AUD/USD Price Prediction – November 28

The AUD/USD trade operation holds a bearish outlook below the 0.6800 resistance trading line. Buyers’ and sellers’ activities have been between 0.67274 and 0.66654 values, keeping a 0.82 percentage rate negative.

AUD/USD Market

Key Levels:

Resistance levels: 0.6800, 0.6900, 0.7000

Support levels: 0.6500, 0.6400, 0.6300

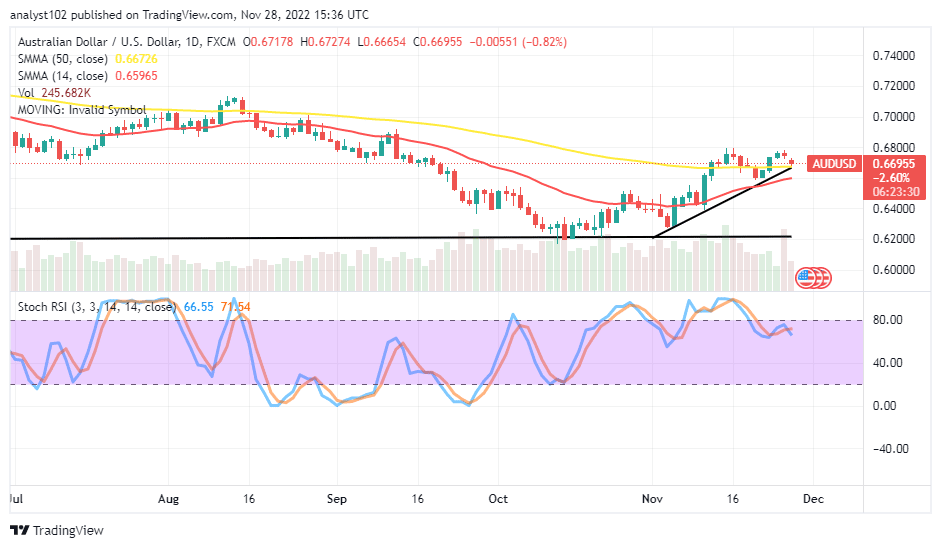

AUD/USD – Daily Chart

The AUD/USD daily chart reveals the currency pair trade holds a bearish outlook below the 0.6800 resistance level. The 14-day SMA indicator is at 0.65965 value line of the 50-day SMA indicator, which is at 0.66726 points. The bullish trend line drew from the low of 0.6200 to touch a resistance around the bigger SMA. The stochastic oscillators are attempting to cross southbound at levels 71.54 and 66.55 and are in the 80 to 81 range.

Will the AUD/USD market continue to maintain values below 0.6800?

There have been two different occasions signaling that the AUD/USD trade hit resistance around 0.6800 during a round of sessions as the currency pair price currently holds a bearish outlook below the value line. Price has been trying to regroup energy around the 0.6600 points to lessen the forces of breaking down into a declining trend resumption mode.

On the negative side of the technical spectrum, long-position placers must hold positions over the SMA values, particularly between 0.6600 and 0.6500. A sudden fearful breakdown against those points will allow the AUD/USD market bears a better edge to ride on a smooth motion to the downside.

A short glance at the technical analysis, the AUD/USD trading pattern suggests the possibility of witnessing more downs below 0.6800 has confirmed rejection signals that have occurred recently around the value point.

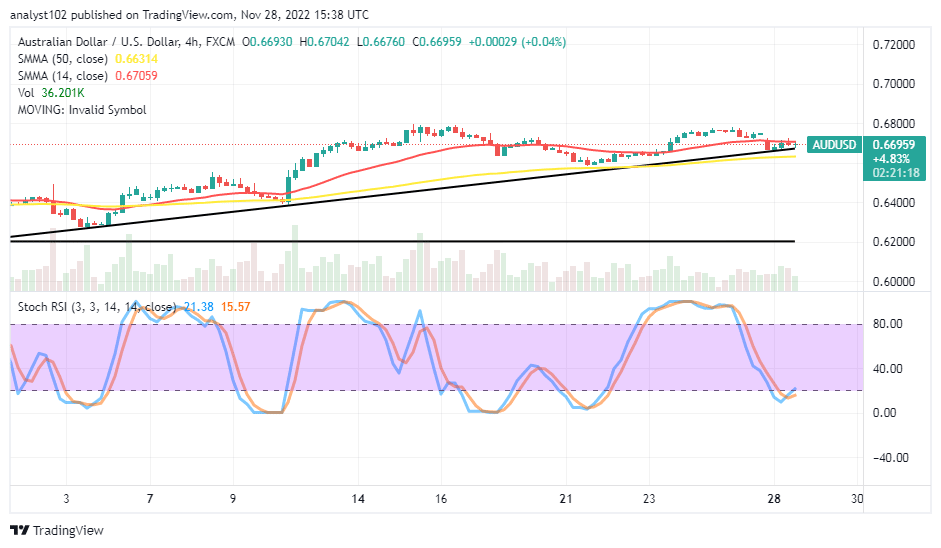

AUD/USD 4-hour Chart

The AUD/USD medium-term chart showcases that the currency pair market has not changed its direction to negate the bullish trend it has embarked upon over time. The 14-day SMA indicator is at 0.67059 above the 0.66314 value line of the 50-day SMA indicator. The Stochastic Oscillators are in the oversold region, trying to cross northbound at 15.57 and 21.38 levels. That suggests the market may have to run into some upward pushes toward the 0.6800 resistance level. We believe that selling motion we prevail in the market afterward.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply