The Long-term and the Medium-term are both in a downward momentum.

Sellers may put aggressive orders in key areas.

AUDJPY Weekly Price Analysis – December 1

The AUDJPY pair looks good for the bears as it trends below the supply levels with huge volumes from the short traders. However, if the selling pressure persists, the currency pair may slide further to the $80.43 lower support level, indicating a significant downward trend and a potential sell opportunity for short traders.

AUDJPY Market

Key Levels:

Resistance levels: $100.00, $101.00 $102.00

Support levels: $97.00, $96.00, $95.00

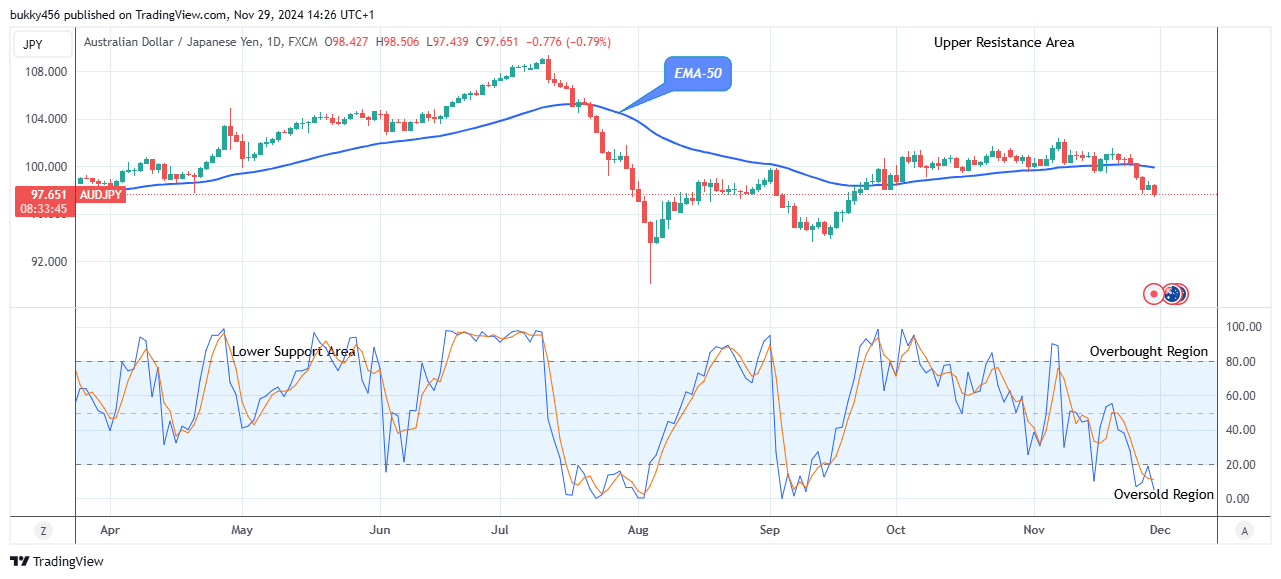

AUDJPY Long-term trend: Bearish (Daily Chart)

ADJPY market is bearish and looks good for the bears. The currency pair is in a downward move in its long-term perspective as can be seen undeniably from the daily chart.

The sustained bearish pressure at the $97.70 support level in the last session has made the Yen price remain below the resistance levels in its recent low.

Today, the AUDJPY pair looks good for the bears as the Yen price dropped to a low at $97.43 below the EMA-50 as the journey down south continues on the daily chart, suggesting a good sell opportunity for short traders.

Meanwhile, if the bears increase their selling activities, the pair may continue sliding to hit the prior support at $90.11 value, indicating potential support for the Yen sellers.

However, the stochastic oscillator signal pointing down suggests that the AUDJPY pair may remain in that direction for a while and look good for the bears before the change in trend arises. As a result, the price may drop to the $80.43 lower support level soon, suggesting a good sell for the bears in its higher time forecast.

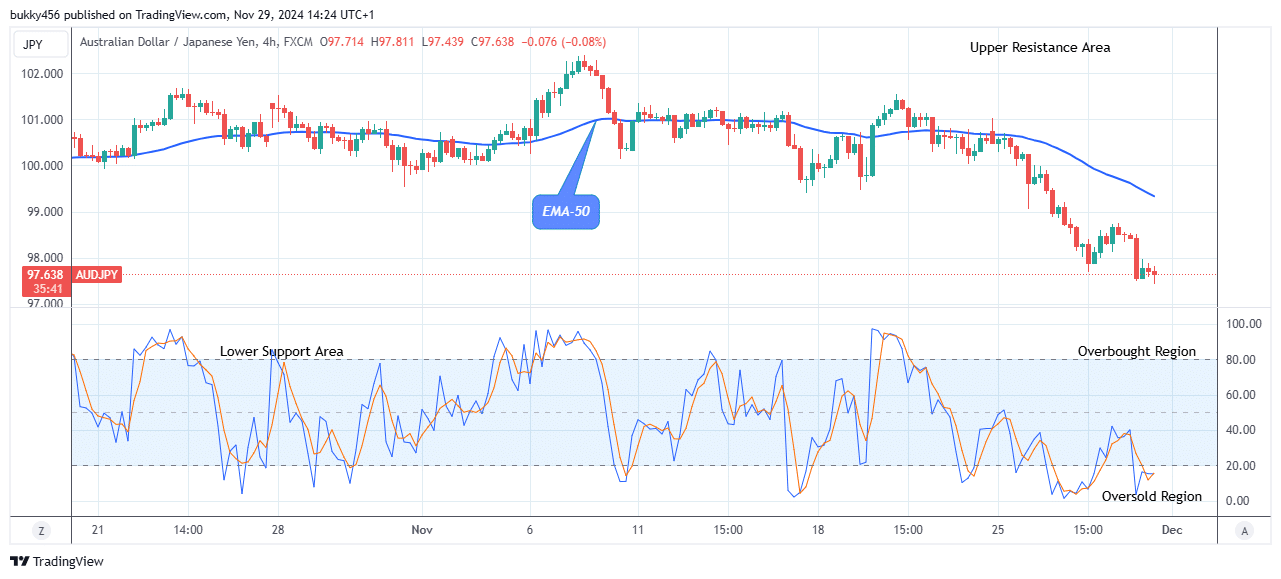

AUDJPY Medium-term trend: Bearish (4H Chart)

The momentum on the medium-term time frame is distinctly bearish and looks good for the bears. The AUDJPY price is moving towards the lower support below the converging trend lines, denoting a bearish trend and a good sell opportunity for the bears.

Actions from the short traders at a $97.5 0low value in the last session have dropped Yen’s price beneath the supply trend lines in its recent low.

Today’s 4-hour chart at the $90.43 low mark beneath the supply trend levels looks good for the bears as the journey down south continues.

However, if the selling pressure increases, the AUDJPY price might drop below the $90.43 current support level before the bulls arrive to change the trend.

The stochastic oscillator signal pointing down suggests a further downward trend, driving the AUDJPY price to a $80.43 support level soon, as the pair looks good for the bears in the medium term. Hence, sellers can take their position as desired before the trend changes.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply