Quant Price Forecast: August 9

Quant price is in an attempt for the next upward performance. The coin price is struggling heavily not to fall and it could remain and continue to face the positive side if the buying traders should intensify their effort and break up the $168.38 previous resistance level. The potential recovery pattern may likely plunge the crypto price to a $300.00 upper high level.

Key Levels:

Resistance Levels: $130.00, $140.00, $150.00

Support Levels: $100.00, $99.00, $98.00

QNTUSD Long-term Trend: Bearish (Daily chart)

QNTUSD indicates a downward trend with a bearish sentiment in its long-term perspective. The coin is trading below the two EMAs. However, the current trend will soon be nullified as the market has just resumed its rising pattern but not yet reaches its goal.

The price drop to a $109.605 low value on the 1st of August has made the Quant price drop below the supply levels in recent times.

After completing the low dips, the coin price found a reliable resistance at a $103.55 value as a pullback below the two EMAs as the daily session resumes today. Thus, it is very likely that the upward performance continue as we are seeing a bullish correction in place at present.

Such lower price rejection indicates that buyers are defending this level and attempting to push the price higher. Hence, a strong push above the $168.38 previous mark will offer strong resistance to the crypto price.

Notably, the daily stochastic is showing an upward move in the oversold region, hence, the next upward performance of the QNTUSD market may hit the $300.00 upper high mark in the later days in its medium-term outlook.

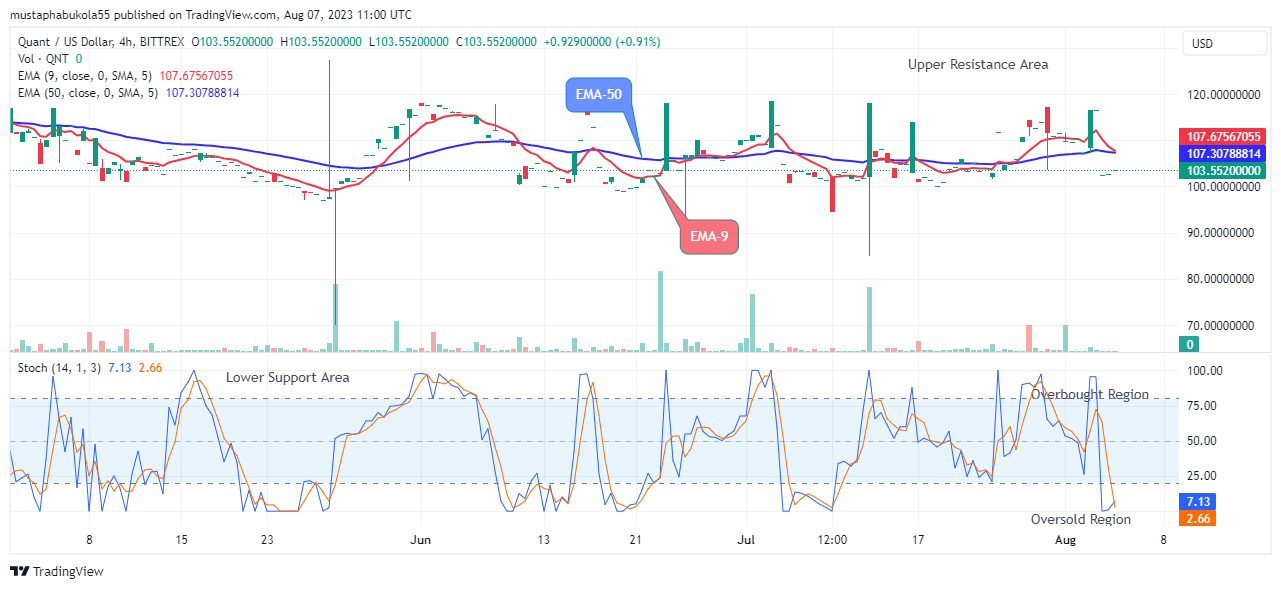

QNTUSD Medium-term Trend: Bearish (4H chart) QNTUSD Attempting the Next Upward Performance

QNTUSD Attempting the Next Upward Performance

The currency pair is showing a bearish sentiment in its medium-term time frame. The price actions can be seen below the moving averages.

Pressure from short traders at the $111.80 support value in the previous action; has made the Quant price fall below the supply levels in recent times.

The 4-hour time frame chart showed a corrective move to a $103.55 high mark by the long traders, indicating the return of the high traders to the market to dominate and control the price actions.

If buyers replenished the forthcoming bullish trend, the price of QNTUSD could break the overhead trend line as a signal of the end of the bearish thesis. The post-breakout rally could bolster buyers to rechallenge the $127.46 previous high.

Similarly, the QNTUSD price is pointing upward on the daily stochastic, this means that the upward performance will still continue and may likely reach the $300.00 supply value in the coming days in the medium-term outlook.

Place winning Quant trades with us. Get QNT here

Learn to Trade Forex Online

Quant (QNTUSD) Price Attempting the Next Upward Performance

Footer

ForexSchoolOnline.com helps individual traders learn how to trade the Forex market

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature so you must consider the information in light of your objectives, financial situation and needs.

Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

We Introduce people to the world of currency trading. and provide educational content to help them learn how to become profitable traders. we're also a community of traders that support each other on our daily trading journey

Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply