The US dollar has gained some strength in today’s trading, leading to a moderate upside correction in the USDCAD. Yet, the general market sentiment hasn’t changed significantly. Let’s try to understand what could be expected from this market shortly.

Key Price Levels:

Resistance Levels: 1.3697, 1.3750, and 1.3850

Support Levels: 1.3600, 1.3500, and 1.3400

USDCAD Remains Below the 1.3700 Mark

As mentioned earlier, the minimal recovery of the US dollar has initiated a resultant minimal correction in the USDCAD daily market. However, considering the market on a broader scale, one will agree that the major bias remains bearish. Trading activities remain below the middle limit of the Bollinger Bands.

Likewise, the Moving Average Convergence Divergence (MACD) indicator lines continue in a downward trajectory, as the leading line has crossed below the equilibrium level. The lagging line is now preparing to cross the same equilibrium level as well. This signals that traders may need more conviction to go long in this market.

USDCAD Bears Straining to Keep Price Action Below the 1.3702 Mark

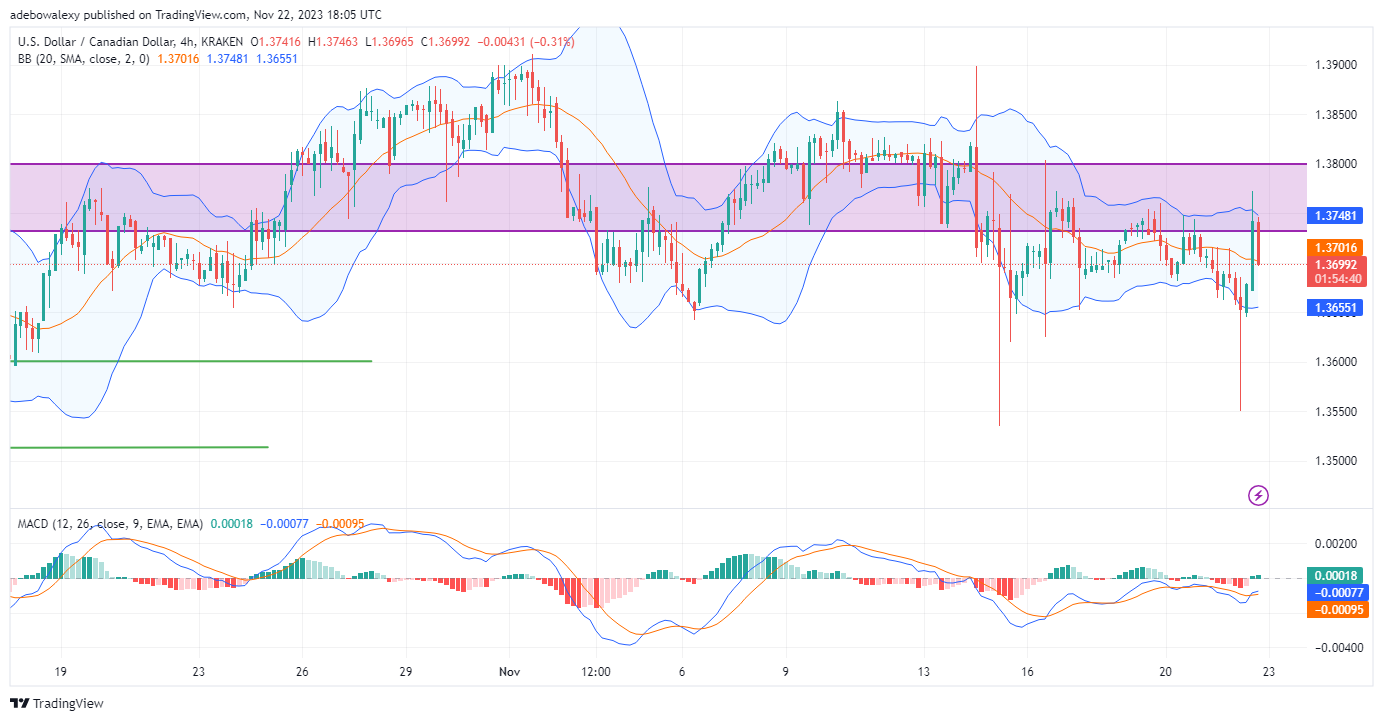

On a smaller market timeframe of the USDCAD, such as a 4-hour market, it can be seen that there has been a sharp upside correction earlier in today’s trading session. However, the sharp upside correction was subsequently met with a sharp downward correction. This correction has brought prices back below the middle limit of the Bollinger Bands.

At the same time, the MACD indicator now has a green bar above the equilibrium level. Also, the lines of the indicator have delivered a bullish crossover. However, the lines of the MACD aren’t progressing on the upside path as they should following a crossover. Consequently, this may be due to the fact that bearish pressure is still on considering the price movements in the ongoing session. Therefore, price action may trend toward the 1.3600 mark.

Do you want to take your trading to the next level? Join the best platform for that here.

Leave a Reply