The long-term outlook is in a bullish trend zone while the medium-term outlook is in a bearish trend.

Patience is needed to wait for a bullish movement before taking a long position or a bearish movement before taking a short position.

AUDJPY Weekly Price Analysis – November 28

AUDJPY is facing an increase in selling pressure and may continue in the same direction if it breaks $111.329.

AUDJPY Market

Key Levels:

Resistance levels: $115.150, $115.250, $115.350

Support levels: $109.150, $109.100, $109.050

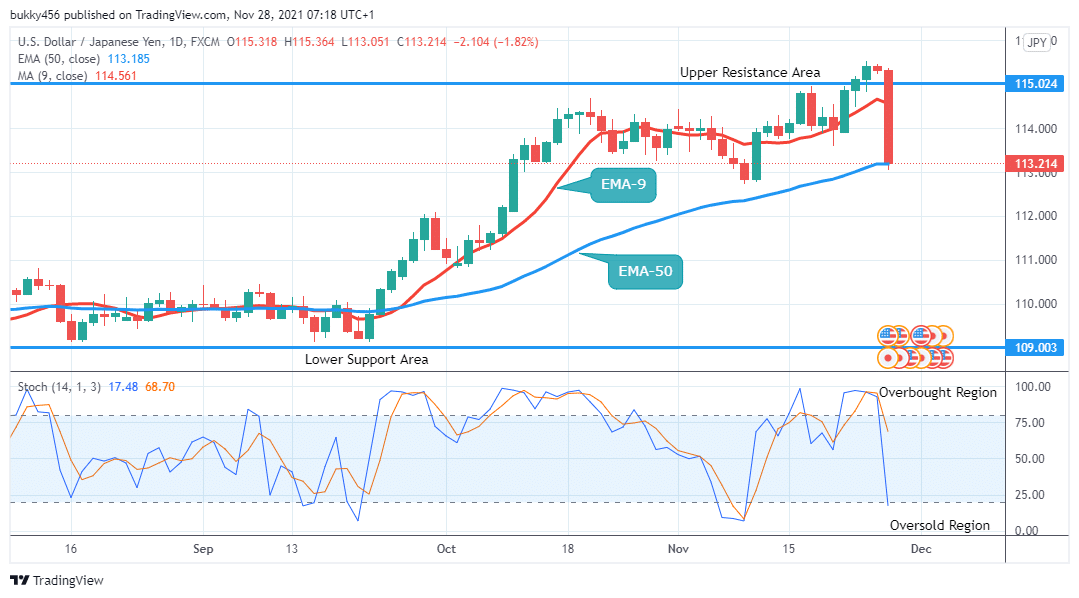

AUDJPY Long-term Trend: Bullish AUDJPY is bullish on the daily chart. The buyers were in control of the market for the past three days. The bearish momentum has pushed the Yen to find support at the $115.251 price level during yesterday’s session.

AUDJPY is bullish on the daily chart. The buyers were in control of the market for the past three days. The bearish momentum has pushed the Yen to find support at the $115.251 price level during yesterday’s session.

The bearish momentum has been triggered and the price is increasingly facing the downsides as the daily chart opens today with a long bearish candle breaking the EMA-9 with its wick below the EMA-50 at $115.318 in the support area.

The pressure from the bears pushes the price down south to $113.214 in the support area.

Price at $113.051 just a bit above the EMA-50 in the support area suggests that the bears are pressing hard to dominate the currency pair in its long-term perspective.

However stochastic oscillator signal around level 19% in the oversold region is an indication that price may still go up and change the momentum in the price of AUDJPY in the future. A break-out or a break-up may occur, hence, traders need more patience before taking a position.

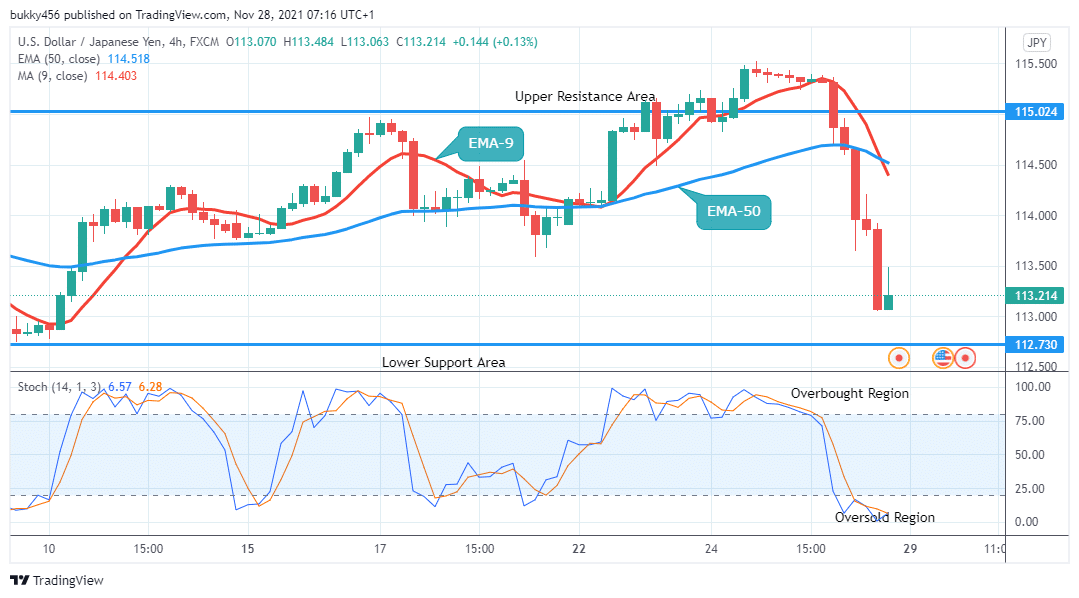

AUDJPY Medium-term Trend: Bearish AUDJPY remains in a downtrend market in its medium-term outlook. Just like usual, the currency pair’s price is going down as we can see from the 4-hourly chart.

AUDJPY remains in a downtrend market in its medium-term outlook. Just like usual, the currency pair’s price is going down as we can see from the 4-hourly chart.

Today’s 4-hourly opening candle at $114.871 below the upper resistance line in the support area is bearish as the bears remain dominant in the market.

Pressure from the sellers further moves the price down to $113.650 in the support area.

The journey down south continues as the impulsive move by the sellers drops the price of the Yen down to $113.054 in the support area.

The buyers return briefly and move the price up to $113.214 in the resistance area.

The price of AUDJPY is initially up at $113.484 in the resistance area which is below the two EMAs, which is an indication of more sellers present in the market.

Thus, the stochastic signal pointing up at level 5% in the oversold region suggests the momentum in the price of the Yen might encounter more buyers coming into the market in the days ahead, in this case, an uptrend in the medium-term.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply