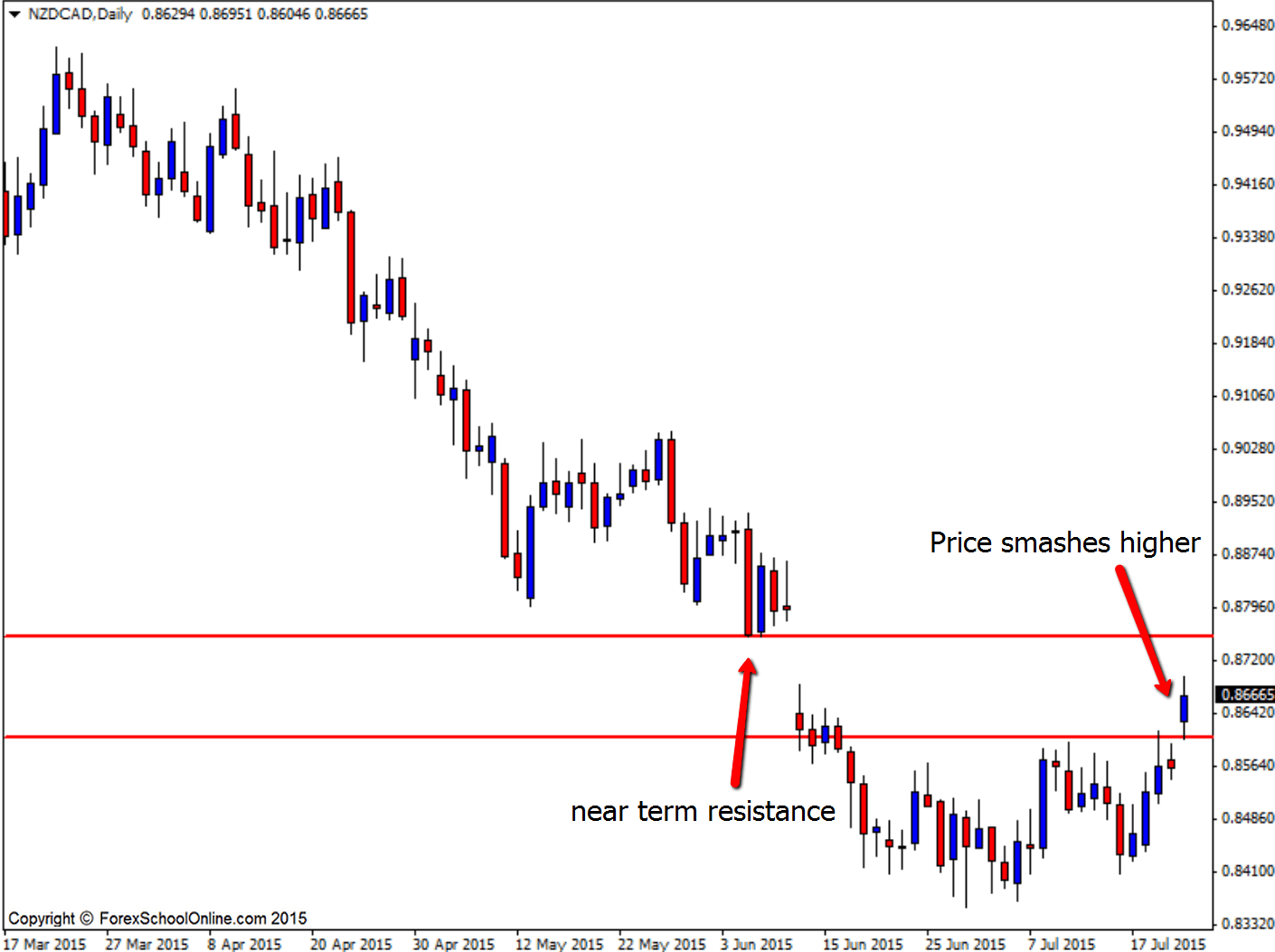

The NZDCAD has flown up and above a major daily resistance level that had been containing price for the previous 12 days. As the two daily charts show below; both zoomed out and in, this key level is of major significance to price and now the price has broken through, it could become a ‘price flip’ level and hold as a new support level.

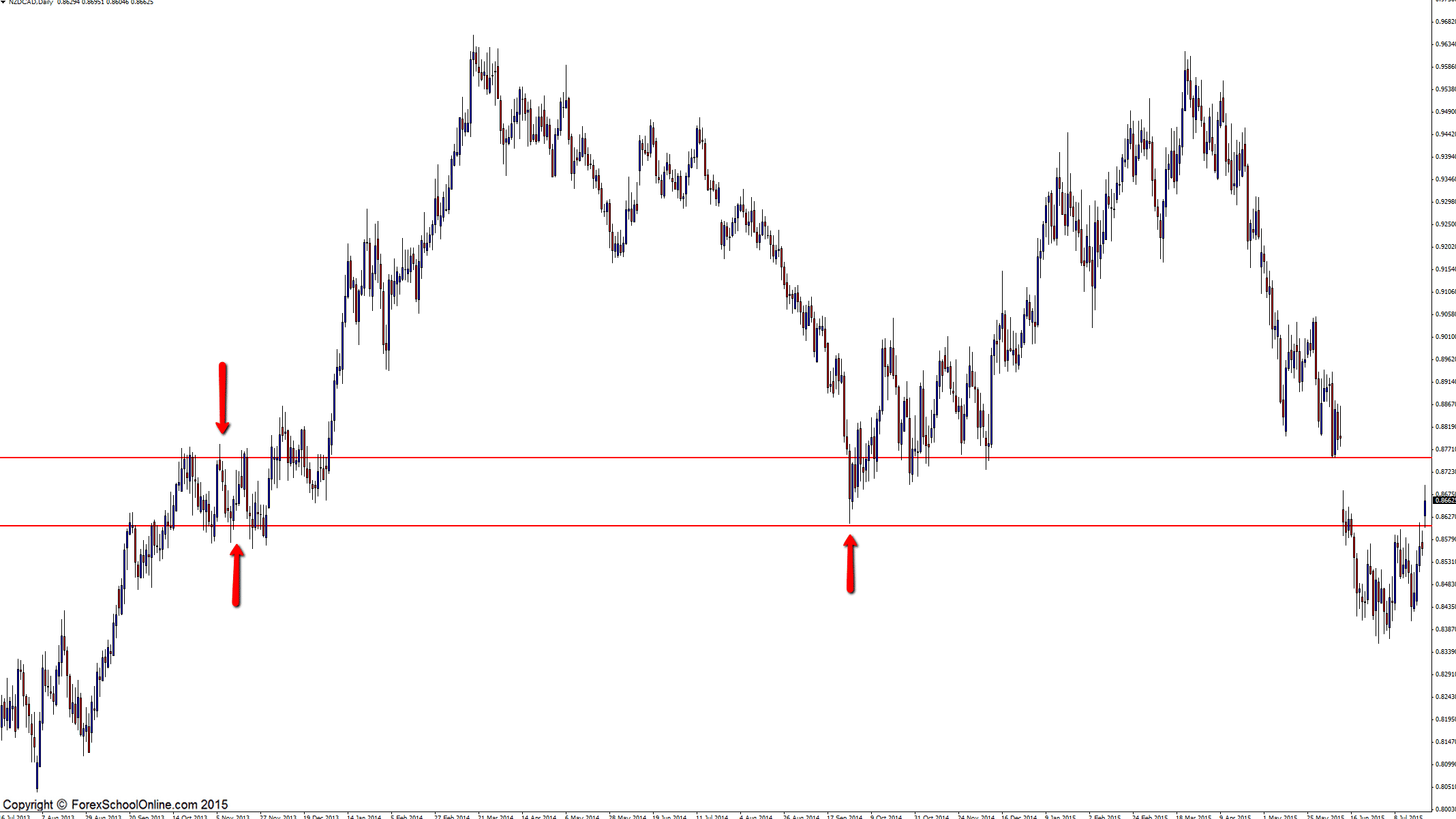

As the zoomed out chart shows below; this level has been a proven price flip level going back a long way that has acted as both a support and resistance level. Now that price is above the resistance level it will be crucial to see how the price action behaves if we do get a re-test at the old support/new resistance level.

If price does pull-back into the price flip area, you could watch the key daily area for potential high probability A+ bullish trigger signals to get long, just like the trade setups I teach my members in the Lifetime Membership Price Action Course. For any trades to be confirmed you are going to need to see quality bullish trigger signals formed at this new support area.

If price can move back higher the near term support looks to come in around the 0.87550 area as I have marked on the daily chart below.

MAJOR IMPORTANT NOTE: Become a FREE *VIP* Class Member and receive behind closed door teachings not shown to the public! Sign up to become a student here;

Daily Chart Zoomed Out

Daily Chart In

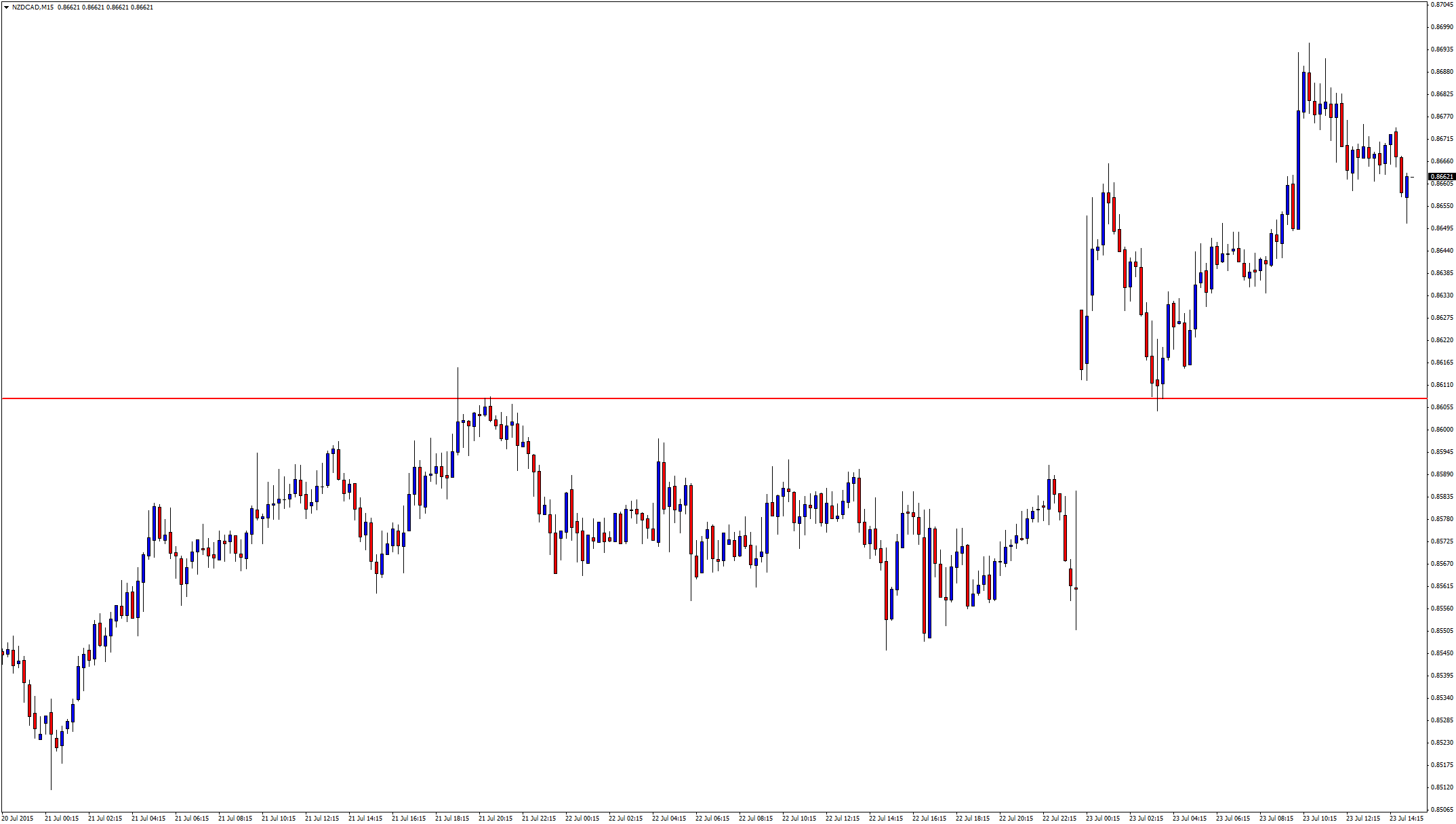

15 Minute Chart

Related Forex Trading Education

– The Ultimate Guide to Marking Support and Resistance on Price Action Charts

Hi Jonathan,

Would like to post a quick question. From the 4H chart, it looks like a classic setup where price broke resistance and is retracing to value area for us to enter long from a valid PA. But looking at the Daily Chart, it seems like the trend is towards the downside and a Daily selling Pin Bar has formed.

Since there are two conflicting views on different timeframe, and that the higher timeframe should be more reliable, shouldn’t we go Short?

Please advise! 🙂

Hi Jackson,

both the daily & 4 hour charts are not valid trade setups as they do not meet the basic pin bar criteria.

You will note on the daily chart the pin bar does not open & close like it should for a pin bar and on the 4 hour chart the pin bar does not have a nose that is 3 x. The 4 hour pin also does not stick out and away from all other price like we would need it to.

Please read the lesson that I think will really help on pin bars here; https://www.forexschoolonline.com//pinbar/ and also; https://www.forexschoolonline.com//pin-bar-reversal/

Any questions just let me know,

Johnathon