EURCHF Analysis – The Market Maintains Its Overall Bullish Approach

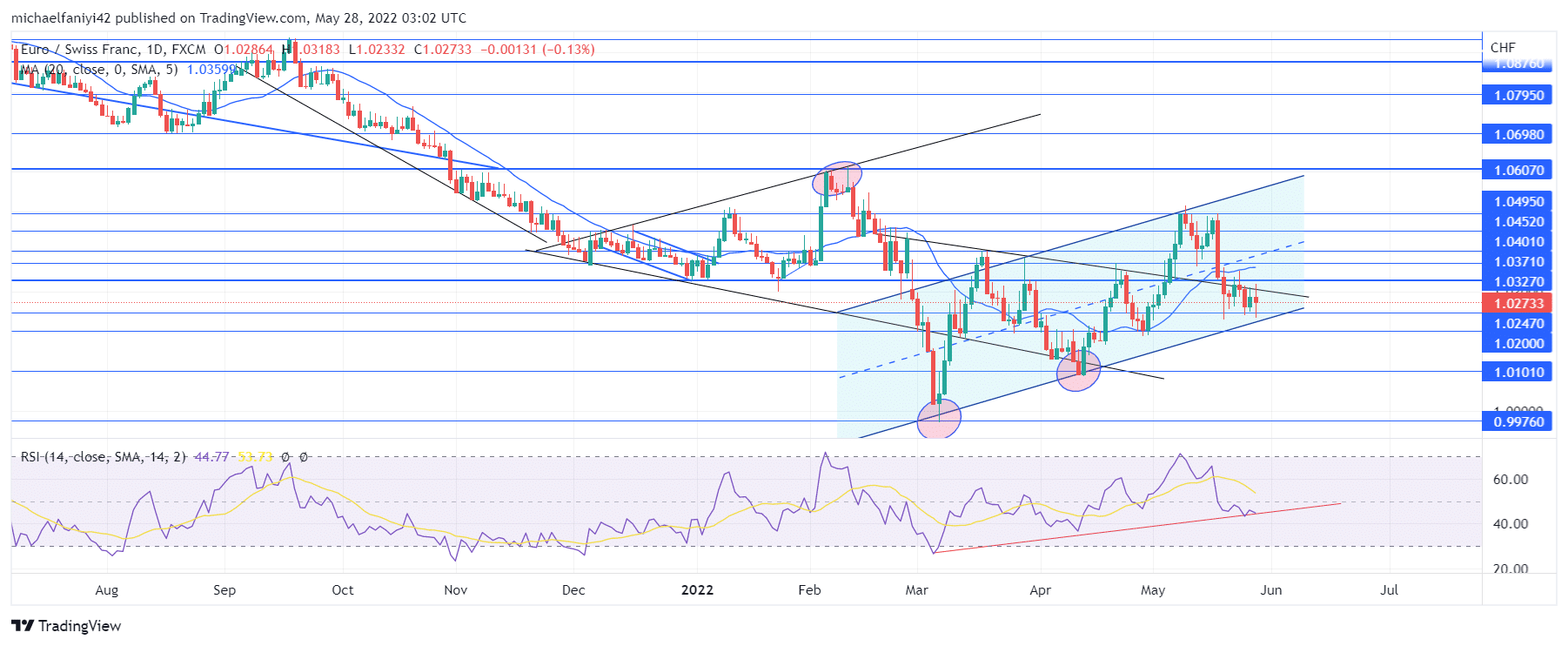

EURCHF market maintains its overall bullish outlook as it looks to reclaim lost price levels. The buyers are making more strides in the market than the drawdowns inflicted by the bears. The latest such activity sees the market leap from 1.02000 to 1.04950, as opposed to the drawdown, which stopped at 1.02470, which is a level higher, making a higher low.

EURCHF Key Levels

Resistance Levels: 1.06070, 1.04950, 1.03270

Support Levels: 1.02470, 1.02000, 0.99760 There have been a lot of twists and turns in the EURCHF market. A predominantly bearish market was interrupted with the start of the year 2022. This led to a brawl that fashioned the price into an expanding triangle system. This gave equal opportunities to opposing market forces to wield their influence. The bears took the chance to drive down the price to 0.99760. This became a trigger for the bulls.

There have been a lot of twists and turns in the EURCHF market. A predominantly bearish market was interrupted with the start of the year 2022. This led to a brawl that fashioned the price into an expanding triangle system. This gave equal opportunities to opposing market forces to wield their influence. The bears took the chance to drive down the price to 0.99760. This became a trigger for the bulls.

The bulls began to engineer a reversal, and in doing this, they had to battle off the dominant influence of the bears. This gave rise to the use of the rising channel. A consistent attribute of the market through the channel is constant higher lows. This is a result of the pullback on every upward drive. Nevertheless, the price keeps making progress upward. The RSI (Relative Strength Index) shows this with a general uptrend.

Market Expectations

Market Expectations

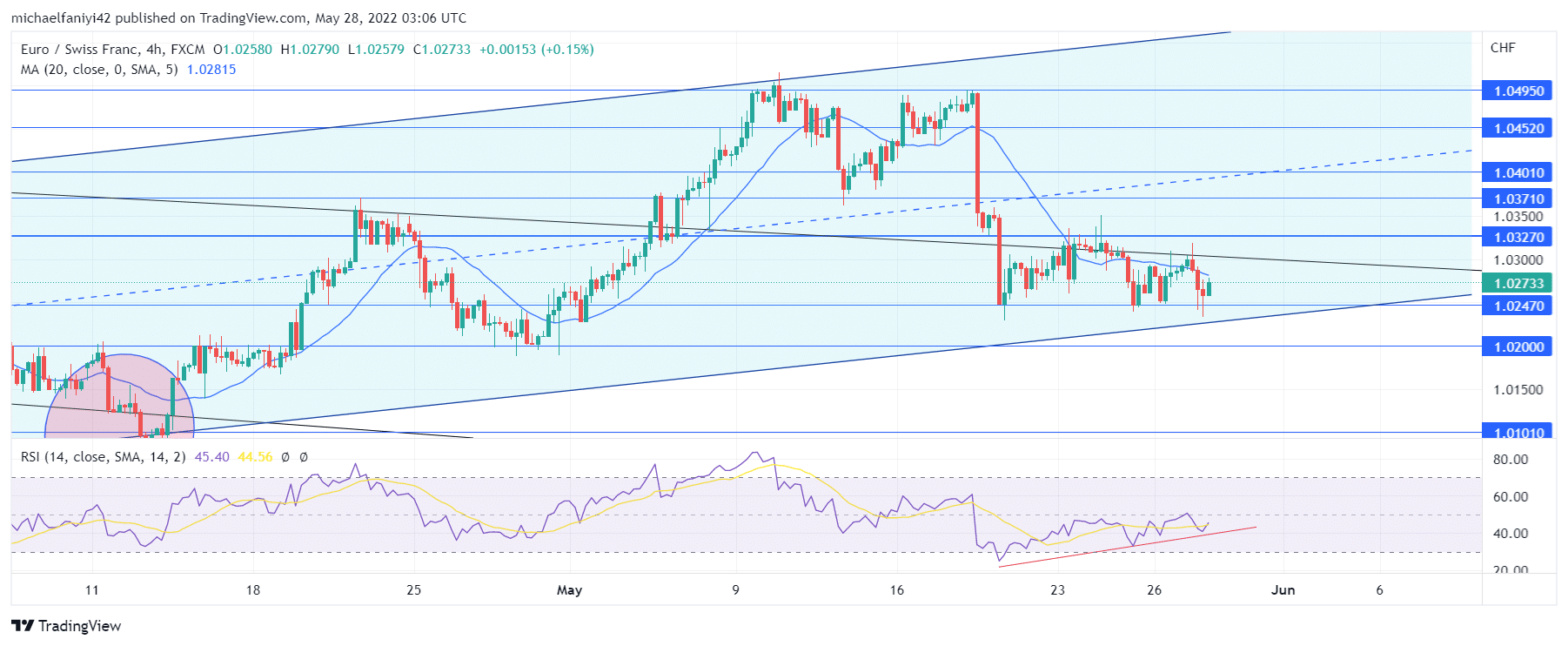

On the 4-hour chart, the price stabilises above the 1.02470 critical level as bulls look to regroup and rally. However, the price has traded below the MA period 20 (Moving Average), which will pose a resistance level going up to the market. Nevertheless, the RSI indicator shows that bullish prowess is building up, despite the current sideways movement in the market. EURCHF is anticipated to rise towards 1.06070.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply