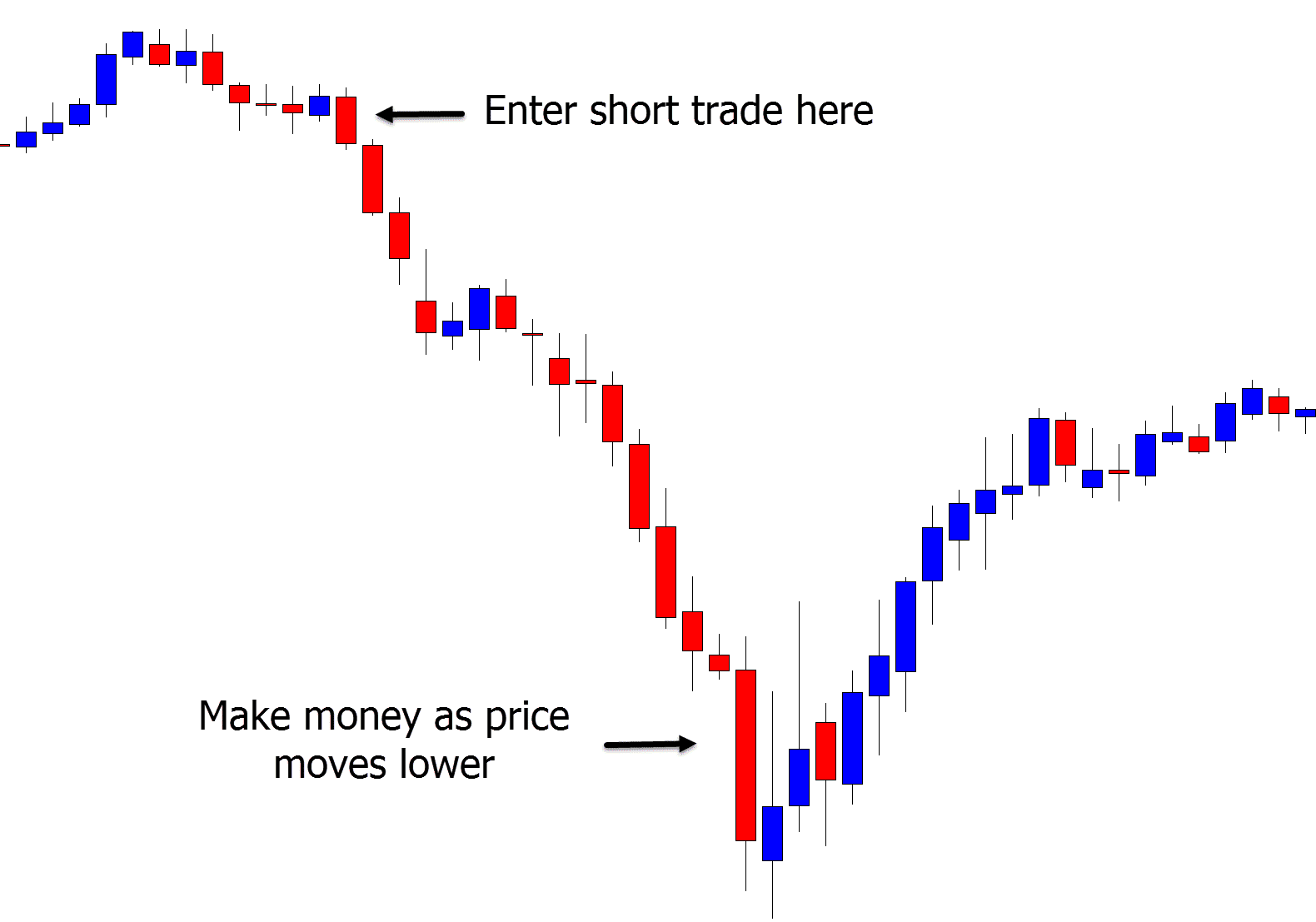

When short selling you are looking to make a profit as price moves lower.

Whilst a lot of traders especially stock traders only look to make ‘long’ trades buying and then making a profit when price moves higher, you can also make money if an asset or Forex pair moves lower.

How Does Short Selling Work?

Short selling is very popular in the Forex market.

When short selling you are speculating on the price of a particular Forex pair or other asset moving lower.

Some investors will also use shorting to hedge their risk that they may be carrying in other positions.

When short selling in the Forex market you are taking a sell trade looking to make a profit when price moves lower.

Many traders will use leverage when making their short trades. It is important you keep in mind your risk management strategies such as using a stop loss if looking to make short trades because there is no set limit on how high a price can rise.

Short Selling Example

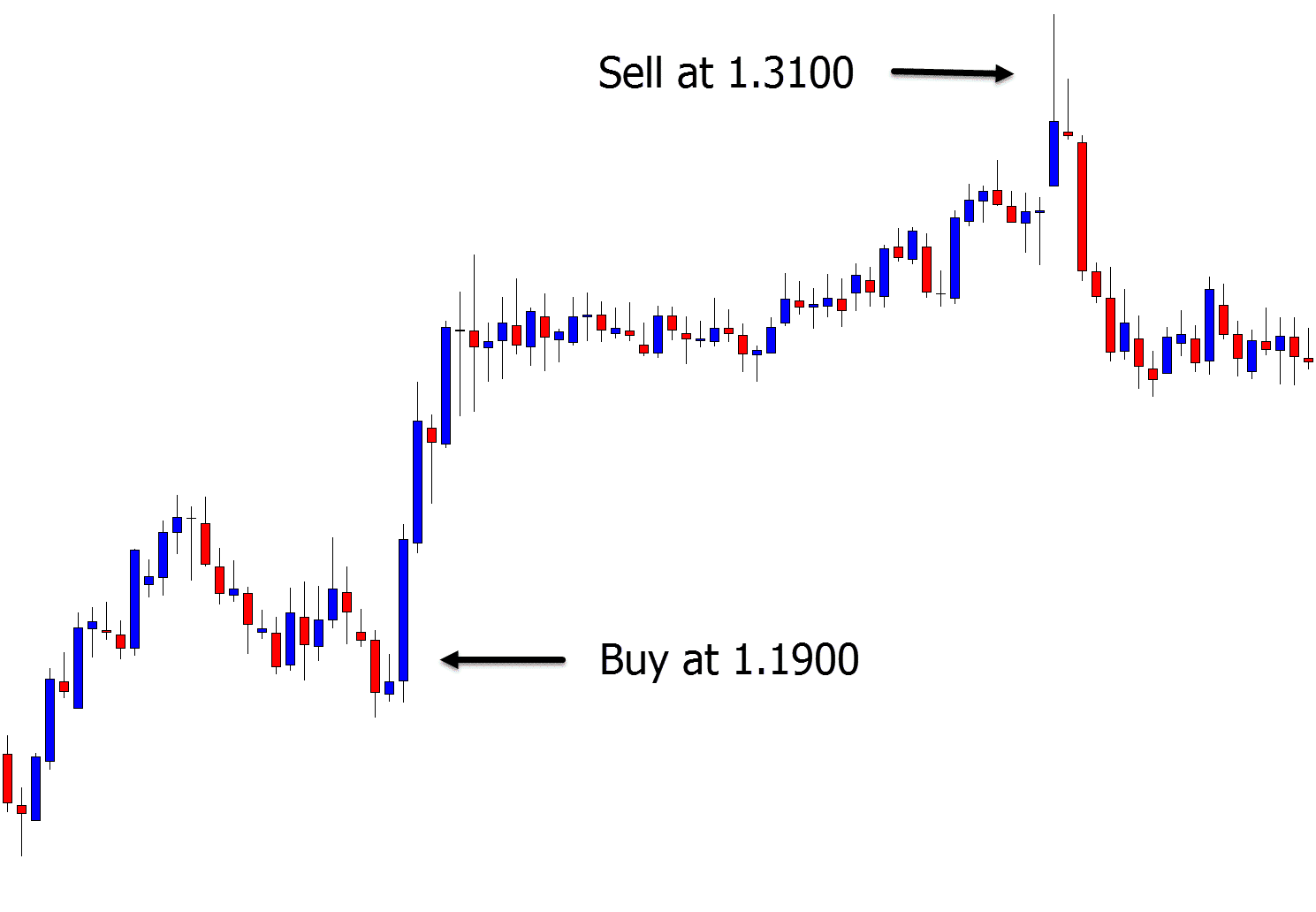

The most common way of investing in the markets is by going ‘long’. This is when you buy an asset or Forex pair and hope to make a profit when the price moves higher.

The chart example below shows how you could have made a profit if you bought at the low with a long trade and then exited when price had moved higher.

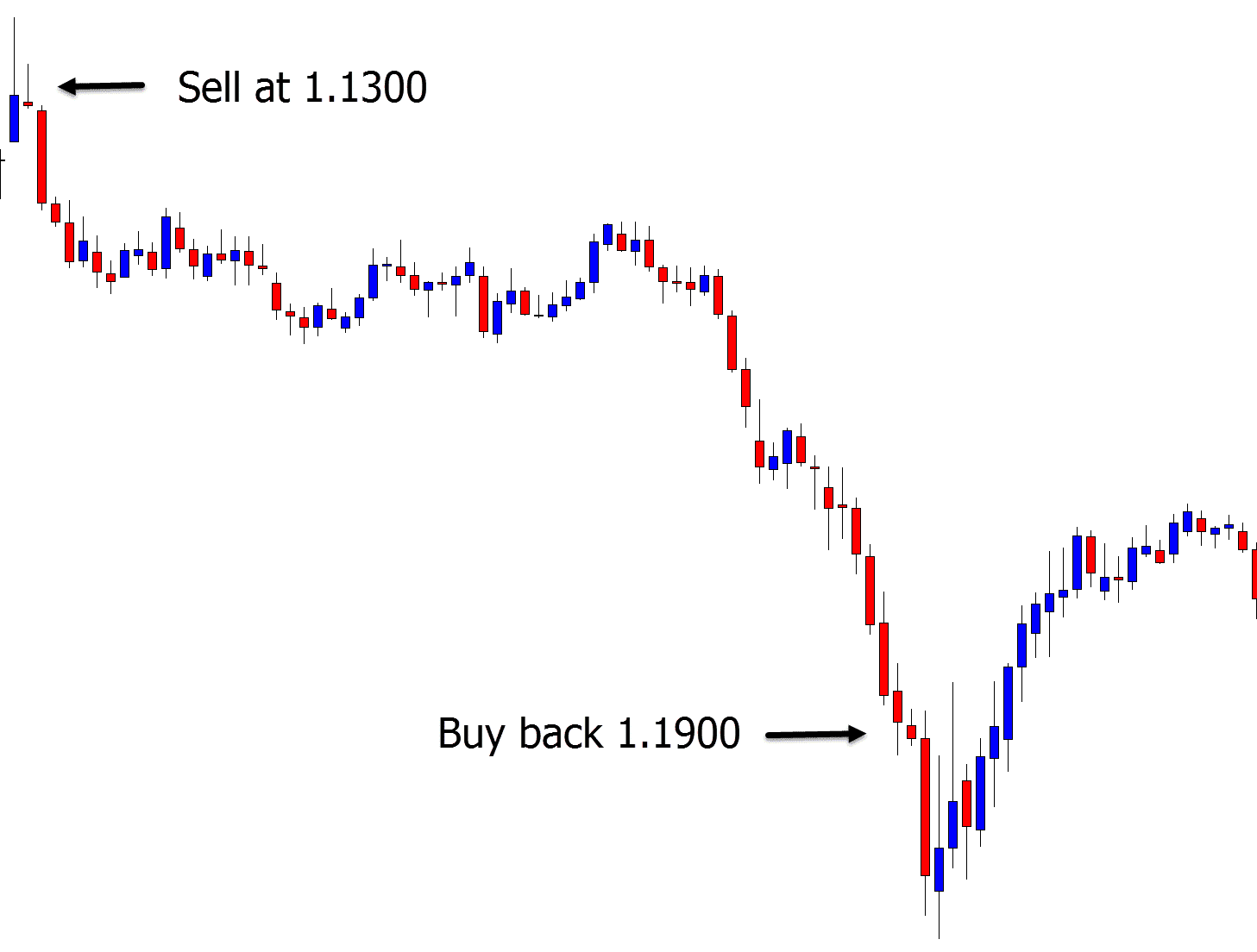

The opposite of this is short selling. As the chart example shows below; you could have made a profit if you sold when price was high at 1.1300 and then exited at 1.1900.

Why Would You Want to Short Sell?

There are a number of benefits to short selling, but the major benefit is that you will have a lot more opportunities to make profitable trades.

When only looking to buy and profit as prices move higher you can only enter long trades.

If you add short selling to your strategies you can begin looking for trades that can profit when prices move lower. This can open a large range of new opportunities as price will often fall faster than it will rise.

The other benefit to short selling is that you can use it to hedge your risk on other trading positions.

Whilst short selling comes with its benefits, it is not without risks.

If you are not using correct risk management strategies, then your risk is unlimited. There is no cap on how high an asset’s price can move.

You can also get caught out in a ‘short squeeze’. This is when a lot of short sellers are all trying to get out of their positions at once which further sends prices higher.

Recap

Using short selling can open a lot of new trading opportunities and potential trades that you previously did not have access to.

Whilst it does not come without its risks, if done correctly with solid risk management strategies it can offer a lot of ways to make profitable trades.

You can also use short selling with more advanced strategies and learn how to hedge your risk on other positions you’re holding.

Leave a Reply