Quite a few Forex pairs have formed 2 bar reversals on the daily price action chart such as the USDJPY and GBPAUD charts. Whilst neither of these are perfect price action setups, they could be hinting at higher prices if price can break higher and gain momentum. In yesterday’s commentary we discussed a price flip level that price had broken on the GBPAUD where traders could target short trades if bearish price action presented. To read this original post see here: GBPAUD Price Flip Level Price did move higher and back into this old support/new resistance, however price cut back above this level without any bearish price action indications or setups. This level will now once again become a price flip level as price has closed back above and price has made a bullish 2 bar indicating that price may look to move higher over the coming days if it can confirm the price action signal.

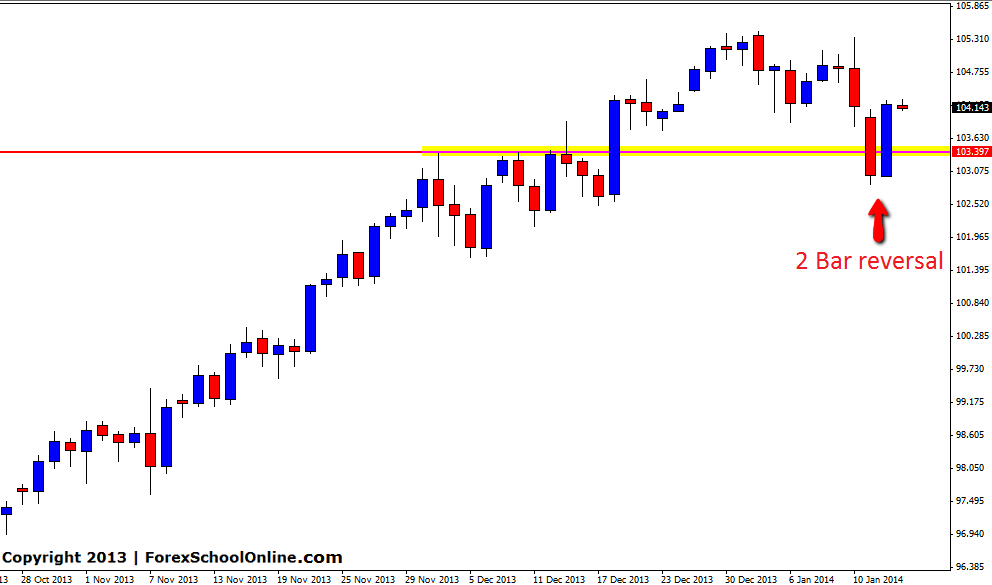

The USDJPY has also formed a 2 bar reversal that is rejecting a long term and short term support level. This 2 bar is inline with the up-trend that has been raging for many months now. One major issue for this 2 bar is that there is a very close resistance area over head which could cause problems for price trying to move higher. If price can manage to make any decent moves higher and through the close first resistance, the next major resistance is the recent swing high.

USDJPY Daily Chart

btw IMHO, A+ setup is not only referring to candle but the whole “story”

Thank you very much Fazliy.

There are three characteristics for me to take a trade:

1. Clear trend and no or very little ‘road block’

2. Enough pullback and enough for me to take first profit target and make breakeven

3. Very large PA candle, usually I like to trade using pinbar

I would like to wait to see what market do. If price move higher I would wait until the price is hitting the resistance 105.441. And if price move lower I would wait until the price hitting 103.381. Then will look for A+ PA setup. Johnathon have I taken the right decision?

Waiting for your kind advice.

I would not take either of this two yet, it is not an A+ setup for me…

Johnathon, I went "long" on USDJPY this night, I placed a pending order when it passes 104.263 to open the trade, and actually the pair passed it, I'm having some profit (little) and I was expecting that this 2 Bars were representing a bullish sentiment. After reading your article I'm a little bit confused… In your opinion USDJPY is going for a Downtrend? What is the signal that everybody needs to wait to confirm it?

Johnathon, I went "long" on USDJPY this night, I placed a pending order when it passes 104.263 to open the trade, and actually the pair passed it, I'm having some profit (little) and I was expecting that this 2 Bars were representing a bullish sentiment. After reading your article I'm a little bit confused… In your opinion USDJPY is going for a Downtrend? What is the signal that everybody needs to wait to confirm it?