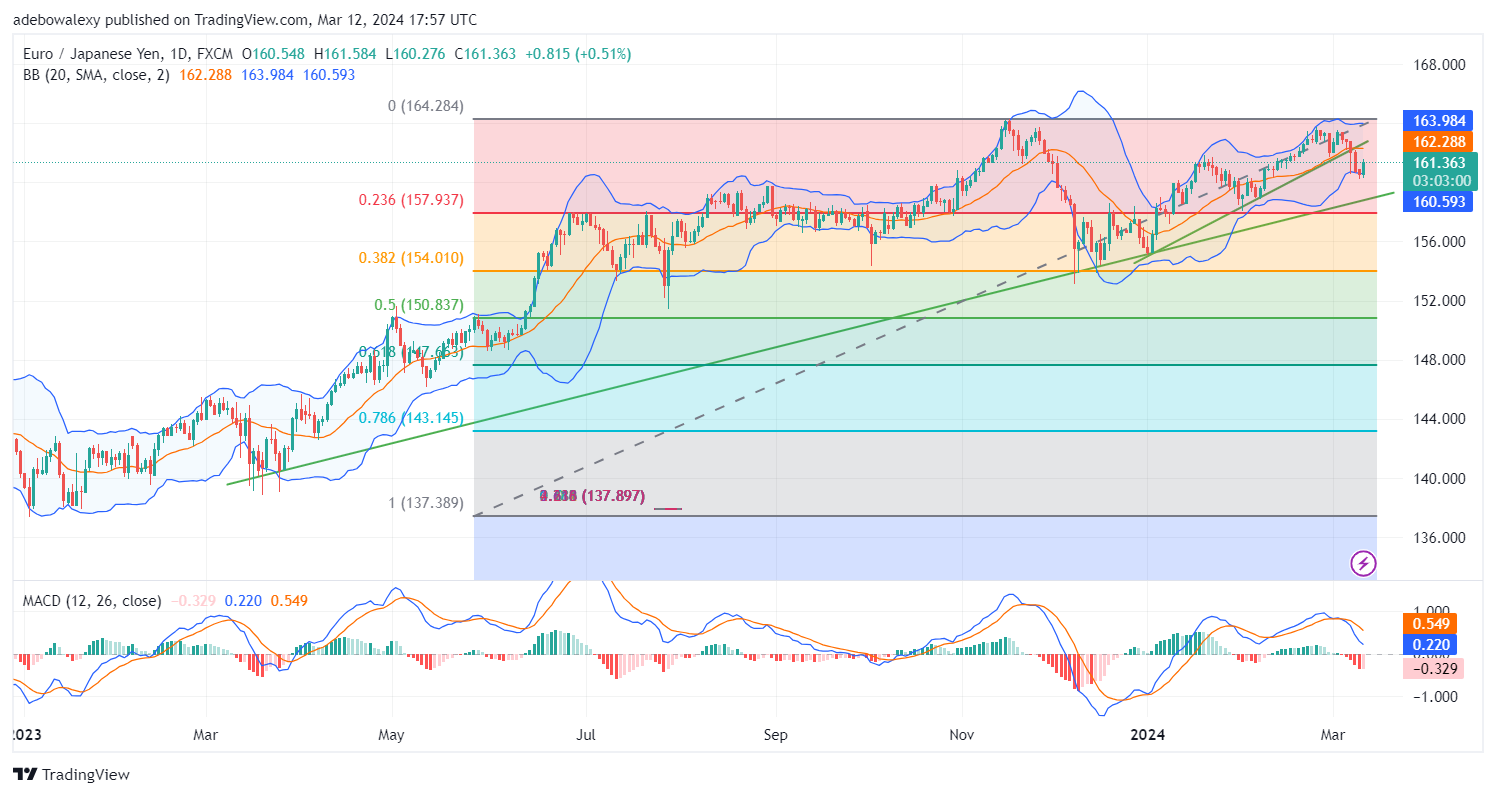

The EURJPY market has rebounded off the support at the 160.50 mark. Considering the magnitude of the rebound, the bounce seems to reveal that the bulls are gaining momentum. This appears largely due to the momentum gained in the EUR, while the Japanese yen seems less motivated on a fundamental basis.

Key Price Levels:

Resistance Levels: 161.36, 162.00, and 163.00

Support Levels: 161.00, 160.00, and 159.00

EURJPY Maintains an Overall Long-Term Trend

While the EURJPY market seems to have corrected downward on the daily chart, it appears that the market still has an upward trajectory over a longer period of time. Price action in this market has corrected below the middle limit of the Bollinger Bands.However, the ongoing session has brought some upside rebound off the floor of the Bollinger Bands.

The size of the price candle at this point suggests that upside forces have stood strong against headwinds. Consequently, price action seems to have resumed an upward path above the upside-sloping trendline drawn over a much longer timeframe. The Moving Average Convergence Divergence (MACD) indicator lines have a downward bearing, but the indicator’s last bars show that upside forces are likely to keep gaining strength at this point.

EURJPY Market Now Has Increased Upside Propensity

While things were looking fair on the daily EURJPY market, we can see that the market looks even brighter on the 4-hour market. Here, price action has been able to cross above the middle limit of the Bollinger Bands. Also, we can see that the market has moved on afterward and is now heading towards the uppermost limit of the Bollinger Bands.

Likewise, the MACD indicator lines have kept on rising steadily, with respect to the increasing bullish momentum. The bars of the MACD as well can be seen appearing solid green above the equilibrium level. This suggests that traders can still place their trades using Forex signals with targets near the 162.50 mark for this pair, as the market seems to be heading in that direction more strongly.

Do you want to take your trading to the next level? Join the best platform for that here.

Leave a Reply