How to Manage Your Forex Trades: Quick Guide

Trade management is one of the most important aspects of trading. I am not going to say “the most” important because that gong goes to the psychological side of trading.

Yes, believe it or not, how your mind reacts and how you think, behave, and operate in the markets is the number one most important factor that will determine your success – or not.

This is surprising to a lot of traders, but it really shouldn’t be. If we stop and think logically about it for a second, we know that trading is really just about making really great decisions, time and time again. We have our individual plans and rules, and once we have a profitable trading plan, it is just a matter of sticking to the plan and making great decisions time and time again.

It is our minds, including both the conscious and subconscious minds, that determine the types of decisions we make. We can have great plans, but do we stick to them? Do we get into a trade and panic? Do we cut a trade before we should or let a loser run for too long and go past our stopping point?

These are all mistakes, created from the mind, that can be eradicated if you spend time working on yourself and time on working on your trading psychology.

As I say, time and time again, if you take the time to become a better decision maker and a better psychological trader by working on it, you are going to put yourself way out in front of the pack, no matter what method or system you turn your hand to!

Why is Trade Management so Super Important?

You have probably heard me say this; however, it is very true about trade management; without spreads, anyone could flip a coin and pick winners 50% of the time, even a monkey could. Only a skilled and educated trader, who has a plan and understands their trading strategy, can manage their trades time and time again for consistent profits.

Whilst entering the market at the correct entry position is very important (because if we don’t, we are not going to have any chance of managing any profits), it is in the trade management where all the profits are either made or lost, and this is where one trader can either walk away from a trade with a profit or another trader can walk away from the exact same trade with a loss, due to trade management.

Traders are often so wrapped up in finding their entry signals and the “holy grail” of entries, they are not realizing that it is actually their trade management that is killing them and their trading profitability. They are either leaving their losses on for too long, not protecting their capital when they should be, or not taking their profits off when the market makes it available to them.

The Key to Becoming a Super Trade Manager

The key to becoming a consistently good trade manager is both having a great mindset that allows you to make great decisions without fear or any other emotion dragging on you, and also, having a really solid, sound, and logical rule set that tells you EXACTLY what to do, when to do it, and how to do it.

This is how you build your trading edge and become profitable. Your trading edge is so important, and hand in hand with it is your rule set. It is this rule set that is like an automated machine and you are just the person working the machine pulling the levers and emptying the money slot.

If you have a profitable trading edge, it is these trading management rules that will tell you when to move to break even, when to take your first profit, if you should trail a stop, if a particular setup should be managed a bit tighter than another setup, or because it is in a trend, you should look for a bigger risk reward pay off.

As just stated above, your edge and rules are just like an automated machine and all you have to do is continue following the rules, keep making great decisions, and as long as your edge is a profitable one, you will make profits.

The secret then, becomes making sure your rules are all set up correctly and your discipline is so strong that no matter how small a rule is, you stick to it!

You Need to Have a Plan of a Different Kind – a Pre-Trade Plan

The “Pre-Trade Plan” is something that can literally turn a traders career around because it takes the most tricky and difficult part of trading and makes it structured, logical, and methodized.

Without this pre-trade plan, traders enter their trade and are often just hoping for the best. A lot of good traders have a fair idea before entering the trade of what is ahead of them before they enter, but the vast majority of traders get into their trades and then think “crikey, what on earth should I do now?”

How often do you see traders post in forums, asking complete strangers for trade management advice whilst they are half way through a live trade, asking whether they should be holding or getting out of their live trade? The reason this is happening so often is because they DON’T HAVE ANY PLANS before they are getting into their trades.

When we get into our trades with no plans, it means we are going to be prone to making really, really, really terrible decisions. It also means we are going to be full of doubt when price flips or flops because we do not have any set concrete plans that we can simply follow, no matter which way the price moves.

A pre-trade plan allows us to have the clarity and certainty of mind that we need to have when going into a trade. The best time to make a trading decision is when there is no money on the line, and that is before you have placed the trade. This is important to note because, as a trader, making really great decisions is what you do as a career.

Before you have placed your trade and before there is any money on the line, you can firstly, set up your whole trade.

Get the entry and perfect stop level worked out. You can then work out exactly where the major areas to manage your trade are going to come in. You DO NOT need to get half way through the trade for the price to hit the exact same areas to work it out then. You can work these areas out before the trade has begun, and then, manage the trade according to a plan and rules.

You should have a trading plan, and this trading plan should go through exactly what your individual trading rules for your trading method are. These rules should cover everything from when you enter, to how you manage different markets, etc. The pre-trade plan will be using these rules so that every time you manage a trade, you are managing a trade the EXACT same way.

Obviously, you want to be managing your trades consistently over time because the more consistent of a trader you can be, the more consistent your results will be. This is why both having a plan, and the rules within the plan are super important.

A Pre-trade plan should cover the following:

⦁ Where you plan to enter

⦁ How many positions you plan to have

⦁ First target

⦁ If you are going to move to break even, where is the break even spot/price

⦁ Second target

⦁ Third target?

⦁ Any other applicable notes.

For example, you may decide that after taking profit on the second target, you want to use a trailing stop with the 3rd and last position. Make sure to write this or anything else in your pre-trade plan.

Your plan needs to be as detailed as possible. You want to make your pre-trade plan so that if someone was to come and find it, they could manage your trade for you without any instructions from you at all.

Watch the Trap – The Different Market Trap

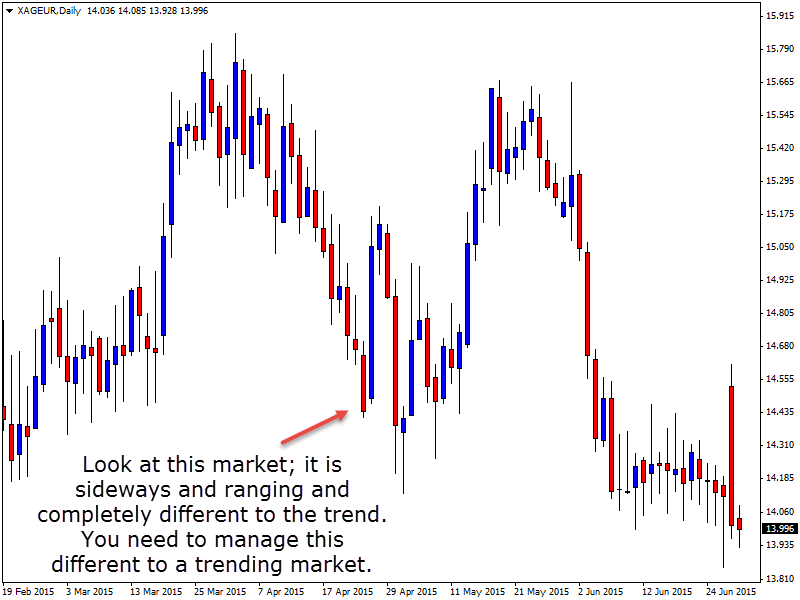

A HUGE mistake a lot of traders make (nod your head if this is you) is that they manage all of their trades the exact same way, no matter what type of market conditions. If the market is in a strong trend, the trader will manage the exact same way as another trade that is in a really tight and consolidated ranging market.

So, what is wrong with this? The problem is that if you are managing trades this way, you are giving away a lot of missed potential profits when the market is open and trending, and, as I will explain in a moment, perfect for looking for the bigger risk reward setups.

On the flip side, you may be taking on a lot more losses than you need to because you are not managing anywhere near tight enough or protecting your capital at the right times in the markets – at the times that you need to.

Not All Markets are the Same

Not all markets are the same. We can just flick through our daily charts and, quite clearly and obviously, see that not all markets are anywhere near the same and that is where you, as a price action trader, earn your money.

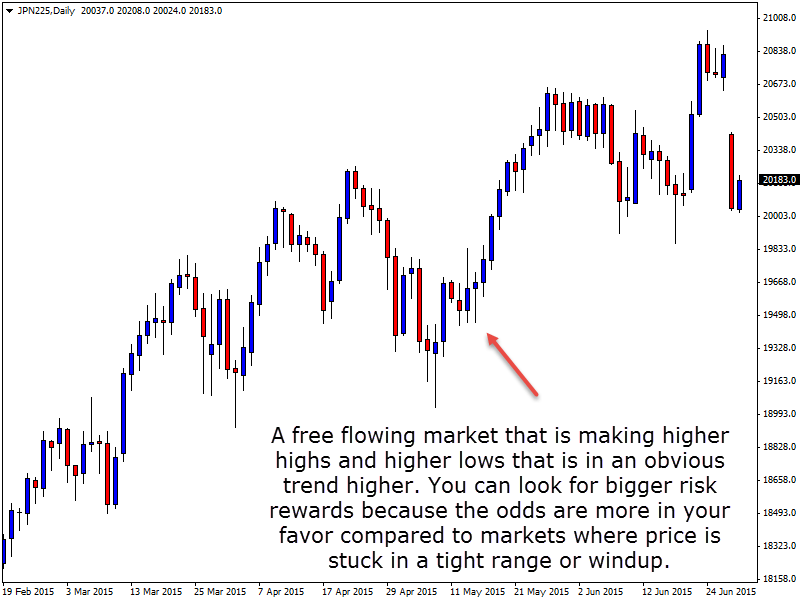

It is your job to identify the market types and to work out if price is in a strong trend; if price is making higher highs and lower lows. Is price winding up or is price caught in a tight box of consolidation? Is there a clear range with an obvious high and low to the range that can be traded in between or is the whole chart just a big choppy mess with a lot of traffic that is best left alone until some space is made?

These are all questions you need to be constantly asking yourself as you piece together the WHOLE price action story.

Price is a lot more likely to continue doing what is has just been doing. For example, if price has been in a range, then it is super likely to continue ranging, and if it has been in a trend, then a trend is likely to continue until something happens to change it.

The reason for this is because of how the order flow behind it works. For example, if price was stuck in a range, the big guys know that price normally does not go far in ranges (i.e. it makes smaller moves). Normally, trades are higher risk in ranges. There are a lot more minor support and resistance levels and the big guys also know that price is a lot more likely to stay ranging.

Because of all this, the big guys will generally stay out of making a trade inside the range. This will mean that when price gets into a range, the order flow can start to dry up; in other words, the amount of buy and sell orders can start to become less and less. This is why you will often see price start to wind up tighter and tighter. This is the price action order flow getting smaller.

Then what happens? BANG! A huge breakout one way. All of a sudden, this windup will explode because the pros have watched everyone else get squeezed and they have waited for the windup and range to break and then they pounce.

Once you identify the market type, it is so super important that you recognize that there are better times than others to look for bigger risk reward trades, and other times when you should be managing your trades a bit tighter.

As I go through this following section, try to keep in mind what I have just said about price moving the same way as it has just been moving. The best times to look for the bigger risk reward setups, and to look for the running trades with multiple positions, are when price is in an obvious and strong trend.

The simple reason for this is because price is a heck of a lot more likely to continue rolling back over in your favor and because there is also going to be space on your side. The obvious trends are the times to look for the big risk reward trades, not trading in ranges or counter trend.

Identify The Market Range

When you are trading in a range, a consolidation period, or some sort of windup, you need to be measured and a lot more cautious. Price in these markets is a heck of a lot more likely to whipsaw and bounce around. You can often pick the correct direction, but be stopped out before price gets to your targets.

You need to obviously manage these types of markets differently. You’re not going to be a hero in a tight ranging market and look for huge risk reward setups. You need to respect the market type.

See examples below of two different markets and how you need to manage them very differently. One is a trend higher that is free flowing and the other a range and sideways market that you would need to manage a lot more tightly with more respect.

This is where it gets to personalities, knowing what type of trader you are, and knowing what suits you. If you are the type of trader who only likes big risk rewards, then you may choose to only trade trending markets and skip tight, consolidated, and ranging markets. This may mean you are out of the market for awhile, waiting for trades because the market ranges a lot more than it trends, but everyone is different.

I personally just like making profits and will trade all market types to make them. I don’t care what market type it comes from, as long as it is profit overall, I am happy with it. I will just adjust my trade management accordingly to the market type.

The Crucial Points to You Crushing it & Becoming a Success

I know that I keep banging on about it :), but there are a few non-negotiables to becoming a successful trader and this means being super disciplined to your rules and plan. In our trading careers, there is no one to hold us accountable, but ourselves.

If you are in a trade that is looking super promising and moving really strongly in your favor, there is going to be NO ONE to tell you to stick to your plan and take profit when your rules and plan say that you should be.

You are the only one that will know if you get greedy and don’t take profit when your plan says you should and instead, you look for a bigger profit target than what your pre-trade plan has written down. Whilst it may work this time and it may work the next five times, this type of trading is GUARANTEED to fail in the end because you are trading against yourself, breaking your own rules, and once you break one rule, it becomes a lot easier to start breaking all of the others.

As alluded to above, the markets, all of them in general, don’t have any rules. There is no one telling you when to trade, how much to trade, what time you should exit the trade, if you should exit half the trade or all of it, if you should trail a stop, or what time frame you should be looking at, etc, etc. There are no rules EXCEPT the ones you put on yourself!

This is why the rules you make and the trading plans you create, including the pre-trade plan to manage your trades, are so, so important. If you lack discipline and start to break rules, it is like a stack of cards and your whole trading edge falls apart.

Why? I get asked this all the time. I get asked, “Why are you so strict about such a small rule?” My answer is, it does not matter what the rule is; a rule is a rule and once you break one rule, where do you stop? It is a very slippery slope.

Keep that in mind when you are about to break your next rule because your whole trading edge and profitability hangs on it. Once you break one, it becomes a lot easier to start breaking all the rest.

I cannot stress just how important a pre-trade plan is to your trading and how, by you implementing it, you will be able to start seeing results in your trading almost immediately.

I would love to hear your comments below about your trade management experience, and also, how you go with implementing the pre-trade plan into your trading. Also, let me know if you have any questions.

Safe trading and all the success,

Johnathon

I’m expecting to implement my trading plan after I finish my course

Quality artical thank you for sharing.