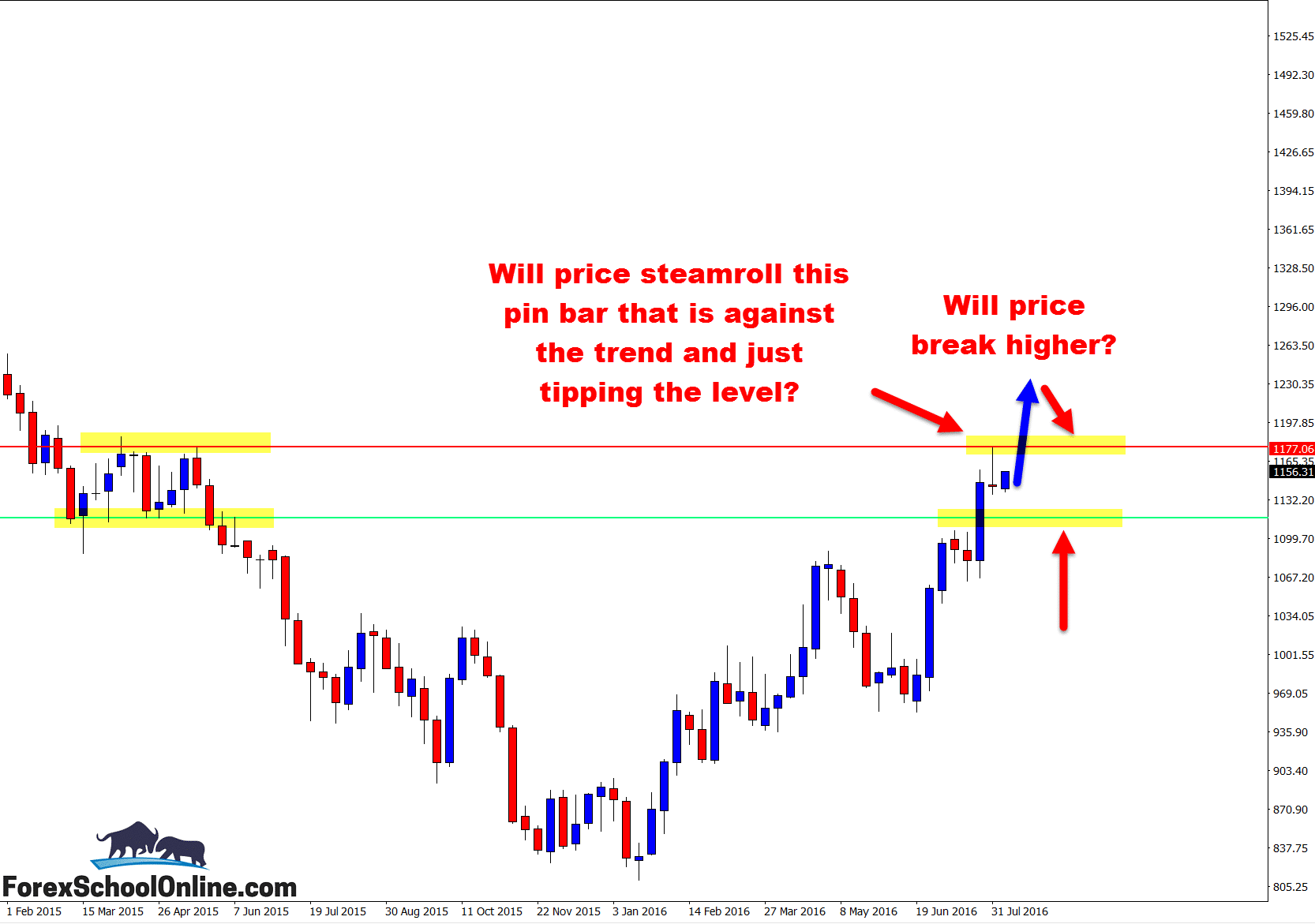

Price on the weekly price action chart of the Platinum market has fired off a bearish Pin Bar reversal that is right up at the high end, and as you can see on the chart below, the nose is tipping the resistance level.

Notice I said “tipping”, and not “rejecting” or that the pin bar was sticking out and through?

This is of key importance and something that we need to be picking up as price action traders . One of the tricky things for traders learning price action is learning these clues, putting them together within the overall price action story and then trying to work out how not to get caught out playing the wrong reversal setups.

Traders are told constantly that they need to make reversal setups from swing points and from swing highs and swing lows. They are told to make sure if making a short trade to enter a reversal setup when the bearish reversal has made a swing higher.

So, now we see on the platinum weekly chart, price has made a nice swing higher and also into a resistance level as well! And, here at this level, price has fired off a pin bar reversal.

Wouldn’t this be the perfect time to make a short trade?

In the lesson Reading Price Action With Order Flow I explain how price moves with traders and with supply and demand.

The most important factor to a high probability trade is the price action story – that is, everything that comes BEFORE the reversal trigger signal. If we look directly before this reversal trigger we can see that we have a 1,2,3 trend reversal and a very strong upward momentum.

This pin bar is forming right up at the high of this momentum. The concern however is that whilst it is against the recent move, it is also very small. As well as that, we have already covered the fact that it does not move through the major resistance level. If it did this it would activate many more bears/sellers who would potentially look to push price back lower.

Will the pin work out from here? The very last line of defence is yet to be tested. It is a super-regular occurrence for price to test the same high/low as a pin bar and move back away again. That is why the pin bar rejected it in the first place.

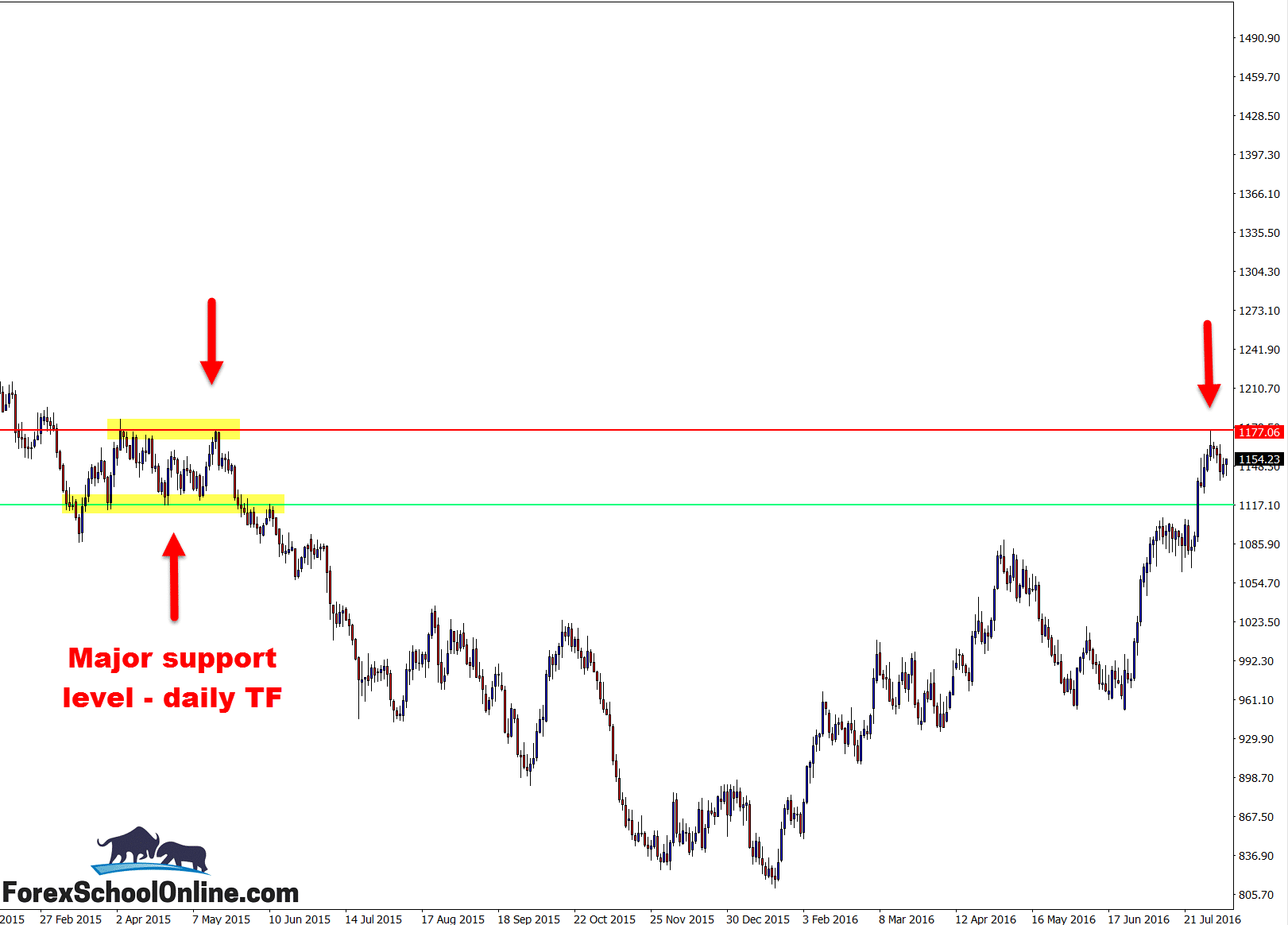

I am looking for long trades from where I have marked support on the daily chart below if price can possible make a move lower.

Weekly Platinum Chart

Daily Platinum Chart

Related Forex Trading Education

Leave a Reply