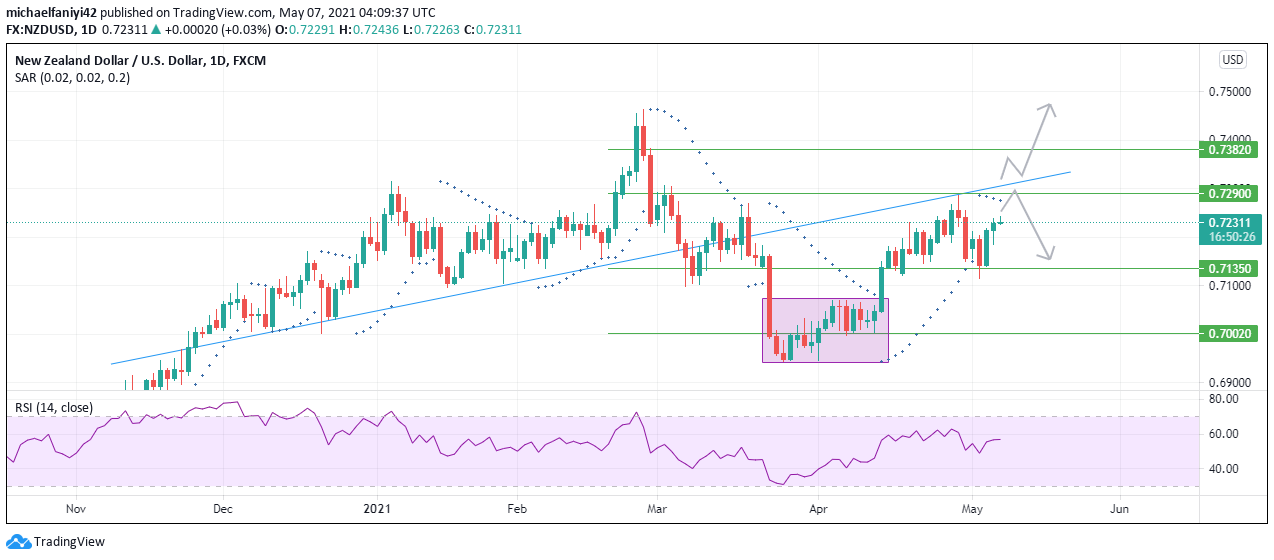

NZDUSD Key Levels:

Resistance Levels: 0.73820, 0.72900

Support Levels: 0.71350, 0.70020

NZDUSD hit a significant high of 0.74680 on the 25th of February 2021 after which it has been on a downward trend. Price then ranged for a short period with 0.71350 as support after which there was a major break-out directly to the next accumulation zone. The bulls have since dominated the market starting with an upward breakout from the accumulation zone to using the next resistance of 0.71350 as support. The price however faced a major resistance at 0.72900, which happens to be a confluence with the daily trend line. Retaining the support at 0.71350, price has rallied again to re-examine the 0.72900 resistance. What to Expect From NZDUSD

What to Expect From NZDUSD

NZDUSD is having a go again at the 0.72900 resistance having failed to break through it just over a week ago. Price closed with a very strong bullish candle two days ago but closed with a smaller candle yesterday. However, price started the day with a bullish candle and could gain sufficient momentum to re-examine the 0.72900 resistance. If price breaks the resistance, price could reach the significant-high attained earlier in the year at 0.74670. Failure will mean price could fall back to the support at 0.71350 or further back to the initial accumulation zone at 0.70020.

Currently, the Parabolic SAR (Stop and Reverse) is still against the bulls as the points are still above the candles. This shows that price needs to gain more strength if it is to break the 0.72900 barrier.

The RSI (Relative Strength Index) also shows that the price is currently indecisive, but at 57.70, the market remains swayed in favor of the bulls. The 4-hour time-frame shows more progress upwards. The Parabolic SAR currently shows all the dots under the candles. This means bulls are currently in control.

The 4-hour time-frame shows more progress upwards. The Parabolic SAR currently shows all the dots under the candles. This means bulls are currently in control.

The RSI at 61.90 also shows a strong buying position. If price continues in this momentum today into tomorrow, the barrier at 0.72900 will be broken.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Learn to Trade Forex Online

NZDUSD to Reappraise the 0.72900 Supply Zone

Footer

ForexSchoolOnline.com helps individual traders learn how to trade the Forex market

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature so you must consider the information in light of your objectives, financial situation and needs.

Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

We Introduce people to the world of currency trading. and provide educational content to help them learn how to become profitable traders. we're also a community of traders that support each other on our daily trading journey

Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply