The USDCAD price movement seems to have met with a temporary barrier ahead of key economic data. The perceived pause in upside movement appears to be due to the fact that the market is anticipating the US PCE and Canadian GDP. These two economic data points will play a key role in providing the market with a clear direction.

Key Price Levels:

Resistance Levels: 1.6300, 1.6400, and 1.6500

Support Levels: 1.6287, 1.6200, and 1.6100

USDCAD Price Action Corrects Off the 1.3600 Resistance Mark

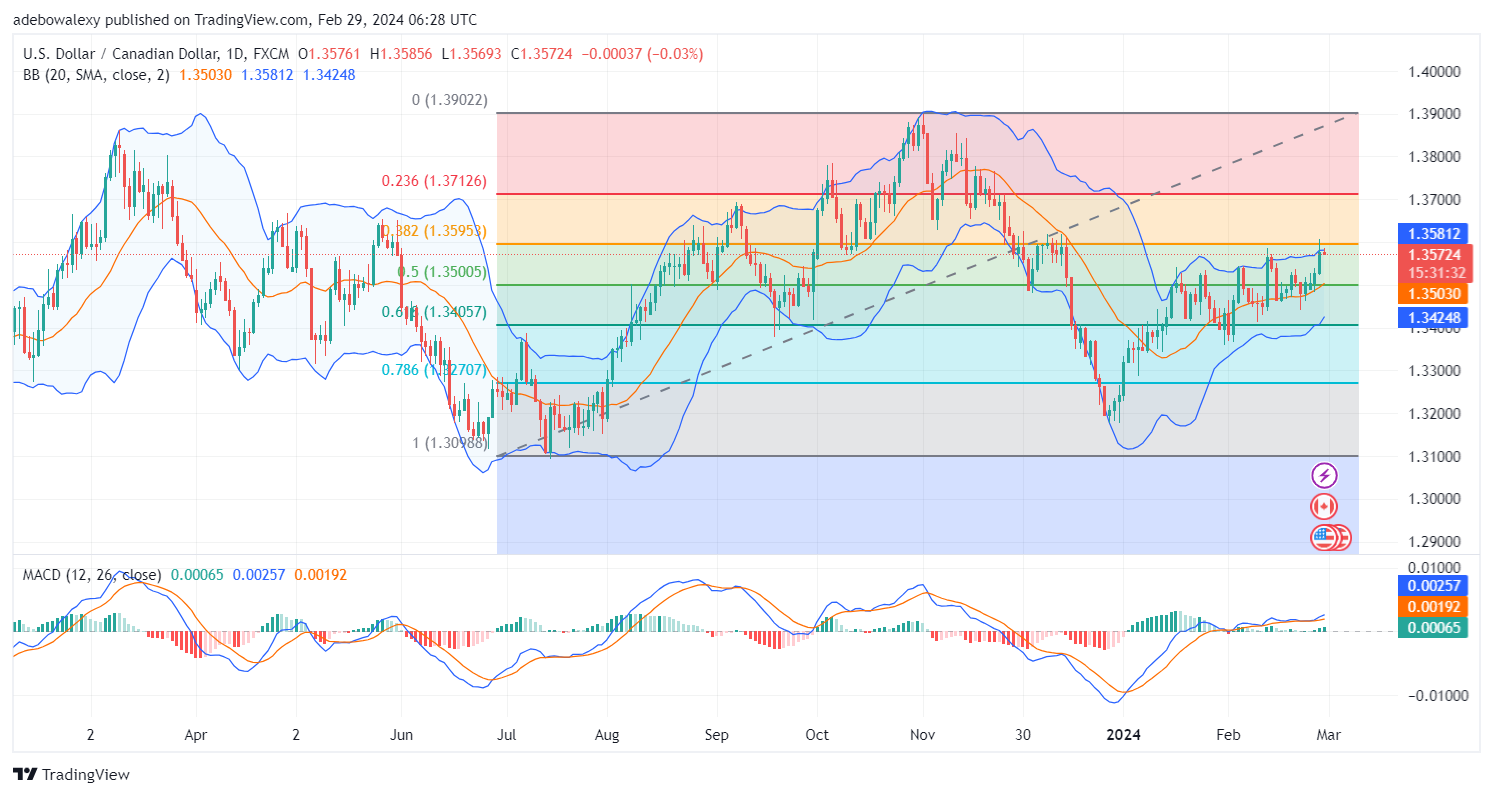

During yesterday’s trading session, the sentiment around the US dollar was fairly strong. This gave the USDCAD a significant boost towards higher price levels. However, the mood started changing towards the end of the trading session, causing a moderate price contraction, which brought the market back below the 1.3600 threshold.

The cautious mood was further reflected in today’s session and introduced yet another minimal shift in the market’s direction. Nevertheless, the pair continues trading above the Bollinger Bands MA, quite close to the uppermost limit of the indicator. Meanwhile, the Moving Average Convergence Divergence (MACD) indicator lines maintain a slightly upward bearing above the equilibrium level. Likewise, the bars of this indicator are still solid green, indicating that the upside momentum remains viable.

USDCAD Downward Correction May Be of Minimal Effect

The USDCAD 4-hour market has shown that price action in this market has, for the second session, started printing additional minimal profits. Here, we see that another tiny red price candle has appeared on the market chart, bringing the market further lower. However, market activity remains far above the middle limit of the Bollinger Bands.

While the Bollinger Bands seem slightly tilted upward, the MACD bars are also still above the equilibrium level. In addition, although the lines of this indicator are now coming closer to each other, there is still some distance between the two indicator lines. Therefore, traders can still anticipate the market to resume upside retracement towards 1.3630, so the use of carefully crafted bullish Forex signals may still be a good move.

Do you want to take your trading to the next level? Join the best platform for that here.

Leave a Reply