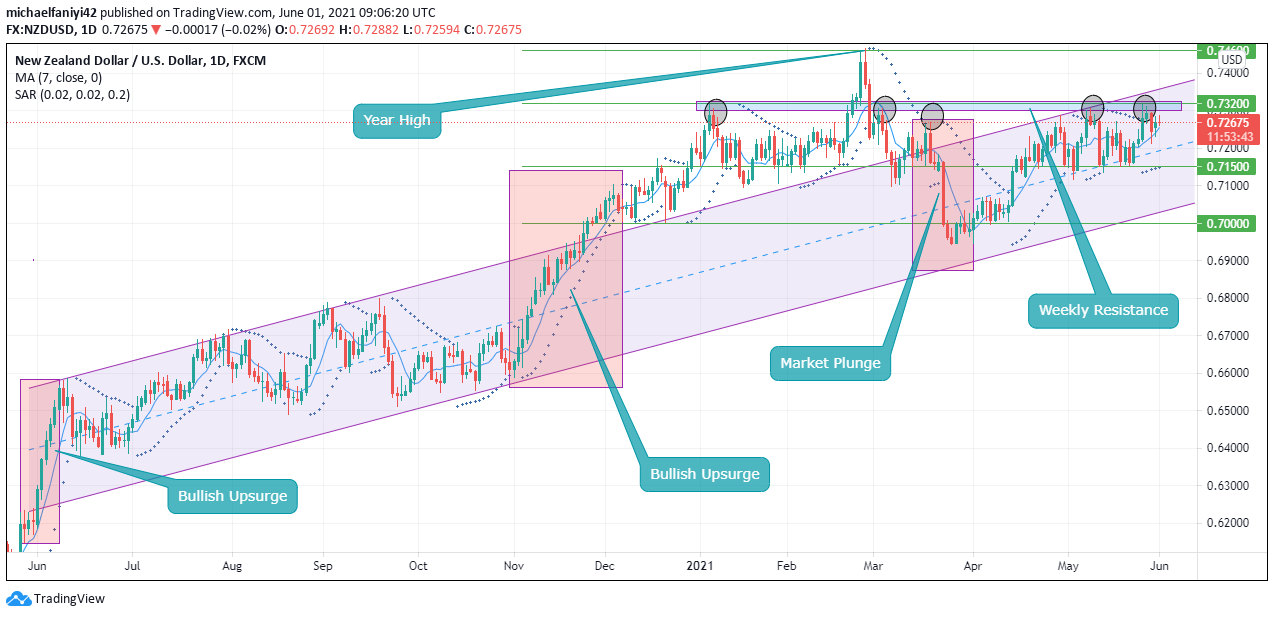

NZDUSD Major Zones

Demand Zones: 0.7460, 0.7320

Supply Zones: 0.7150, 0.7000

NZDUSD Market Analysis

NZDUSD uptrend movement has continued but must now overcome a major impediment to progress. Since the market hit a major low in March 2020, the New Zealand Dollar has been strengthening itself against the U.S. Dollar in leaps and bounds, literally.

On the 26th of May 2020, there was an upsurge into a new uptrend parallel channel, with the midline acting as a resistance/support in the uptrend. Another upsurge happened again on the 2nd of November 2020, breaking the impediment of the parallel channel upwards.  NZDUSD first hit the 0.7320 resistance on the 6th of January 2021 to which it was repelled. The price gathered strong support at 0.7150 with which it shot past up to a year high at 0.7460. However, 0.7320 failed to support it when retracing and instead sunk it below. NZDUSD tried the move past the 0.7320 impediment again, but this time, it was knocked out and down back into the initial uptrend parallel channel.

NZDUSD first hit the 0.7320 resistance on the 6th of January 2021 to which it was repelled. The price gathered strong support at 0.7150 with which it shot past up to a year high at 0.7460. However, 0.7320 failed to support it when retracing and instead sunk it below. NZDUSD tried the move past the 0.7320 impediment again, but this time, it was knocked out and down back into the initial uptrend parallel channel.

Can NZDUSD Uptrend Break Past the Weekly Impediment?

The market has since been flowing patiently along the uptrend channel, which has incidentally brought it for a re-match with the 0.7320 impediment. NZDUSD has since failed to get past it twice now, (five times in all) and with another meeting imminent, time is running out for NZDUSD to make progress. The price could either breakthrough to get to the year high at 0.7460 or get knocked down to 0.7000 which could lead the market to consolidation or signal a total change in market direction.

The Parabolic SAR (Stop and Reverse) and the 7MA (Moving Average) are signaling support for the market moving upwards to break the 0.7320 resistance. NZDUSD has been using the midline of the parallel channel as support with consistent higher lows seen on the 4-hour chart. Price is set to test the resolve of 0.7320 impediment again. The 7MA is facing upwards and the Parabolic SAR has its dots under the candles both showing current bullish activities.

NZDUSD has been using the midline of the parallel channel as support with consistent higher lows seen on the 4-hour chart. Price is set to test the resolve of 0.7320 impediment again. The 7MA is facing upwards and the Parabolic SAR has its dots under the candles both showing current bullish activities.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply