Leverage in Forex for Beginners Fully Explained

When trading Forex, traders have the use of leverage.

Leverage can be a really dangerous tool for traders if they don’t understand it and don’t use correct position sizing. For the trader who is well educated leverage can provide a very powerful tool to build profits.

Leverage & Margin in Forex Explained

Leverage works by letting traders enter into trades with only a fraction of the money down. In straight stock trading, traders have to pay for every dollar they invest. For example; if a trader buys $5,000 worth of stock XYZ, they would then have to front up the whole $5,000 to buy those shares.

In Forex traders can use leverage to enter trades whilst only paying a small amount up front.

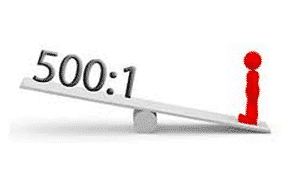

The most common leverage amount is 100:1. This means that for every $100 traded, the trader only needs to front up $1 to enter that trade. Recently in the US the government has brought in stricter rules with leverage in trading which states US brokers can only allow clients a maximum of 50:1 leverage.

In other countries outside of the US leverage ranges from 50:1 right up to 1000:1. If leverage is used as a professional tool 50:1 or 100:1 is more than enough to trade successfully.

Another example of using leverage would be; if trader Joe was going to place a $100,000 with 100:1 leverage, Joe would only need to put up $1 for every $100 of the $100,000 trade.

How this would work out in the brokerage account is that whilst the trade is open, the broker takes and holds the margin or the $1 for every $100 until the trade is closed. Once the trade is closed the broker gives back the money that was held and used as margin. In this scenario Joe would have to front up $1,000 margin to place the trade because that is $1 for every $100 of the $100,000 trade placed.

The reason that leverage can be a huge problem for the uneducated trader or gambler is because it allows them to enter huge trades with only a small outlay. Trading this way will increase the risks massively and lead to potentially wiping out their account.

If leverage is used in a more professional manner it can be used as a tool to manage risk and increase profits. I discuss how traders can use leverage like a professional and with the correct money management in this trade lesson; Using the Correct Money Management

What is Margin in Forex?

Margin goes hand in hand with leverage. Margin is the amount your broker asks you to place up front for any trades you are in. The amount of margin required by the broker will depend on both the size of the trade and how much leverage is being used.

If you are using 100:1 leverage the broker will require $1 dollar for every $100 you have in an open trade. If you are in a trade that is worth 10,000 you will be required to put up $100. The bigger the trade size the more the broker will require. The smaller the leverage the more the broker will require.

Margin is not money that the broker holds onto. When you close out your trade you will get your margin back, the broker just holds it as security for your trade. Whilst this margin is being held you cannot use it to place other trades. If you have a $5,000 account and with trades on have margin required of $2,500 you can only place trades using the last $2,500.

What Are Margin Calls?

Margin calls are something that a lot of traders are very scared of. This should not be the case and if traders are trading sensibly and not like gamblers they do not have to fear margin calls. Please read the above lesson on money management for how you can avoid margin calls.

A margin call is when your account is getting low and getting to the point where you will not have enough money to meet the margin requirement of your broker.

Margin calls can come when you make a trade that is too big for your account size and the trade begins losing.

If this losing trade starts to get close to the point where you don’t have enough in your account to meet the required margin, the broker will contact you. At this point you will be asked to either close out the trade or add more funds to meet the margin requirements. If you fail to do either of these the broker will close your trades.

What Are Trading Lots?

When trading Forex you will enter with what is called a “lot”.

A lot simply refers to how much of a currency a trader is trading. Instead of buying massive amounts of an individual currency pair a trader enters the amount of lots that is suitable. There are 3 main lot amounts which are:

- Standard Lot – 100,000

- Mini Lot – 10,000

- Micro Lot – 1,000

An example of entering a trade using lots would be as follows; Trader Joe wants to enter a trade buying 60,000 EURUSD. To do this Joe will enter 6x Mini lots.

Lastly

You can use leverage to your advantage, but you can also use it blow up your account incredibly quickly. Make sure you are using a position size calculator for every trade and never over-risking.

NOTE: Make sure you are using the correct demo charts to practice using leverage, margin and entering trades before risking real money. Download free correct demo charts here.