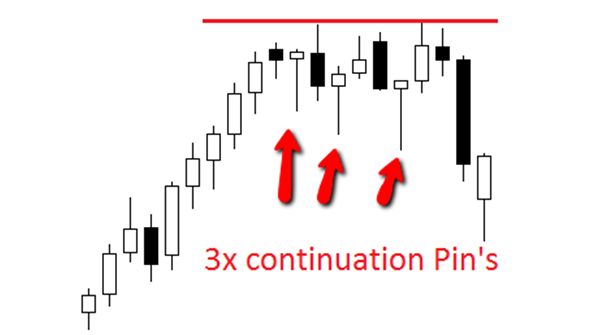

You will notice with this chart below that it had three pin bars that were all continuations rather than reversals.

Because they were continuations they had the major problem of trading straight back into the recent highs which were the near term resistance that is nearly always a problem when trading pin bars as continuations. As you can see on the chart; this resistance held and pushed price lower.

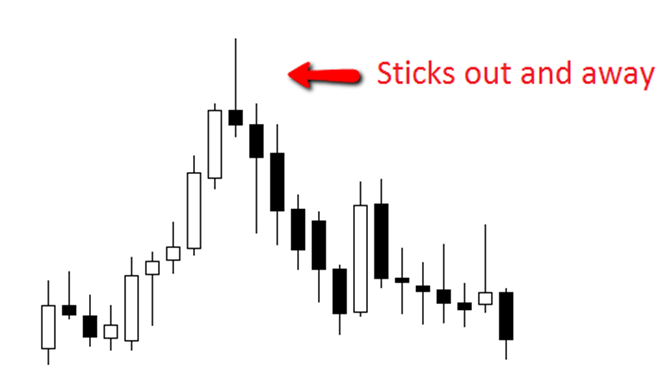

The Pin Bars Are Not Sticking Out and Away From All Other Price and Have no Room to Move

The very best pin bars stick out and away from all other price. They are not hidden away and back in traffic. A large myth with new traders are they want to find the smallest pin bars as they can because then it will give them the smallest stop and the biggest risk reward.

What this fails to acknowledge is that the bigger the rejection and the bigger the pin bar the more powerful the signal. The best pin bars are the large and obvious candles that as soon as you flick over to your chart you notice them.

These are the pin bars that stick out like a sore thumb right there on the screen screaming at you to trade them. They stick right out and away from all other price with their large noses protruding well away from all other price.

All good pins need to have to have their noses sticking out and away from all other price and if they don’t, then they do not fit the basic first three criteria.

The chart below is a great example of a Pin Bar that sticks out and away from all other price. Firstly, notice how it opens and closes within the previous candle and then notice how price has moved higher before forming the pin bar.

This pin bar is being played as a reversal which means it has space and is a pin bar valid trade. Lastly, notice how the nose of the pin protrudes right up and away from all other price and sticks right out.

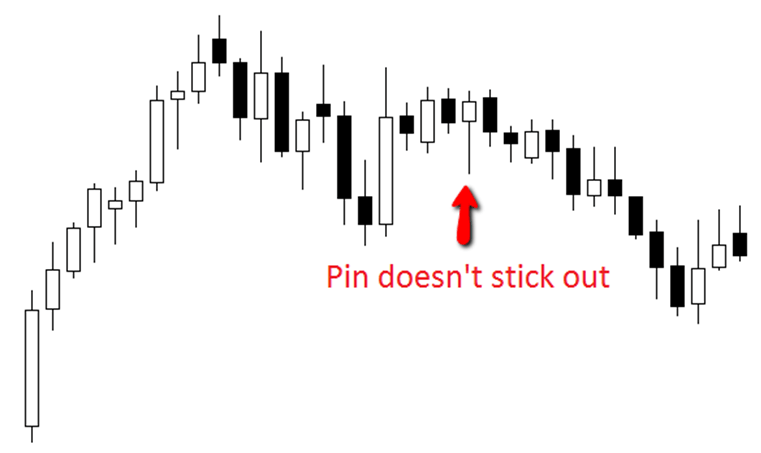

The chart below is a common chart of a pin bar that I often see traders playing.

Notice the difference between the pin bar above and the pin bar below. The pin bar above is large and obvious. It sticks out and away from all other price and has room to move.

The pin bar below is small and in the middle of price. It is a bit of an indecision candle and does not stick out from price at all. There is a clear difference between the two setups.

Discipline, Sticking to the Rules & Not Bending Candles to See What You Want to See

Learning how to do something is not always the hardest part to becoming successful at it. The pin bar can be a great trading setup for a price action trader to have in their arsenal, but if the trader is going to use it in the long-term they are going to have to have set some strict guidelines.

As mentioned above for a trader to succeed long-term they need a clearly defined trading strategy so that they can go into the market and know exactly what is and is not a valid trading setup under their trading criteria. As discussed in this article there are some pretty simple and clear-cut rules with the pin bar.

Once most people understand these rules it is not the understanding they struggle with, it is having the discipline to follow the rules and only trade when the trading criteria is met.

Whereas, the professional trader will sit and wait for the market to come to them and produce exactly the signal that they are waiting for, the amateur will go running off into the market like a headless chook pleading for the market to give them signals because they just want to be in any trade the market will give them.

This is the time that instead of waiting for the market to give them the valid pin bar, the amateur trader will instead start to “bend” and “twist” all sorts of different candles to make a pin bar.

Before you know it, the amateur trader is in a bunch of different trades of what they are calling “Pin Bar” trades that are nothing even close to pin bar trades and this is where it gets back to having the discipline to follow the plan and rule set.

We talk more about the keys to price action trading including support & resistance, using trends and setting up trades in our Free Price Action PDF Guide you can get get below.

Recap

Anyone who has ever traded the Pin Bar will know that it can be a really powerful and reliable price action trading signal. Of course not all pin bars are created equal and of course we do not trade the pin bar by itself. The pin bar is just one candle on a chart full of many candles and we need to take into account the whole price action story when trading the pin bar.

If you you have any questions, post them below along with your comments about this lesson or anything else!

Safe trading,

Johnathon

I am a first timer in the forex trade. However, I enjoy your school lessons and will like to know more, keep it on.

Good afternoon and merry Christmas, is an excellent article, I have a little doubt, when it says that the pin bar must be accompanied with the analysis of price action, refers to the price action patterns in S / R (failures, traps , double floors and climax)? Given that they are repetitive patterns, where would you expect a pin bar for an optimal input?

Hi,

a brief intro can be found here; https://www.forexschoolonline.com//support-and-resistance-the-key-to-price-action-trading-forex-lesson/ with a lot of other lessons in the strategy / log section discussing the same themes.

The pin should confirm a high probability price action story that you have already found.

Safe trading,

Johnathon

I think trying to find reversal patterns is much harder than following the trend, trends last for months weeks years in some cases. Although I admit your arguments have merit they are to pattern based, price action seldom changes….

Hi Tariq,

there is a difference between looking for the market to reverse (i.e a trend change), and using reversal triggers such as the pin bar to enter within a trend.

Often the best way is to look for the momentum and prevailing trend and trade in the direction with these reversal triggers. This is done by looking for price to move back into a swing high / swing low value area and then trading in direction of the trend.

This is discussed more in-depth here; https://www.forexschoolonline.com//swing-trading/

Johnathon

Avoid adding bollinger bands ( and/or donchian ) for the pin bar pin to penetrate for confirmation of support/resistance at your peril.

Hello, Jonathan

You Said Pin Bars Nose Must Stick Out From All Other Price Action….

Lets Say For Instance

I Am Trading The Ranging Market Of 1 Hour Chart Which Contained 70 Candles .

Then A Bearish Pin Bar Appeared To Be The 71st Candle On Reaching The Resistance Level And Potrudes Through The Level But Didn’t Potrude Through Only The 50th Previous Candles. Is That Pin Bar Valid

Hi Louis,

this depends on; what the previous candles had been doing.

Just because price is in a range does not mean price cannot move to a high or low and create a reversal pin bar.

If price had been moving straight sideways however in a tight box / consolidation and then it formed, it would be hard to see how this could be at a swing high/low and away from other price.

Safe trading,

Johnathon

Thanks jon

one of the criteria you mentioned for pin bar to be correct was “Open and close within previous candle”, does that include the wick of the previous candle?

Hi Ibrahim,

yes; price must open / close within the candle – wicks & body.

Johnathon

after long bearish coming good reversal pin bar then next day appear red candle what does it mean. is price indicating go down or up

Hi Amit,

for a bullish reversal or move back higher?

The type of candle, where it has formed; for example the trend, surrounding support and resistance, where and how the candle closed will tell you a lot.

You will also need to think about your entry strategy, and how you are going to manage your trade.

Read about entries here; https://www.forexschoolonline.com//are-your-entries-blowing-up-your-trading-account-high-probability-price-action-entries/

Johnathon

Hi Adeyemo,

The points I have covered above such as; the price action story, where the pin has formed on the chart, if the pin is with the trend or against, if the pin is sticking out and away from price, if the pin is large or small, is the pin making false break, is pin rejecting key support/resistance etc etc; are far more important considerations that if the pin bar closes bullish or bearish (the color).

In 99% of cases it does not matter if the pin closes bullish or of it closes bearish. The importance is on where it closes and how.

An example time it would matter is if there was a key support or resistance level around and we wanted to see price close above this key level to know that price had closed above this level so that we were not going to get trapped below a key level, but for general pin bars the close ‘color’ does not matter.

Johnathon

Please does the color of reversal candle matters for both bearish and bullish reversal or continuation.

Jonathon – one of the clearest explanations of what to do and what not to do when looking for A+ setups with a pin bar.

I primarily use 2 key things – pin bars (for reversals at key SR areas), and inside bars (for continuations between key SR areas).

Any chance of a similar simple, clear explanation of a continuation set up – again what to look for A+ trades vs others you leave alone?

Cheers!

Heya Phil,

we don’t discuss continuation setups in public section in here, but you can find a ton of stuff on trades to avoid and IB’s etc.

Either search for what you are looking for at; https://www.forexschoolonline.com//blog/

Or checkout; https://www.forexschoolonline.com//how-to-avoid-the-dreaded-sucker-setup/

Safe trading,

Johnathon

Hey Johnathon, are there any rules regarding the nose of the pin bar?

Hello Martin,

yes there are. There are three basic criteria for the pin bar for the pin bar to be valid and to be a basic, valid pin bar before we start lookng at other things like the price action story and major levels, space and management etc

Please read the basic pin bar lesson here: https://www.forexschoolonline.com//pinbar/ and feel free to watch the pin bar trading videos.

Johnathon

Hey Johnathon, when you say a pin bar MUST have the criteria you mentioned, does this mean that you measure the wick and the body of a potential pin bar, and strictly trade only the ones, which have 3 times longer wick than the body, or is there some buffer zone, if the wick is only 2.98 times longer than the body for example?

Best regards

Johnathon,

Does the “pin bar” need to open and close within the body of the preceding candle?

Hello Rosey,

please refer to the top of the article and the pin bars criteria for what the pin bar must have. If still have any questions or confusion then just let me know.

Johnathon

wonderful put up, very informative. I wonder why the other

experts of this sector don’t understand this. You must

proceed your writing. I am confident, you have a huge readers’ base already!

I have been relief because i have concluded that price action sometime give fake signals as other lagging indicators does. but with this understanding presented i can now trade better. thanks a lot sir…

so happy to read your comment . but plz if u know the more about the trading strategies and the best ways of trading would you be in connection with me .thanks

Is it true that pin bars do not rely on whether or not they are filled to be considered reversal setups? I was told some time ago that whether the color of the bar is bullish or bearish isn’t important. They could equally indicate a reversal. Is this true?

The points I have covered above such as; the price action story, where the pin has formed on the chart, if the pin is with the trend or against, if the pin is sticking out and away from price, if the pin is large or small, is the pin making false break, is pin rejecting key support/resistance etc etc are far more important considerations that if the pin bar closes bullish or bearish.

In 99% of cases it does not matter if the pin closes bullish or of it closes bearish. The only time it would matter is if there was a key support or resistance level around and we wanted to see price close above this key level to know that price had closed above this level so that we were not going to get trapped below a key level, but just for general pin bars the close does not matter.

Johnathon

Great article. Really makes sense

Excellent!

Great explanation.

Thanks////Now I see my mistakes!

Good Info one can learn a lot from here

Nice stuff!

ThanksVery Informative

Your post is useful to me, it's nice! thank you.

Thanks for the article Johnathon. Greg Swaloski above posted an interesting comment which I also wonder about and would be interested to see a reply from you ,cheers mate

it's really not about a perfection of a Pin Bar… nor perfection of any another candle pattern for that matter…you change a tf from 1 hr to 1hr:05min and your perfect Pin Bar will not be perfect anymore….it will look completely different…the sooner you guys realize that the better for your trading…the not so perfect Pin Bar in the right context will be much better than some other perfect looking Pin Bar…ps. I mean it's enough to change the tf by couple minutes to realize that the whole trading is not about trading candle patterns and not about looking for perfect candle patterns… candles are a tool…but understanding the traders' decision that are hidden in the background of the candles is the true nature of this game…

Hello Greg,

Reall great comments, Thanks. Some of your points are bang on the mark and I agree with them especially with it being super important where trades are entered hence why a ton of my articles/videos are on the price action story and this very article spends over half of it on discussing how traders need to to stop entering pin bars into spots and then getting in trouble…….., but what you have also got to realise at the same time is all traders need a clearly defined trading rule set. Every trader needs a set of rules that they can go into the market that sets out clear parameters of what is and is not a trade and as for many this is causing them grief for the pin bar at the moment. The Pin Bar and how it has formed can give us great insight into the order flow of the market. Combining this with the rest of the price action story and we can have a really solid price action setups, but we need to have a rule set. We can’t just call anything a pin bar and twist and turn anything to make anything we want.

Safe trading,

Johnathon

thanks a lot for your teaching and I hope to be in connection .and I`m so honoured with reading your writings

Really nice article Jon. Thank u for all your work.

Could email this document I will would to print it and have refernece

Thank you Johnathon. I am one of the people who have sent you email and who you have really helped and you have helped me out of site with these pin bars. I really use to struggle with them and now I realise they weren’t even proper pin bars! Thanks again.

This makes a lot of sense, thank u!

nice expalanation

great post