Price Action That Sucks Traders In…

Common Price formations that Price Action Traders use to enter the market such as Pin Bars, Inside Bars, Engulfing Bars and Two Bar reversals form on all time frames, all pairs and regularly.

Traders that are new to the Price Action Trading method tend to get caught in all the excitement, as a result trades are placed and money risked unnecessarily on trades that should never have been entered.

Most Price Action educators or mentors focus solely on the correct setups to enter. They fail to teach which setups Traders should be cautious of. Obviously some Price Action signals are not worthy of risking our capital on. We should just watch them go by without entering as their location on the chart is not at a place where the Trader has a clearly defined edge.

This article will look at which setups Traders need to be wary of and the setups that Traders are commonly tricked into entering.

The Most Common Setups Traders Need to be Cautious of are:

– Price Action signals that form in the middle of the range.

– Price Action signals that form against a very obvious and strong trend.

– Price Action signals that are hard to spot.

– Trades that don’t break in the desired entry direction of the trade to confirm the Price Action signal.

Price Action Signals That Form in the Middle of the Range

These Price Action formations tend not to “stick out” from the Price Action around them. They don’t form at swing highs or swing lows but rather in the middle of a range. These signals are normally produced without a substantial pullback and form after sideways trading.

Another common occurrence with these signals is that they form in a lot of traffic. Price Action that has a lot of traffic or trouble areas around it will struggle to move freely from one area to the next. The reason for this is that all those traffic areas are Support and Resistance areas and when price encounters these zones, price is likely to react by struggling to break through easily, thus creating more range trading.

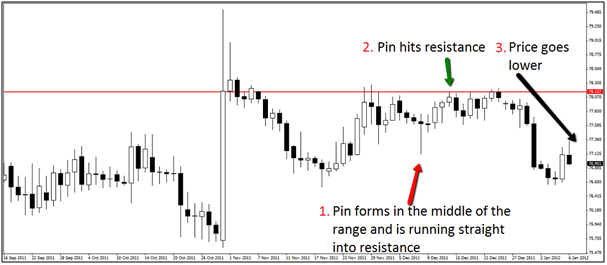

An example of a Price Action signal that is formed in the middle of a range is shown on the following chart. This chart shows a Pin Bar that formed at neither a swing high nor a swing low and was surrounded by traffic. This Pin Bar did not stick out and did not form after a substantial pullback.

Price did go higher once the high was taken out, however you will notice price quickly terminated and went lower once the resistance area was encountered.

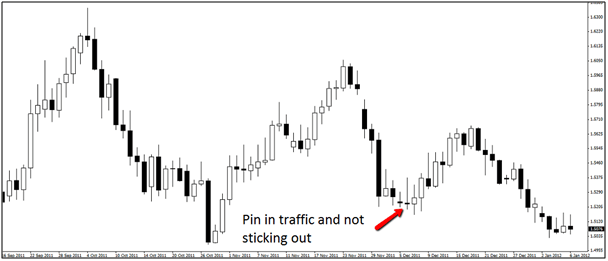

Another example is this pin below. Noticed how it formed without a pullback and not at a swing point? These suck Traders in all the time!

Price Action Signals That Form Against a Very Obvious and Strong Trend

These are the Price Action signals that Traders put on knowing that they probably shouldn’t be. These are the signals that form against a very strong and obvious trend. Traders tend to be sucked into these trades looking for a pullback and convincing themselves that the market is due for a substantial pullback sooner or later.

The problem is that most times the trend will continue and the Trader will be wiped out. Then the Trader will be looking to do a revenge trade and recoup losses.

A much smarter play is waiting for price to pullback and then entering at strategic levels within the existing trend.

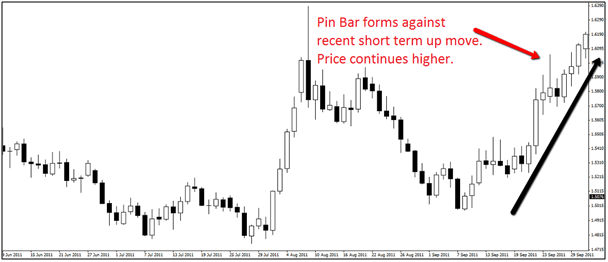

Below is an example of a Pin Bar that formed against a very strong short term bullish trend. Traders who entered this pin would have watched price continue up with the short term momentum.

Price Action Signals That Are Hard to Spot

These are the signals that Traders need to work really hard just to find. They are not obvious or large. Some Traders and especially the new Traders will find any excuse to place a trade. Price Action Traders must ask themselves;

– Is there really a trade here, or am I just making a trade up to participate in the market?

Trading can be an extremely mentally tough job at the best of times, let alone when Traders are entering trades they never should have been in. This opens up a whole heap of new psychological dilemmas that this article is not big enough to address, such as revenge trading to gain back lost money and Traders beating themselves up for placing a trade that, in hindsight, was never there to be placed.

Most Price Action Traders fail to turn a profit for this one very important reason. They can’t sit on their hands and they have not learnt to be picky and only trade the best and most obvious setups.

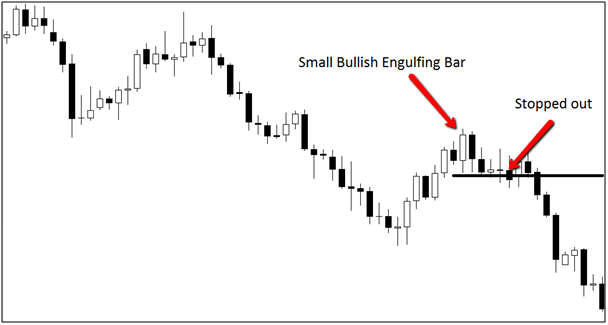

Below is a chart example of a small and insignificant Bullish Engulfing Bar. There are many reasons why this was a poor trade, the main reason being that it was small, not well defined or obvious.

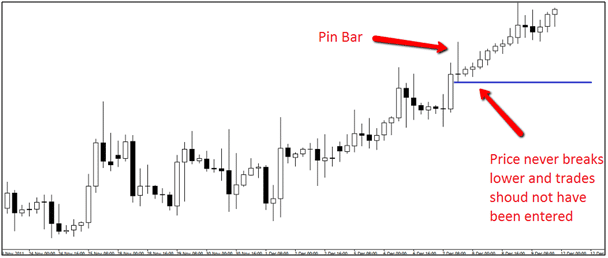

Trades That Don’t Break The Price Action Signal Bar in The Desired Entry Direction to Confirm The Price Action signal

These are the Price Action signals that Traders really tend to beat themselves up about when they go on to lose. They are the Price Action formations that never break in the desired direction of the trade.

If the Traders had just had a little more patience and discipline they could have saved themselves a losing trade by waiting for the Price Action signal to be confirmed.

An example of a Price Action signal is below. You will notice the Pin Bar looks like an okay setup but it never breaks lower. Smart Traders would never have entered into this trade and would never have experienced a loss as the signal did not confirm itself.

I hope you have enjoyed this Price Action educational article. Price Action Traders have many opportunities to profit but it is vital they are aware of what setups to avoid. Many Forex tutors won’t explore this subject as it is a lot more impressive to show new Traders the entry signals only. For Traders to become consistently profitable they must know every aspect of their selected method.

Safe trading,

Johnathon Fox

good article. It’s nice to see this other side of price action trading.

Thanks Roy!

Johnathon

John

I really appreciate your learning lessons on articles of forex . I have learned a lot just from your free info. However its more beneficial actually by joining your forex school. I am now a member and understand better the twist and turns of the currency market. Cheers to you Jonathan, your a Great teacher., mentor.

hi john

my name is jake and I am a novice of your price action course !

I really really appreciated

I follow your lessons on babytips and your going to see me around , a lot 😀

nice article . But in 3rd picture you said not to trade against the trend but pin bar is a reversal signal so can you please explain a little more ?

Yes sure; the pin bar is a reversal signal and we need to trade it from the correct swing points i,e swings highs and lows, but when trading against the trend you need a very good reason to do it for example; a very solid support/resistance level, not just a random pin bar. The much better play is as I said in that paragraph of the article is to play the pin bar at strategic pullback levels within the existing trend. You can still have price making pull-back or retracements within a trend to create a swing high/low for where we would look to play the pin bar and this is how you would play trend trading with the pin bar. See the following for more info on the subject: https://www.forexschoolonline.com//how-professionals-trade-forex-hunt-stops/ https://www.forexschoolonline.com//make-money-trading-reversal-signals/ https://www.forexschoolonline.com//high-probability-price-action-trading/ https://www.forexschoolonline.com//how-to-make-money-forex-price-action-trading/

Johnathon

Very good article John,I’ve been guilty of these basic mistakes at one time or another,keep up the great mentoring!!!!!! Best Regards-Andrew T….