GBPJPY Analysis – Bulls Exert Strength by Breaking 151.500 With Upward Pressure

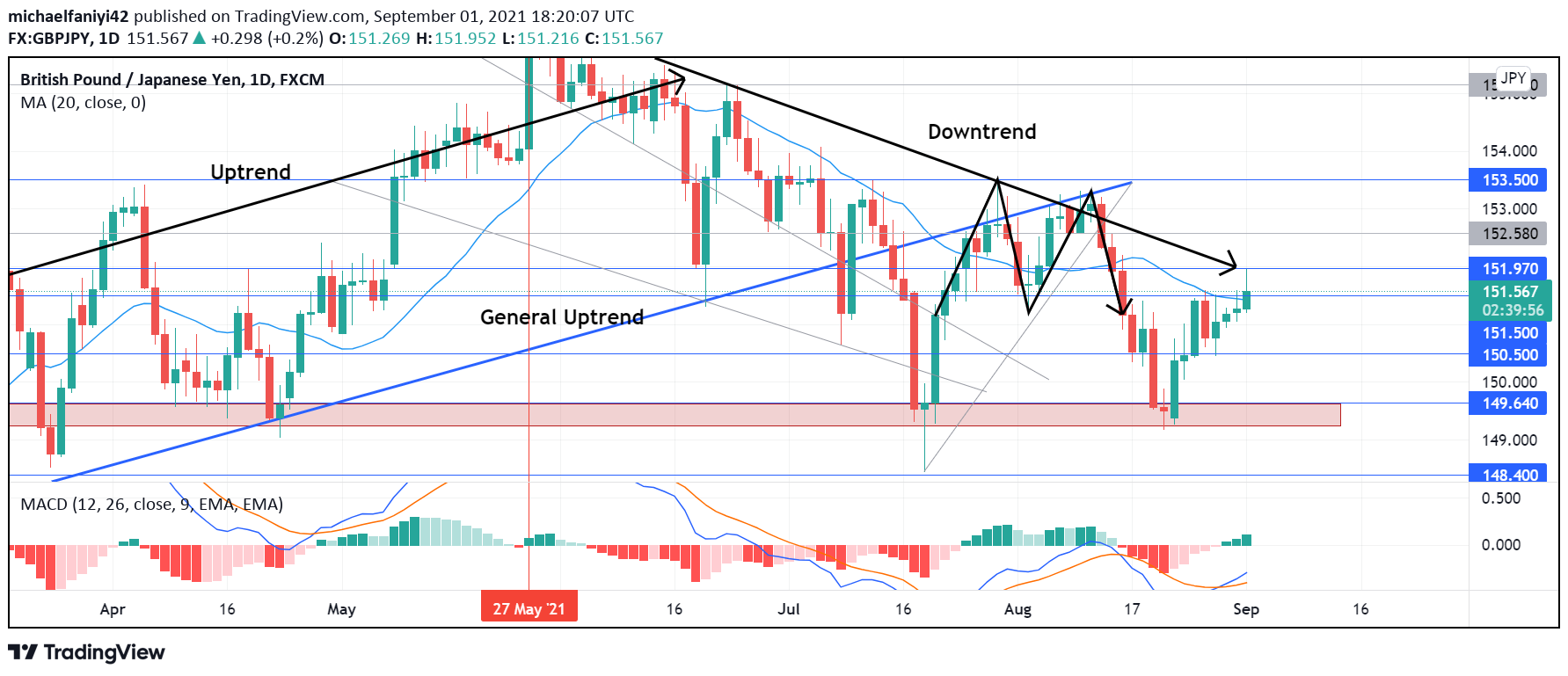

GBPJPY bulls exert upward pressure to demonstrate strength in the market. There has been a real tussle for market dominance, with bears generally having the upper hand. As for buyers, they have used the 149.640 weekly support as a stronghold to act as a defense line against bears and a rallying point for price. This is seen on the 24th of March, the 24th of April, the 19th of July, and, more recently, on the 20th of August.

GBPJPY Key Levels

GBPJPY Key Levels

Resistance Levels: 151.970, 152.589, 153.500

Support Levels: 151.500, 150.500, 149.460

The latest bearish attack sees sellers employing a double bottom chart pattern to plunge the market with intensity. Like previous times, at the 149.640 key level, buyers had to exert strength to defend the market from falling, and then turn it back upwards. A morning star candlestick pattern, which is a downtrend reversal pattern, is employed to redirect the market upwards.

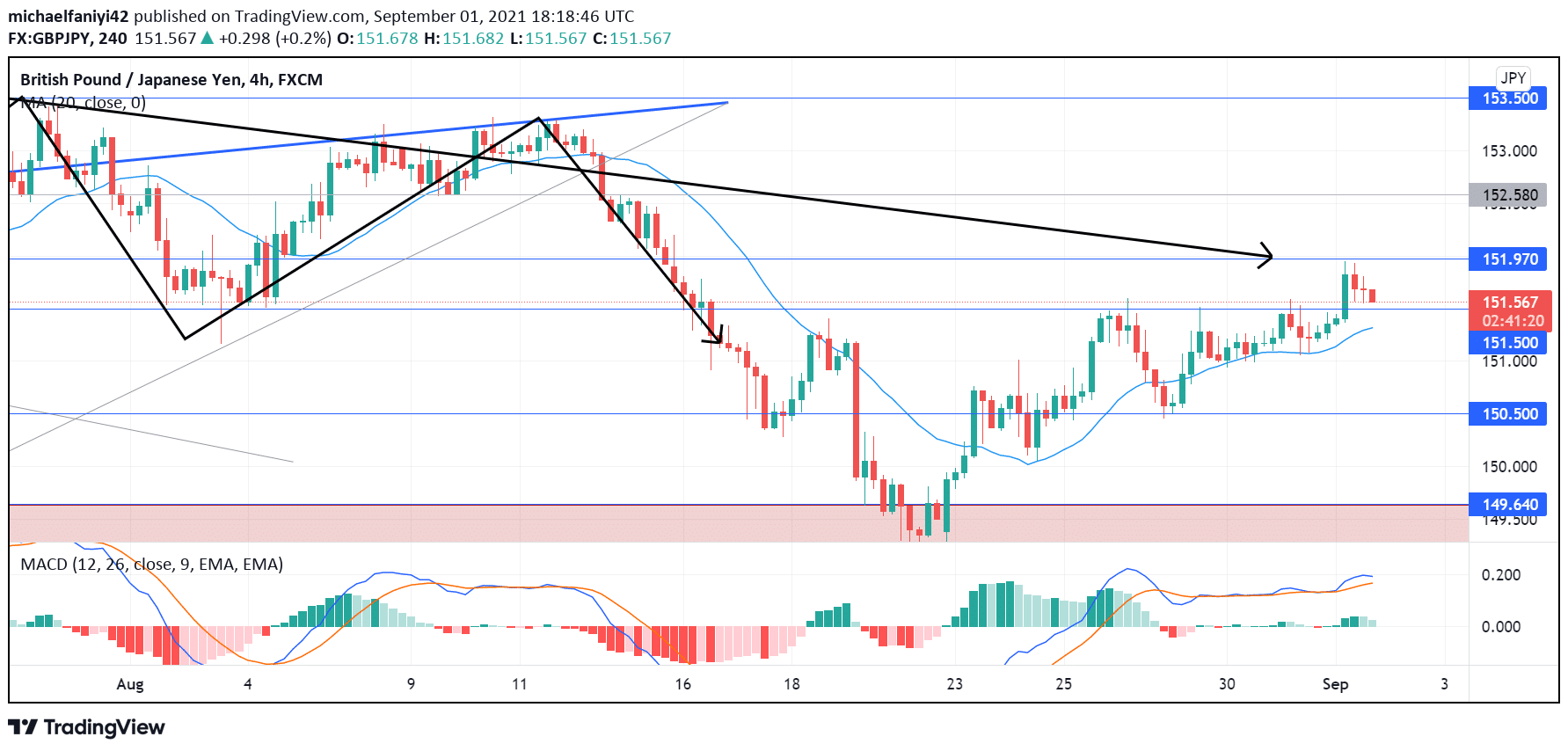

The upward pressure was enough to push the price past the 150.500 resistance level. But when GBPJPY reached 151.500, it had to retrace a bit before pushing up past the resistance. The bullish momentum is set to continue as bulls are now trying to negotiate their way past 151.970. The MACD (Moving Average Convergence Divergence) indicator is showing divergence between the EMA and the signal line, which signifies an ongoing bullish charge.

Market Anticipation

Market Anticipation

On the 4-hour chart, the MA period 20 (Moving Average) has been laid underneath the 4-hour candlesticks to act as support to push the market up. GBPJPY is now retracing after hitting the 151.970 resistance. Price is likely to use the 151.500 support as a springboard to shoot past the 152.970 price level. Multiple crosses on the MACD are in favor of the bulls and the bullish histogram bars keep increasing. The 152.580 key level is now a target for the market.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply