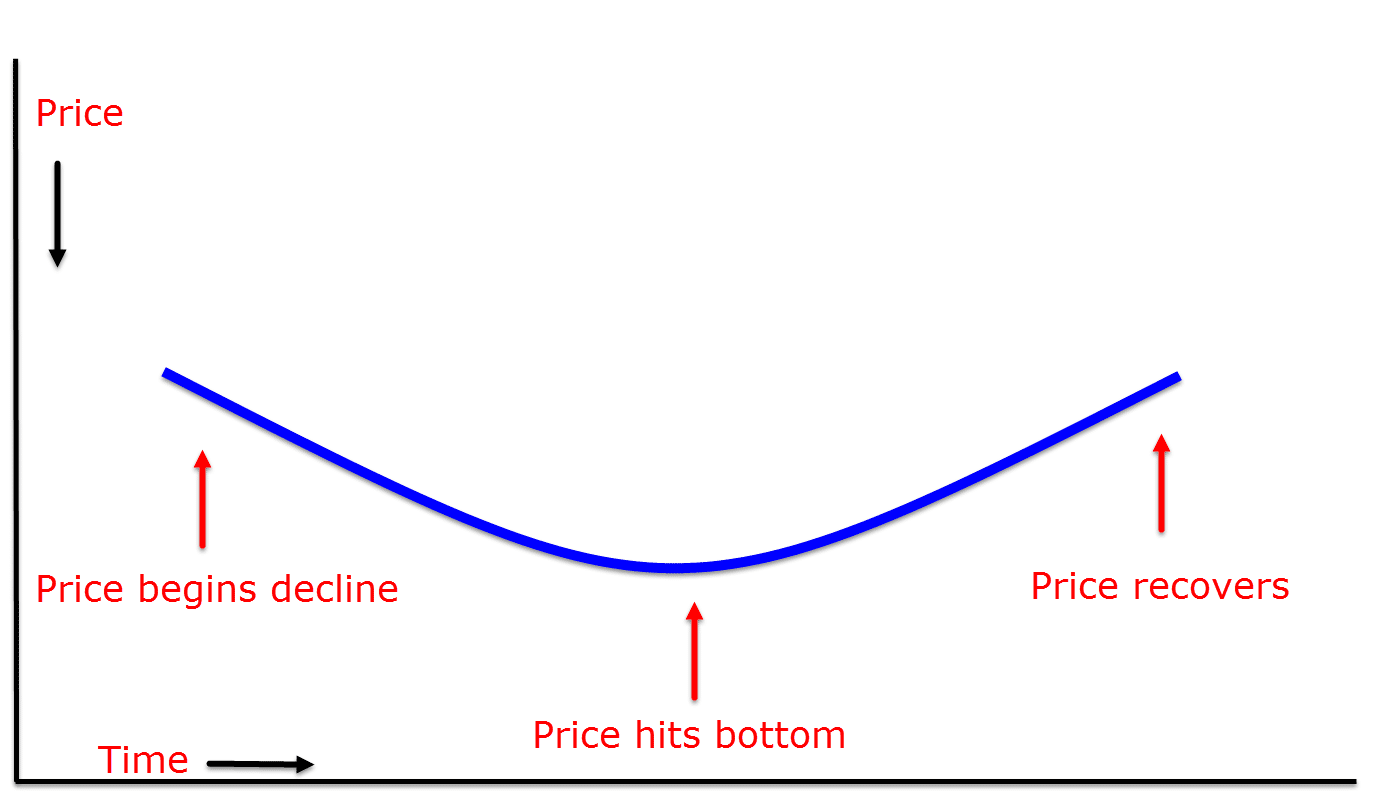

What is a Rounding Bottom Chart Pattern?

The rounding bottom chart pattern is known as a bullish reversal pattern.

After moving lower in a downtrend price will form a series of movements that when created look like a ‘U’ shape.

The rounding bottom can be spotted and traded in many different markets and time frames and you can use it to not only find trades, but also help you set your profit targets.

How a Rounding Bottom Pattern Works

A rounding bottom pattern is a pattern showing price has ‘bottomed’ out and the recent trend lower has come to an end for the time being.

As the example below shows; price is first trending lower. Price then moves into the bottom phase. During this phase it is very common for price to move sideways or consolidate for a period.

Price will then breakout of the consolidation and make a move higher.

Once the neckline of the rounding bottom pattern is broken the pattern is complete.

Whilst the rounding bottom pattern can be used on any time frame, the best time frames to identify and use this pattern are the higher time frames like the daily chart.

The higher time frames can give you greater market clarity and also help you analyze potential trades for the smaller time frames like the 4 hour and 1 hour charts.

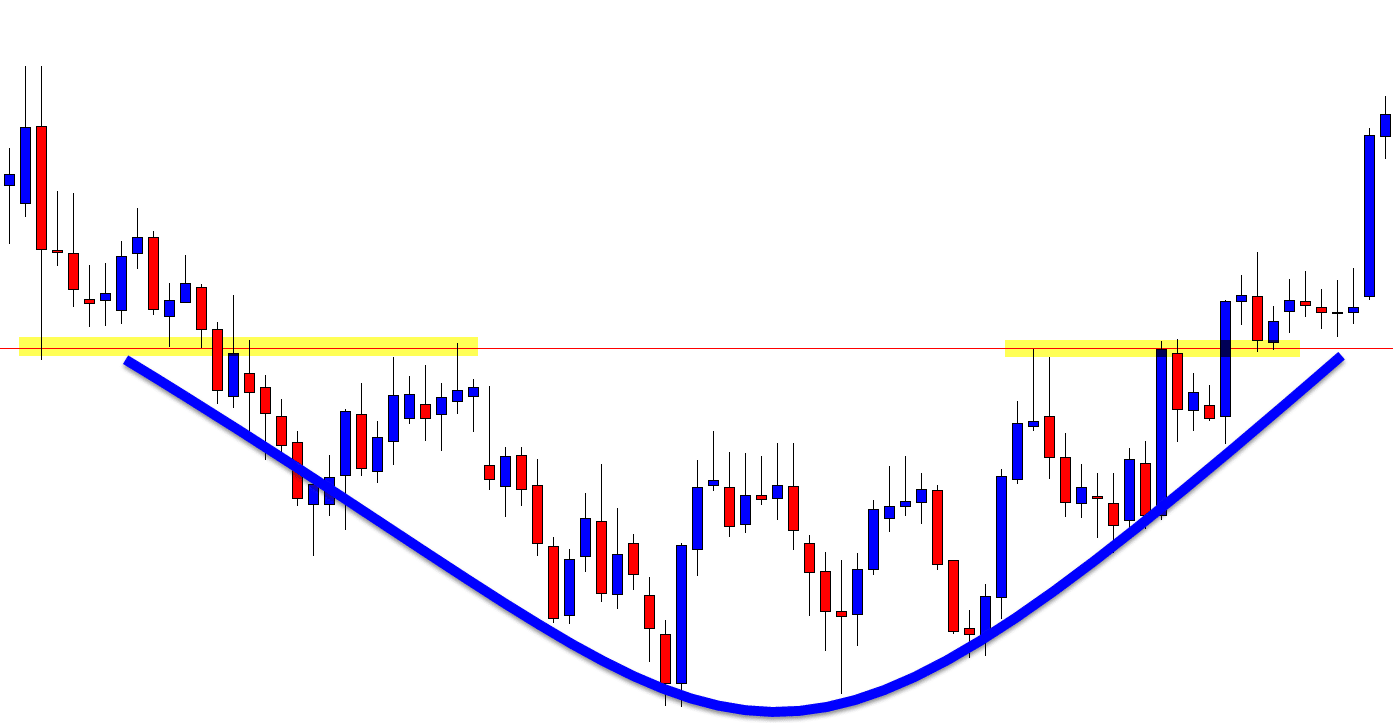

Example of a Rounding Bottom

As the example price chart shows below; there is a clear neckline with the rounding bottom.

Once the neckline is broken with price moving higher the pattern is confirmed. This is also when we will see the largest and most explosive move of the pattern.

Breakout traders will be watching this pattern and looking to enter when the pattern confirms with the neckline breaking.

The best entries when trading this pattern are breakout trades when the neckline breaks.

Two ways you can do this are by either taking a straight aggressive breakout higher, or you could watch for price to first confirm the break and then enter.

Price will often breakout and then make a retest of the old breakout resistance and new support level.

This can also give you a chance to make a re-entry if you missed the initial breakout trade.

The best way to find these entries is to first identify the rounding bottom pattern has formed and price has broken out higher.

Once you have noticed price rotating back lower to test the old resistance and new support level you can look for bullish price action trades.

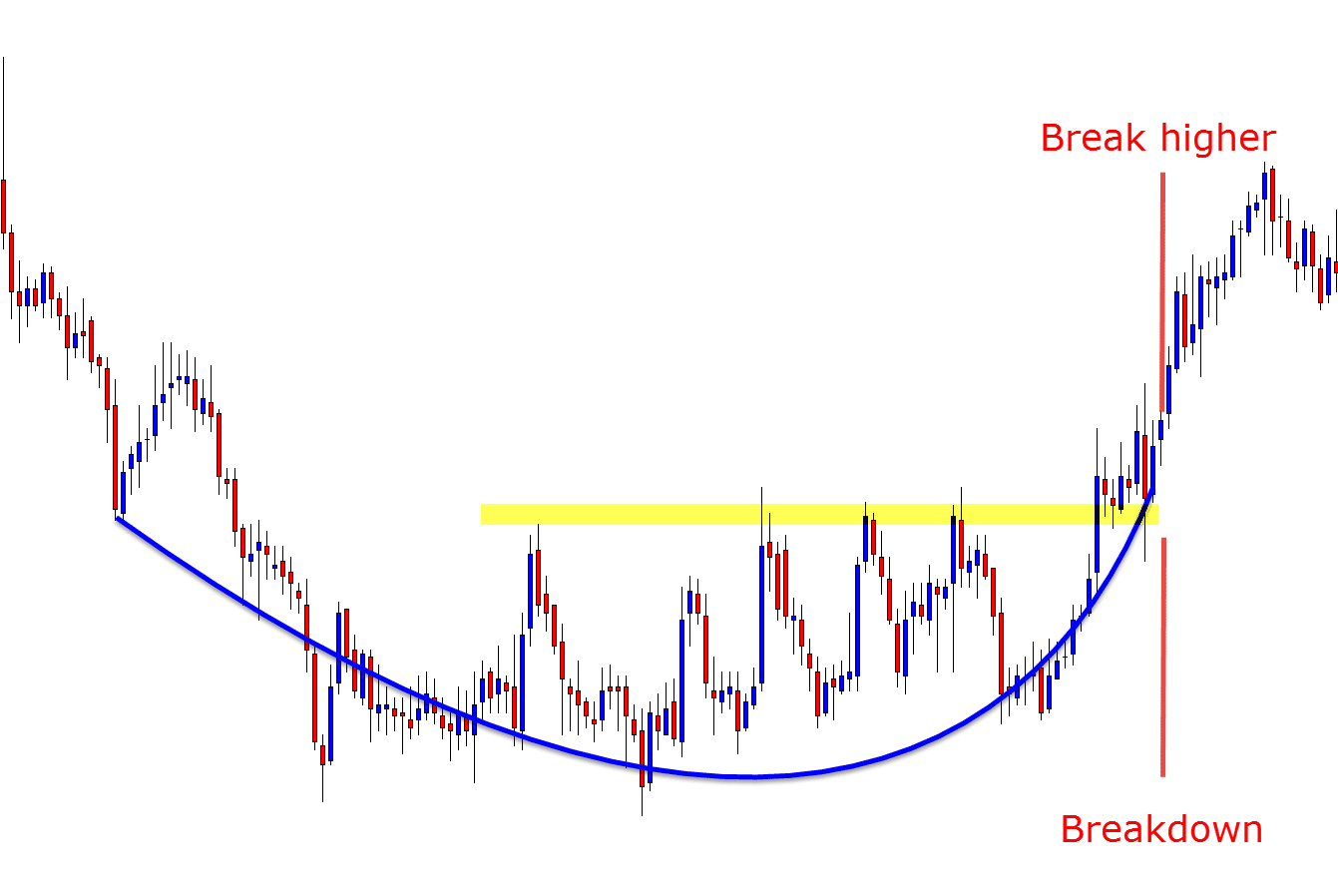

How to Find Targets With the Rounding Bottom

Rounding bottom patterns are not just used to find potential entities, they can also be used to find accurate profit targets.

After breaking the neckline, price will normally move the same length higher that the initial breakdown moved lower.

For an example of this see the chart below; if price broke down from the neckline 250 pips, then we could expect the price to move 250 pips higher once it completes the pattern and breaks higher.

Keep in mind this is not a hard and fast rule, but a guideline.

You should still use other technical analysis and tools to help guide your profit targets. These include the major support or resistance levels or other major market factors.

Leave a Reply