EURUSD Analysis -Market Seeks Sell-Side Liquidity at the Previous Daily Low

EURUSD seeks sell-side liquidity at the previous daily low. While the current market’s environment is trending, both EURUSD buyers and sellers are actively participating in the market as impulse waves and corrective waves emerge one after the other.

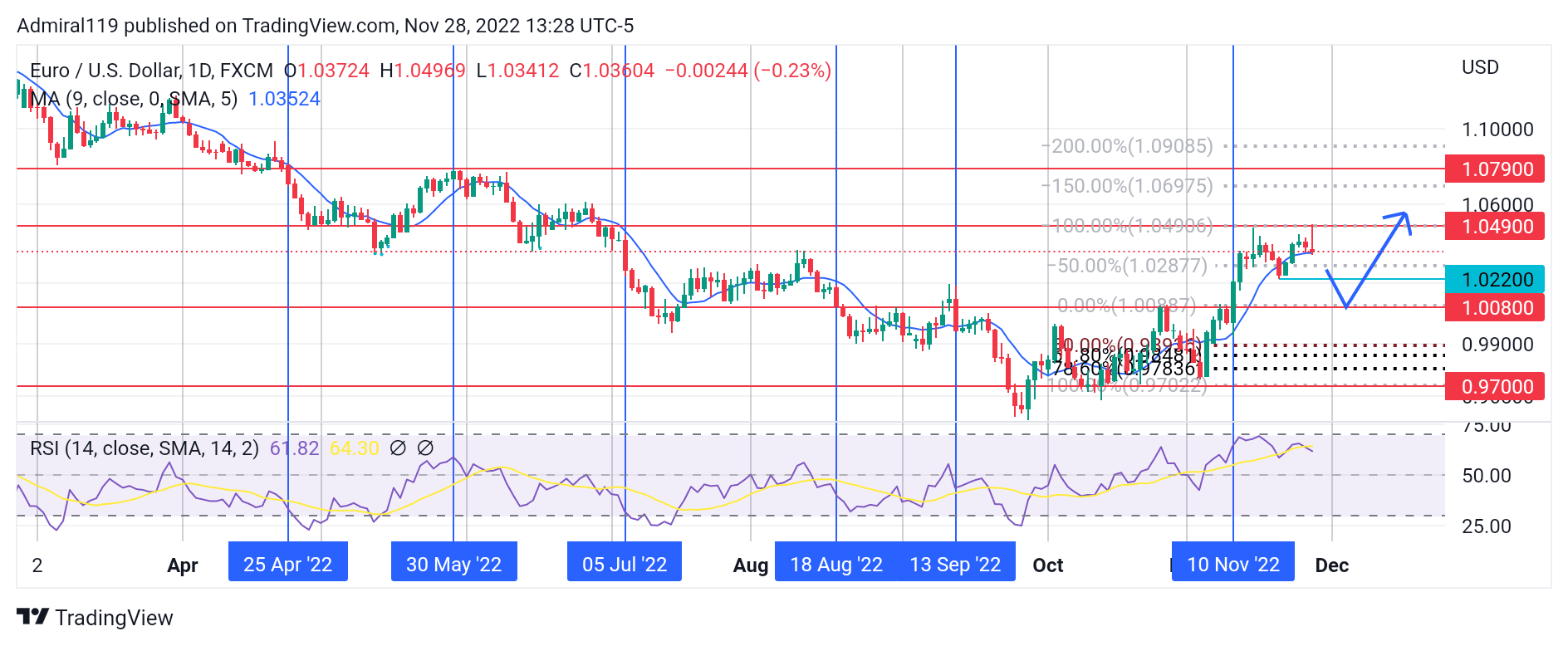

EURUSD Significant Zones

Demand Zones: 1.0080, 0.9700

Supply Zones: 1.0490, 1.0790

Using the 0.9700 and 1.0080 price levels, it seems EURUSD was projected by its buyers to reach the –100% Fibonacci retracement level before the impulse swing ends. Now the EURUSD buyers are exiting the market for the EURUSD sellers to take over. In the second quarter of the year, major previous support was invalidated on April 25, 2022. Price declined into an oversold region as indicated by the Relative Strength Index (RSI) before retracing upward to fill the liquidity void created along the way. On May 30, 2022, the 1.0790 price level was retested, and the price crashed further this time around to form a double bottom.

Due to the EURUSD sellers’ influence in the market, the double bottom was invalidated on July 5, 2022, and the price continued again into an oversold region. On August 18, 2022, prices were delivered to the downside, thereby creating a bearish order block that pushed prices downward on September 13, 2022. The rejection at the bearish order block caused the price to sink into the oversold region for the last time before the occurrence of the failure swing. On November 10, 2022, the change of character was confirmed as the price expanded aggressively to the upside.

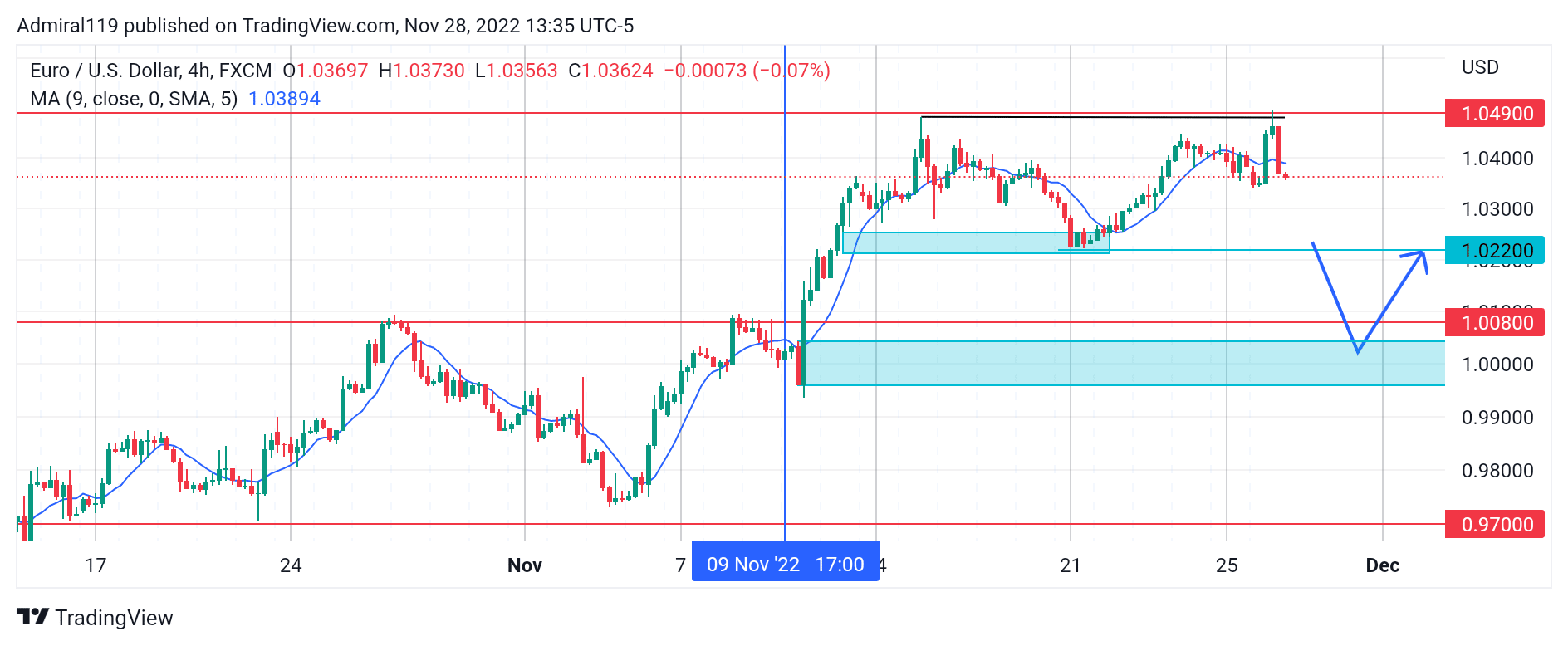

Market Expectation

Following the grab of buy-side liquidity at the previous high, the market appears to be heading into a discount for buy orders. Once the old low at the 1.0220 price level breaks, EURUSD might head into the four-hour bullish order block before resuming the market’s uptrend.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply