What is a Pip in Forex Trading?

When you are first starting to trade the Forex market understanding what a ‘pip’ is can be quite confusing.

Pip stands for percentage in point or price interest point and is used as unit of measurement between two currencies.

Each currency pair is normally quoted in either 4 or 5 decimals and in the case of some Japanese Yen pairs they are normally quoted in either 2 or 3 decimals.

A pip is quoted on the 4th decimal or 2nd decimal (for some Yen pairs). When trading we use the amount of pips to work out things like our entry, stops and targets as well as things like the profit made and our amount of risk.

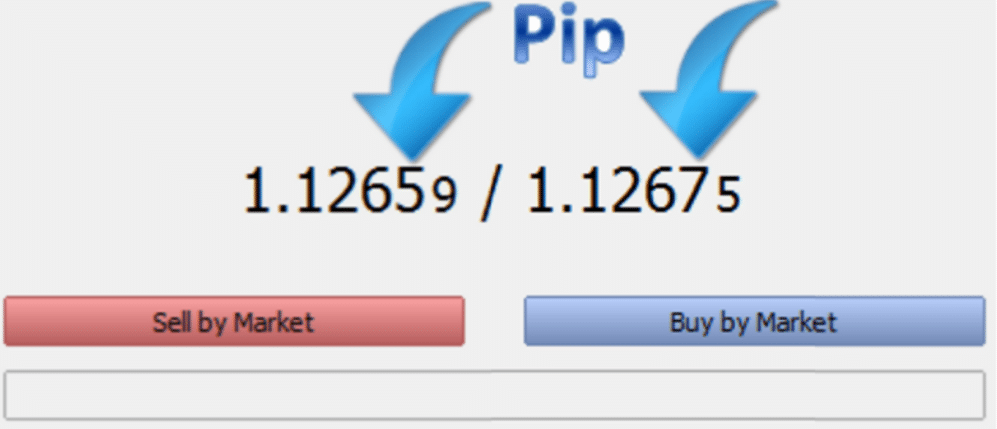

The picture below shows an order window. The 4th decimal is known as a Pip with the 5th decimal known as 1/10th of a pip and they are called “pipettes.”

For example; if the EUR/USD exchange rate moves from 1.1500 to 1.1501, that 0.0001 move represents a one pip change in price.

How to Calculate Pip Value

The pip value allows you to translate “pips” into dollars. This will help you understand how a certain number of pips equals a certain amount of profit or loss in your account and ultimately it will help you to understand your Forex risk better.

Besides the “pip” variable we also have a specific volume of our transaction which is represented by the number of lots variable, and together these two variables combined will determine the pip value for our transaction.

The pip value is not just a function of the currency pair you trade as pip value depends on the number of pips the currency pair has moved and also on the volume of your transaction.

For example; if you enter into a trade with a higher number of lots, then your pip value will be higher. If you enter a trade with a lower number of lots, then your pip value will be lower.

It’s important to understand how to calculate the pip value in order to know how much money you’re going to make or lose in each trade.

Each currency has its own relative value and pip value.

How to Work Out Pip Value in Your Base Currency

Whatever currency your account is held in, when that currency is listed second in a pair the pip values are fixed.

For example; if you have a USD base account, any pair that is xxx/USD, such as the EUR/USD will have a fixed pip value.

A standard lot will then be worth USD $10, a mini lot USD$1, and a micro lot USD$0.10.

This method also applies if your base currency is different.

If the US dollar is the base currency (E.g. USD/CAD) we’re dealing with a direct rate and the Pip Value can be calculated by using the following formula:

Pip Value = (One Pip / Exchange Rate) * Lot size

Example 1: If we buy 1 standard lot USD/CAD at an exchange rate of 1.3500, each pip move in your favor will be worth 7.4 USD.

Pip Value = (0.0001 / 1.3500) * 100.000 = 7.4 USD

If your account currency is USD and we want to know the pip value of the EUR/CAD, the standard lot for the CAD is 10 CAD$ for this pair.

We need to convert that 10 CAD$ to USD by dividing it by the USD/CAD rate. If the rate is 1.3500, the standard lot pip value is USD $7.40

So, for every 1 pip move in EUR/CAD, you will earn 7.40 USD if the exchange rate moves in your favor our lose 7.40 USD if the exchange rate moves against you.

To find the value of a pip when the USD is listed first, divide the fixed pip rate by the exchange rate.

For example, to find the value of a standard lot, if the USD/CHF exchange rate is 0.9920, a pip is worth USD $10.08.

This same method can be used for any base currency you hold your account in.