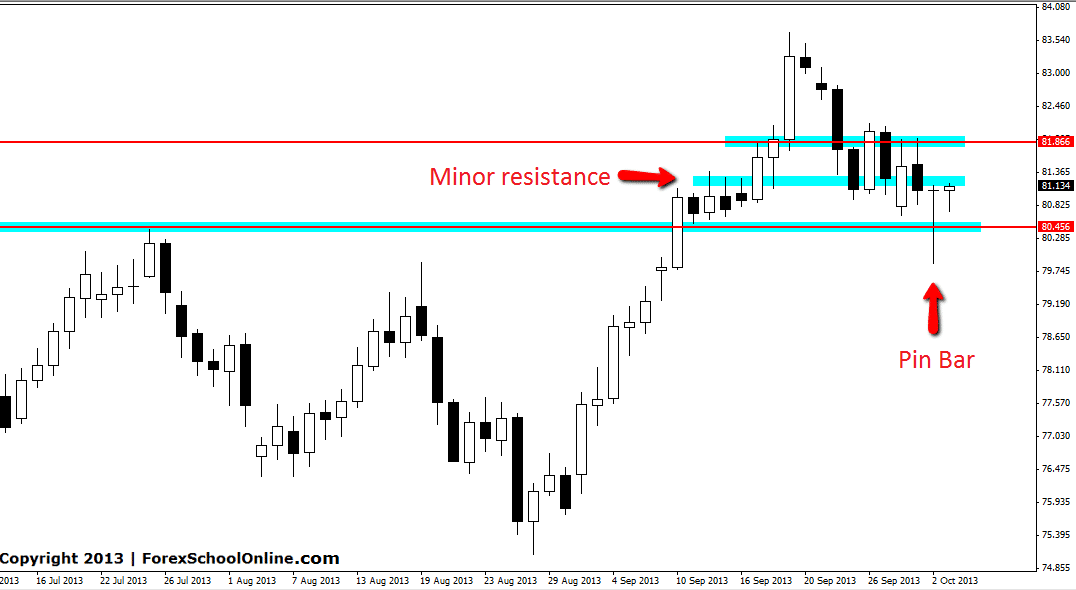

The NZDJPY has fired off a live bullish pin bar on the daily price action chart. This pin bar is rejecting the recent support level. Price during the daily session moved down lower to test the support before snapping back higher and creating the pin bar. Whilst this pin bar is valid and is sticking out and away from all other price; how all good pin bars should, it does have a few points that make it less than an A+ pin bar.

Just above this pin bar is a very minor resistance level. This resistance could get in the way of price moving higher. If price can bust through this area then it wont be a worry, but for any traders looking to take this trade it is a major concern. For price to have any chance of moving higher price will have to break the high of the pin bar. If price can gain momentum and move through the minor overhead resistance, the next resistance level comes in around 81.85.

NZDJPY Daily Chart

Special Note: All setups posted in this section are market commentary only and not trading signals. If you would like to know what Johnathon and the Forex School Online’s Coaches are trading in live time, you can join up to the Forex School Online Lifetime Membership where members gain access to the live price action setups forum plus a heap more. See here: Forex School Online’s Lifetime Membership.

I did not taken this pin bar trade as the price action suggests more downside

Yes, the resistance above is a concern, but we never even got there, well over 45 pips shy of it.

Yet it sold off anyway which = sellers were looking to sell below resistance and on rallies. If they were willing to sell below resistance, and away from the prior selling orders, it means they are still wanting to push this pair lower. They did this in the face of the pin bar, so obviously they were not concerned about it. This was all being communicated in the price action ahead of time. If someone wanted to get in on this pin bar, this level would have been better imo.

Ouch, i already take the trade…..

As I said in the post; the resistance above the pin bar is a major concern for any trader looking to take this trade. Whilst this trade is still valid price is going to have to break this resistance if it wants to move higher.

Thanks Johnathon..