How to Use Set and Forget Trading Strategies

A lot of traders who attempt set and forget trading strategies either don’t have the correct tools to help them do it correctly or they don’t stick to their rules and plan after a few failed trades.

Set and forget can be a powerful strategy and can free you as a trader both psychology and in time, but it can also be aggravating when it does not go right.

As we will discuss today; if you want to use ‘set and forget’ in your trading, then the correct tools will help, along with the mindset of how to use it for the longer term.

What is Set and Forget Trading?

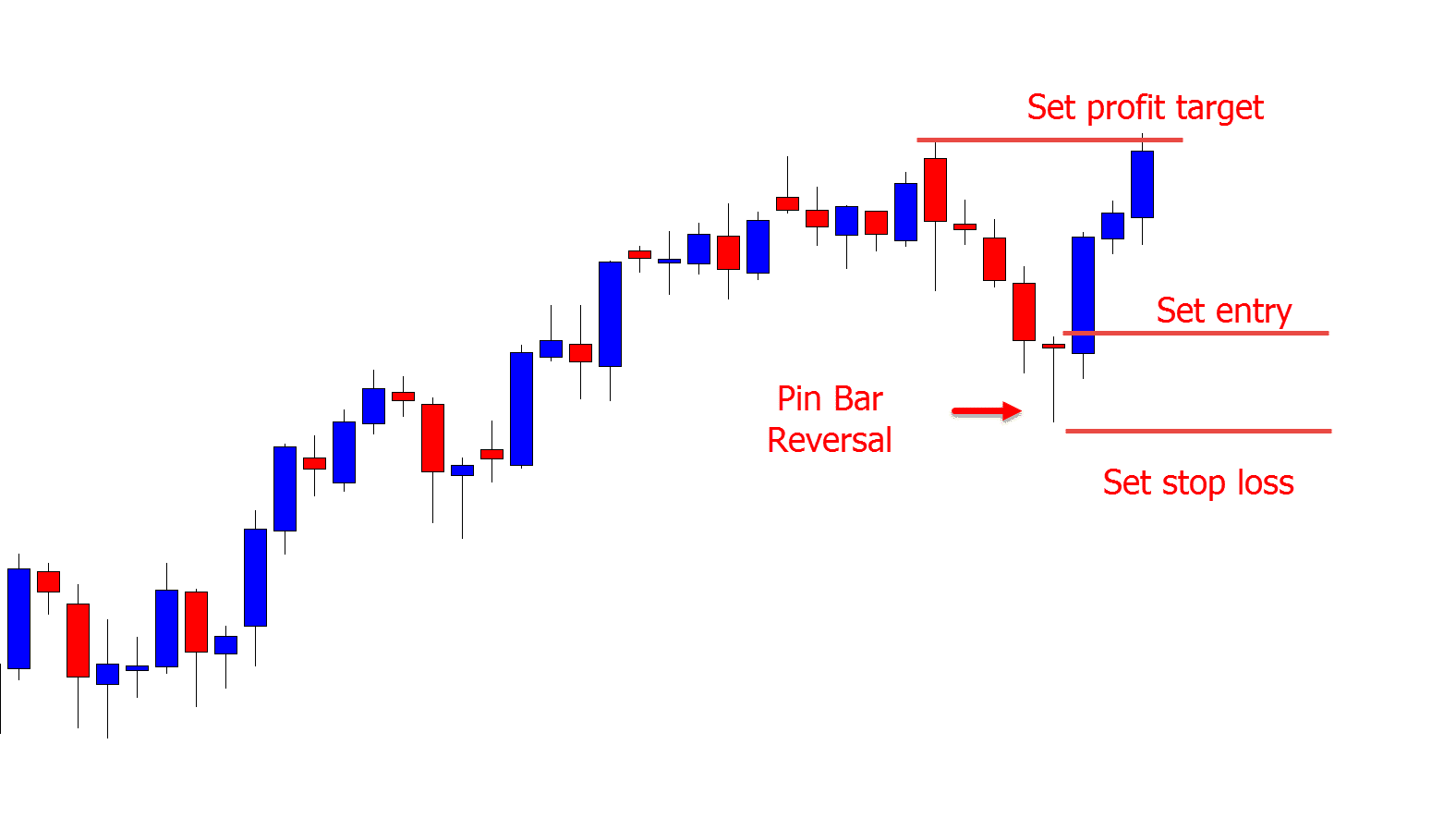

Set and forget trading is the process where you set all of your trade up at the start including, your stop loss and profit targets, and then forget it to let it either make a profit, or be stopped out.

You are “Setting” your trade up with everything it needs to run it’s course, and then “Forgetting” to let price move without you interfering.

This strategy is not for everyone, but it does have a lot of benefits. It can be incredibly helpful for those traders who don’t have the time to watch their charts all day long or the traders who prefer longer time frames and like to hold trades overnight.

See example chart below;

Advantages of Set and Forget Trading

A lot of traders have full-time jobs, are studying or just don’t have the required time to watch their charts and manage their trades as price ebbs and flows.

A lot of traders have also learned the hard way that watching price tick higher and lower is both super frustrating and leads to making rash and poorly thought out trading decisions.

When you set and forget your trades you are setting everything up at the start and then letting the market make you a winner or a loser. There is no constant watching or management needed.

This can help immensely with your trading psychology as you will make your clearest and best trading decisions before you have entered your trade and started risking money.

Once you have skin in the game and your profits and losses are whipping up and down, you are a lot more susceptible to the universal trading emotions fear and greed.

These emotions will often lead traders to make rash decisions like close their trades when in profit far too early so price does not turn against them, or let a loss carry on for far too long.

Set and forget trading takes this away. Your maximum risk and profit targets are defined before entering the trade and once you enter all you must do is wait for a result.

The Problems You Will Encounter With Set and Forget Trading

Whilst set and forget trading has a lot of positives, it also has some drawbacks and is not for everyone.

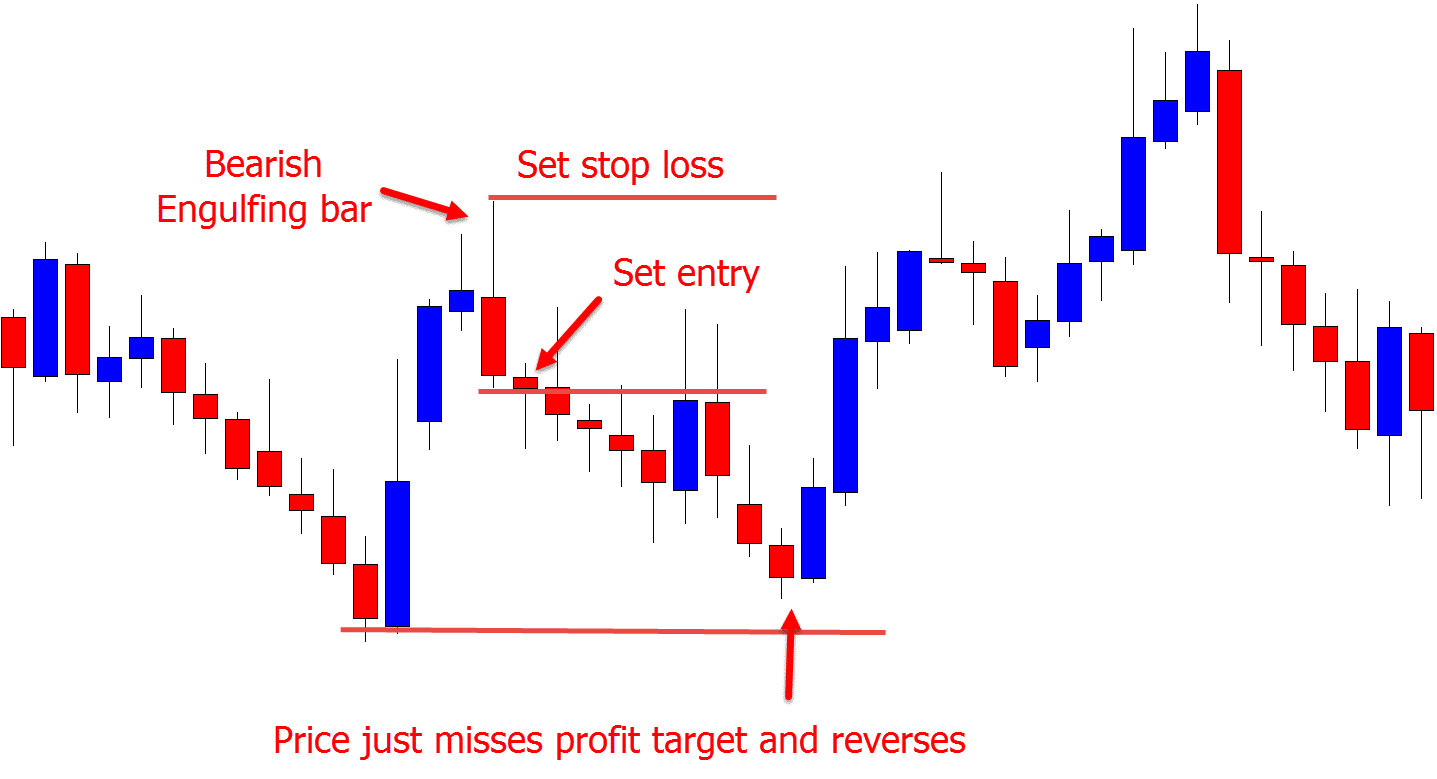

Some traders prefer to be more hands-on and actively manage their trading. Whilst that comes with its own set of challenges, it can prevent the times when price just misses a profit target and reverses.

If you are going to ‘set and forget’ you need to trade to make profits over a month and year and not individual trades. You must trade with an edge and goal to make profits overall and not throw everything out after one trade or bad result.

You have to accept that some trades you enter will go close to hitting your profit targets and then reverse to stop you out. This is part and parcel of set and forget trading.

See an example below; a Bullish Engulfing Bar forms, entry is taken and the stop loss and profit targets are set. Price goes close to hitting the profit target, but instead returns to take out the stop loss.

You can mitigate a lot of these risks as we will discuss in a moment using different tools and cut out a lot of the losses when this does occur.

However, this style of trading will help you perfect your profit target placement and overtime if you stick with it you will become far better at knowing where to take profits and where the highest chance is of price reversing.

How to Set and Forget Your Trading

To correctly set and forget your trades you need to be following the same process for each and every trade.

Before even spotting a trade to enter, you will need to know the amount of your account you are going to risk on your trade.

You should have a trading plan that contains these rules and includes how you manage your trades, the amount you risk each trade and how you set your profit targets.

Read about calculating your position size.

Once you find a trade you will then workout everything that is needed to see the trade from start to finish. This includes; where you will set your stop loss and where you will take profit.

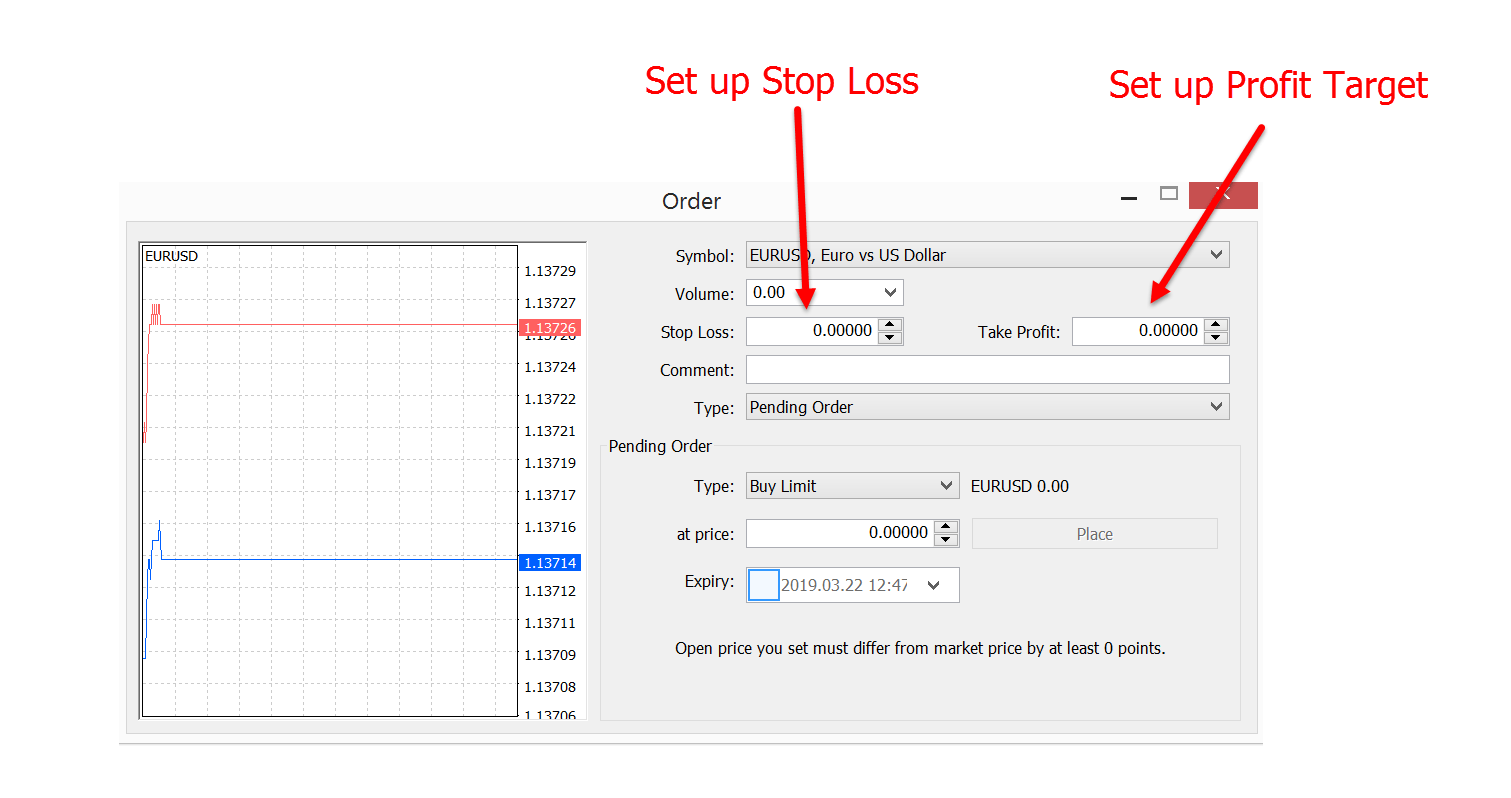

As soon as you enter the trade you will enter your stop loss and profit target/s into your trading platform and let price make its move.

How to Lower Risks With Set and Forget Trading

As discussed above; price can at times go close to your profit and then reverse, stopping your trade out in the process.

This is not just a part of set and forget trading, but a part of trading full stop.

You can minimize these risks by either having your stop loss move to breakeven, or trailing your stop loss.

This would mean that if price gets to a certain point, and this is a point that you choose and does not have to be your profit target, your stop loss would move to breakeven (your point of entry and a no loss position).

We posted last week showing how you can do this with a MT4 Trade Management Expert Advisor that will also help you increase your profits if you think price is a chance to run on to bigger profits. You can use it to have 1,2 or 3 different profit targets whilst also protecting your capital.

Lastly

Whilst set and forget trading is about letting price move without you being there, it is also about creating more time and freedom and not having to watch the charts every moment of the day.

If you still want to know what price is doing or get alerts when price reaches a certain level, you can create them so they come to your phone for free. Read how to do this at; Create Free Mobile Price Alerts

Set and forget trading is not for everyone, but it does have a lot of positives and can help a lot of traders who want to trade higher time frames, hold trades overnight or who simply do not have the time to monitor their trades.

Safe trading,

Johnathon

Any comments or questions please add to comments section below;

hi sir, for example i use risk reward ratio is 1:2, if price touch 1R, should i move stop loss to entry point + spread to reduce loss? thank

Hi,

how you would like to manage trades, take profit and reduce risk is your call.

Moving your stop from a full loss position into a breakeven or no lose position will obviously prevent a loss, whilst still allowing the chance for a win. It is also lessening the chance price will move into your full profit target as the stop is now closer to being hit which is why I say you need to work out what style suits you best.

Safe trading,

Johnathon

Thanks for this post. It is good to remember these information’s.

I can find my self in this. When I am trading during day it can happen that I intervene on trade even I should not. Impulsive reaction.

One of the best solution I use in long term trading i trailing stop. If I go into profitable trade I will not end in losing one if conditions for trailing stop move are fulfilled.