The currency pair is preparing for the next uphill trend.

Buyers may take over the entire market soon.

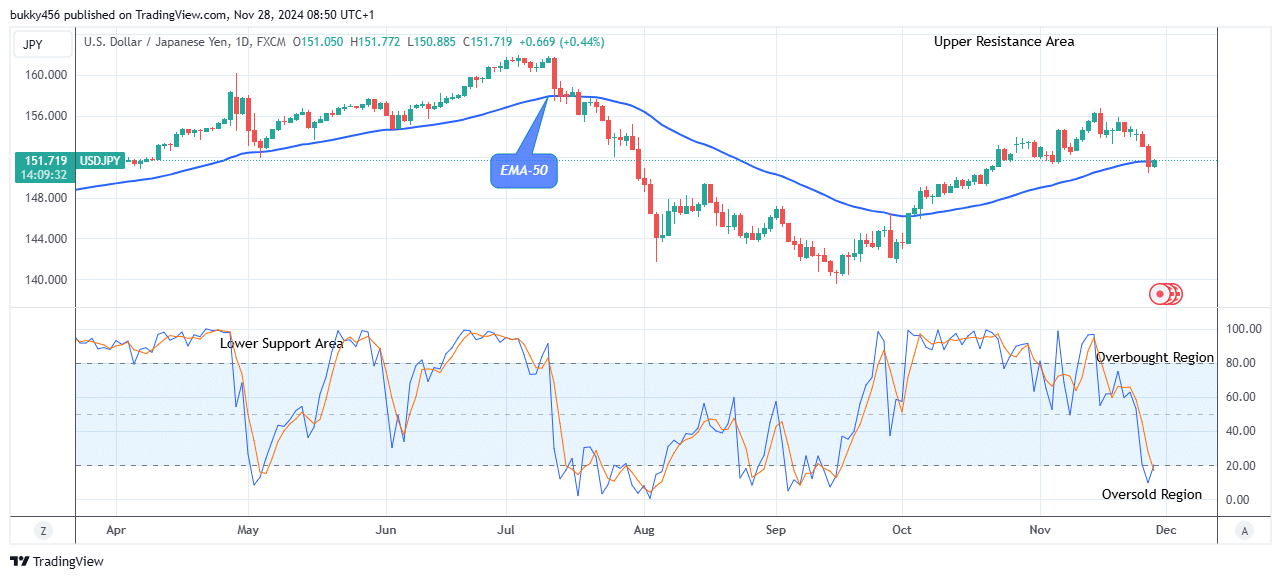

USDJPY Weekly Price Analysis – November 29

The USDJPY pair is primed for a breakout as it prepares for the next uphill trend. After completing the downside turn, the bulls begin the uphill trend, and a swift increase will follow soon. If the bulls could add more aggression to their buying actions in the market, the target might be the $160.00 upper resistance value, resulting in a profitable session for the long traders.

USDJPY Market

Key Levels:

Resistance levels: $152.00, $153.00, $154.00

Support levels: $130.00, $129.00, $128.00

USDJPY Long-term Trend: Bullish (Daily Chart)

The USDJPY market is preparing for the next uphill trend as the bulls anticipate more buying pressure to move the Yen price above the resistance levels in its long-term view. The price bar is slightly above the EMA-50, suggesting a bullish trend.

The sustained bullish pressure on the currency pair at the $154.17 high mark in the past few days has sustained the Yen price above the supply trend levels in its recent high. This has enhanced the Yen price to stay green, preparing for the next uphill trend.

The USDJPY pair on the daily chart today is preparing for the uphill trend as the price rebounded and faces resistance at the $151.77 level below the EMA-50. Further, the rising prices reclaimed more confirmation for a bullish recovery.

Therefore, if the bulls should increase their tension in the market, the price tendency may break up the $161.95 resistance value, resulting in an intraday gain for the buy traders.

In addition, the daily stochastic indicates an upward trend as the pair prepares for the next uphill trend. In light of this, buyers may likely continue with the bullish correction pattern to break up the $161.95 supply value and extend the USDJPY price to reach the $160.000 resistance mark soon in its long-term outlook.

USDJPY Medium-term Trend: Bearish (4H Chart)

The currency pair’s orientation trades in a bearish market while the pair prepares for the next uphill trend in its medium-term outlook. The price bar is below the moving averages.

The sustained selling pressure at the $150.75 low mark in the previous action has made the coin price stay below the supply trend line in its recent high.

Meanwhile, there is about to be a turnaround for the USDJPY buyers as the pair prepares for the next uphill trend to resume the bullish momentum.

The market value of USDJPY jumped to the $151.77 high level as a pullback below the EMA-50 shortly after the commencement of the 4-hourly chart today, indicating that positive sentiment is returning to the market. Thus, buyers must add more pressure to their activities to move the market beyond the current price level as it prepares for the next uphill trend.

In addition, the USDJPY market is showing more upside possibility as it remains in an uptrend on the daily stochastic; we expect more gains and strength from the coin. Hence, the pair may grow to hit the $160.00 resistance level in the days ahead in its medium-term time frame.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply