The Long-term and the Medium-term are both in an upward momentum

Buyers may put in their aggressive orders at key areas

AUDJPY Weekly Price Analysis – May 29

In case the bulls try to increase their pressure, the resistance level of $93.828 may be tested which may be a broken upside, and the price increases to $95.134 and $95.742 significant levels.

AUDJPY Market

Key Levels:

Resistance levels: $93.800, $93.850 $93.900

Support levels: $89.600, $89.550, $89.500

AUDJPY Long-term Trend: Bullish The currency pair is in an upward move in its long-term perspective. The formation of a doji candle at the $89.645 support level which was a sign of trend reversal during yesterday’s session returned the buyers to the market.

The currency pair is in an upward move in its long-term perspective. The formation of a doji candle at the $89.645 support level which was a sign of trend reversal during yesterday’s session returned the buyers to the market.

The journey up north begins as the daily chart opens today with a bullish candle at a $90.182 resistance level.

The market value of AUDJPY rises further to the $90.950 resistance value as the pair continues its upward move.

The market value of the Yen is now up at the $91.018 resistance level above the moving averages which are glued together, an indication of upward momentum in the price of the pair.

The AUDJPY pair is pointing up around 75% range of the daily stochastic in the overbought region. The market is in bullish momentum. Buyers are expected to continue the upward trend to a significant level in the days ahead in the long-term view.

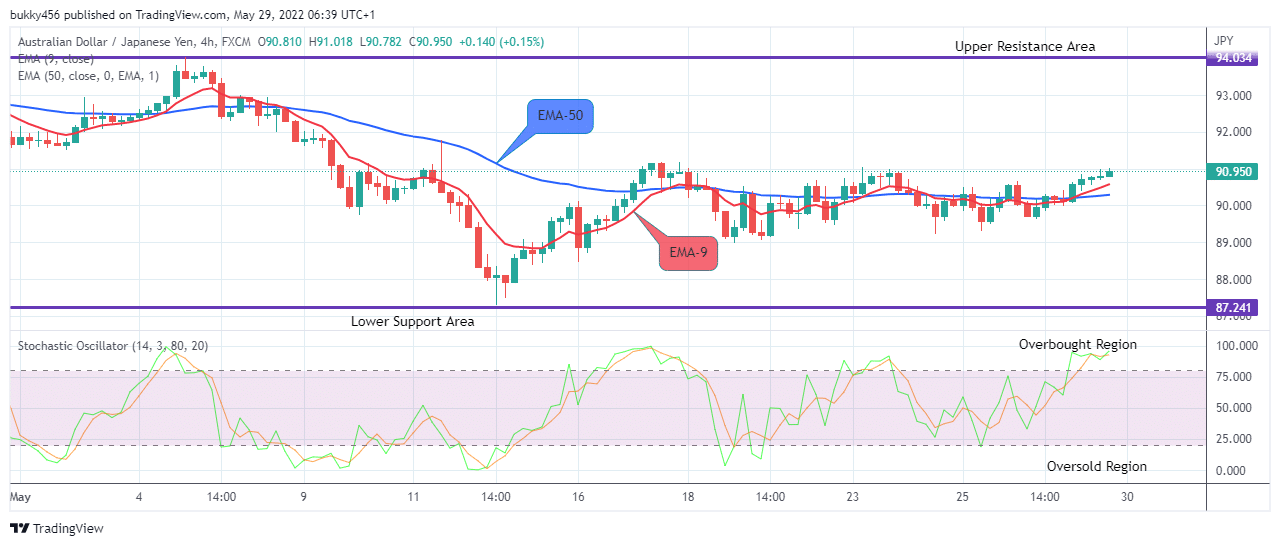

AUDJPY Medium-term Trend: Bullish The momentum on the medium-term time frame is also distinctly bullish. It seems the bulls are taking over and pushing us higher. The market is resuming a fresh uptrend. Pressure from the buyers pushed the price of the AUDJPY pair up to the $90.298 resistance level before the close of yesterday’s session.

The momentum on the medium-term time frame is also distinctly bullish. It seems the bulls are taking over and pushing us higher. The market is resuming a fresh uptrend. Pressure from the buyers pushed the price of the AUDJPY pair up to the $90.298 resistance level before the close of yesterday’s session.

Today’s 4-hourly chart opens with a bullish candle at a $90.118 resistance value as the bulls are now progressing forward.

Further moves from the buyers increase the price action of the Yen up to the $90.950 resistance level as the movement to the north remains unstoppable.

The Price of AUDJPY trading at the $91.017 resistance level above the two EMAs suggests the momentum in the price of the currency pair is in an uptrend.

The momentum indicator which is also pointing up at around level 92% in the overbought region suggests that the buyers are in control of the market at the moment and the trend may likely remain or continue in the same direction in the nearby days before the sellers will take over in the medium-term view.

Buyers may therefore take their desired position now before the bears resume their trend.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply