BlackBull Markets is an award-winning ECN broker that offers thousands of tradable assets like forex, shares, commodities and indices at low spreads. The broker is compatible with MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms as well as WebTrader.

Our BlackBull Markets review covers the key features, fees, and user experience that the multi-asset broker provides. Later on, we’ll also explain how to get started with live trading on BlackBull Markets.

BlackBull Markets Pros & Cons

Check out our BlackBull Markets review pros and cons list for a roundup of the broker’s most important features.

Pros: Cons:

Your capital is at risk.

BlackBull Markets Tradable Instruments

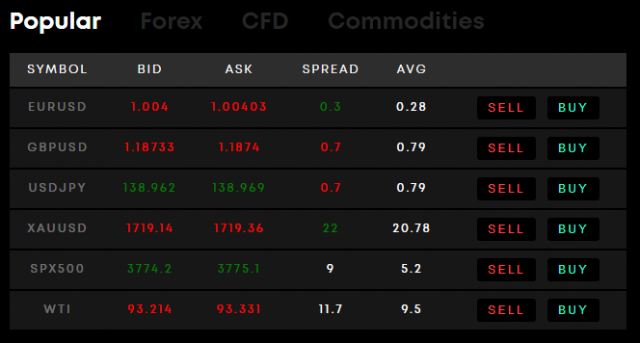

BlackBull Market users can trade four main assets: forex, indices, commodities, and stocks. In this section of the BlackBull Markets review, we discuss each asset in more detail.

Forex

BlackBull Markets lets traders take positions in some of the most popular forex pairs available. Over 25 major and minor pairs can be accessed through the broker and traded using established forex platforms like MT4 and MT5.

BlackBull Markets tradable major forex pairs are:

- EUR/USD

- GBP/USD

- USD/JPY

- USD/CAD

- AUD/USD

- NZD/USD

- USD/CHF

Index CFDs

Using indices is one of the best ways to trade different industries as an index is a group of different securities. In BlackBull Markets, users can trade index CFDs which lets them buy the assets without ever owning the underlying asset. The advantage to trading CFDs is that the trader can open positions based on the price movement of the asset.

BlackBull Markets indices are: US30, SPX500, AUS200, FRA40, UK100, and GER 30.

Commodities

Commodities are raw products that many investors trade when other markets have poorer trading conditions. It allows them to hedge their positions on other markets like stocks since they are different asset classes. In BlackBull Markets, traders can open both spot and future commodity positions which let them trade current and future asset prices.

The commodities offered by BlackBull Markets comprise of:

- Gold Spot/Futures

- Silver Spot/Futures

- Crude Oil Brent Cash/Futures

- West Texas Intermediate Crude Oil Cash/Futures

- Natural Gas

- US Cocoa

- London Cocoa

- Soybean Futures

- Wheat Futures

- US Sugar Futures

- London Sugar Futures

- Corn Futures

- US Cotton Futures

- US Coffee Futures

- London Coffee Futures

Stocks

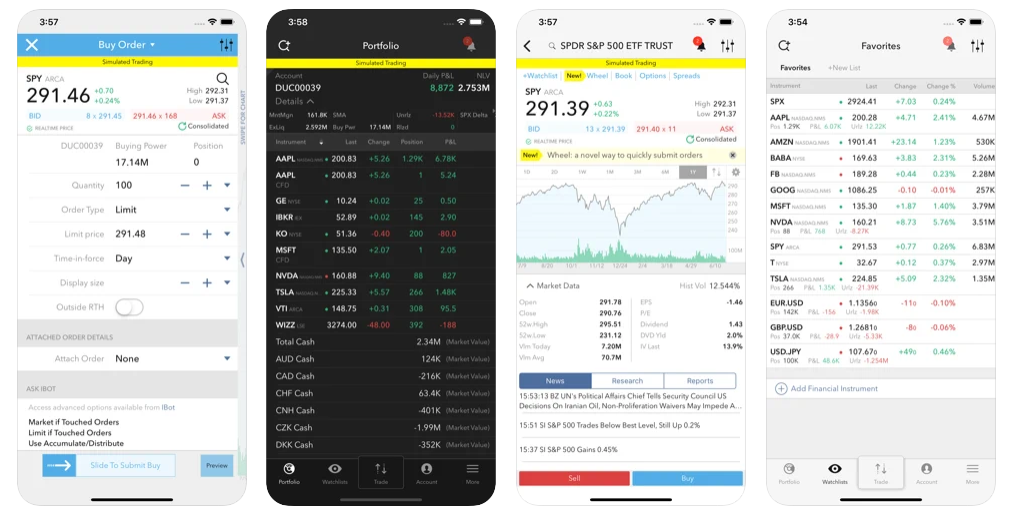

BlackBull Markets offers over 23,000 stocks from the world’s most traded public companies. The broker has their own stock trading app, BlackBull Shares Trading, where users have access to extended-hours trading, stock news and analysis, and more than 70 order types.

BlackBull Markets Fees

Finance platforms and brokers earn through trading fees that are usually in the form of spreads or flat trading rates. Depending on the account type used in BlackBull Markets, users will have trading fees in commission per lot for Prime accounts and spreads (bid/ask price difference) for Standard accounts.

Below is a table summary of important fees when using the BlackBull Markets broker.

2,000 USD (Prime account)

Deposit fee

None

Withdrawal fee

5 USD or 5 Base Account Currency

Standard Account commission

None

Prime Account commission

6 USD per lot

Minimum deposit

50 USD (Standard account)

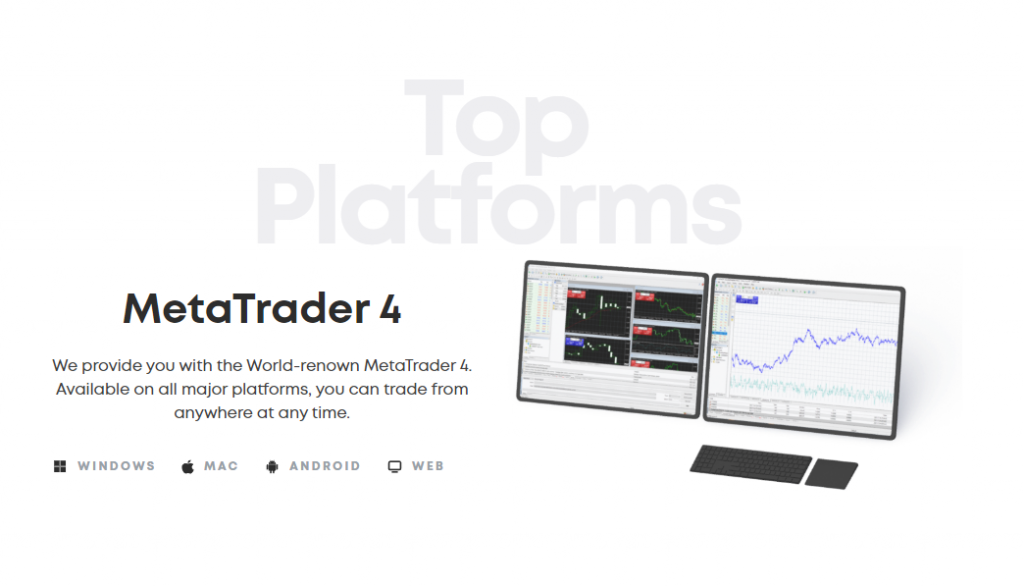

BlackBull Markets Platforms Offered

BlackBull Markets can be used in three different platforms that users can choose from depending on which works best for them. Aside from being compatible with MT4 and MT5 programs, the broker can also be used through the WebTrader program. Here are the three BlackBull Markets compatible platforms in more detail.

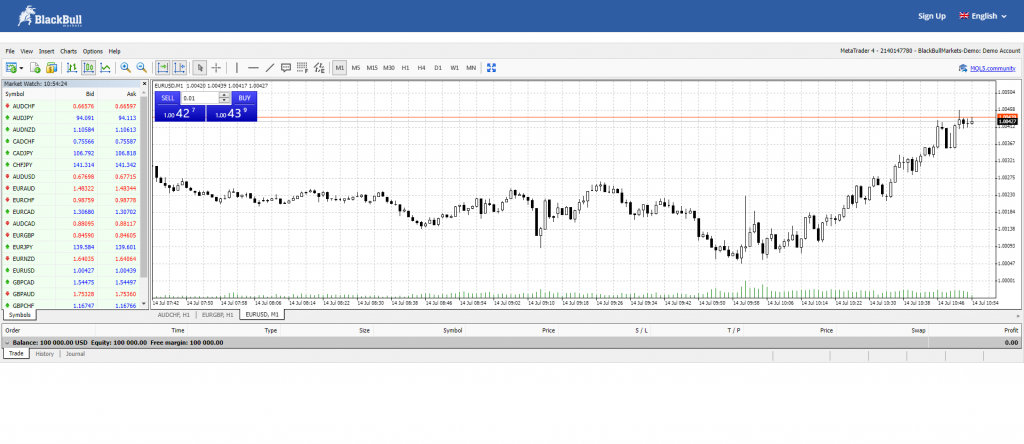

- MetaTrader 4 – MetaTrader 4 is one of the most popular forex trading platforms and one of the most widely used across forex brokers. Both retail and institutional traders make use of the platform’s many technical indicators, analytical tools, and expert advisors.

- MetaTrader 5 – MetaTrader 5 is known as the next-generation trading platform with its quicker processing speeds and hedging capabilities. Aside from forex pairs, MT5 can also be used to trade other financial instruments like commodities, indices, cryptocurrencies, and ETFs.

- WebTrader – Using the BlackBull Markets broker through WebTrader lets users access all the same features as MT4 but only using their web browsers. The advantage with WebTrader is that users can access their accounts through different devices and operating systems as long as they have a major web browser installed.

BlackBull Markets User Experience

BlackBull Markets makes it easy for anyone to register for an account, deposit funds, and start trading. Signing up for a live or even forex demo account can be finished in minutes, alongside the verification process which only requires two documents.

Both new and experienced traders will find the BlackBull Markets broker a highly intuitive platform since beginners have access to trading guides and videos while trading veterans can start trading through MT4 and MT5.

As we mentioned earlier, the broker also has its own mobile trading app in BlackBull Share Trading – available in both Android and iOS app markets. The app lets users trade over 23,000 stocks with a user-friendly dashboard design, complete charting, and trading tools for users to best analyze the market.

BlackBull Markets Tools and Charting

One of the advantages to having MT4 and MT5 compatibility is that all trading tools and charts in the platform are accessible to the user. MetaTrader products are known to have some of the best technical indicators and charting objects to give the most value to traders across different time frames.

BlackBull Markets also lets users create a free demo account which they can use to try new forex trading strategies and learn how to use the broker’s features. The demo accounts start with 100,000 USD in virtual equity and makes use of live prices so that the trading experience is as realistic as possible.

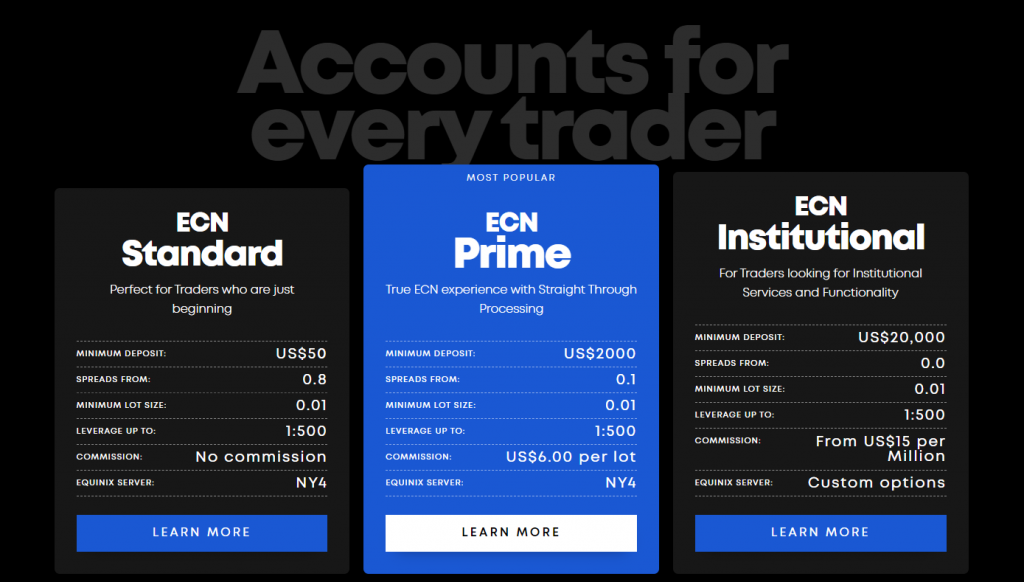

BlackBull Markets Accounts

To accommodate the different types of users of BlackBull Markets, the broker has created four account types that suit various trading goals, account sizes, and trading strategies. In this section of the BlackBull Markets review, we’ll go through all four account types and what each has to offer.

Standard Account – This account type is most recommended for novice traders. The ECN Standard account has the lowest barriers to entry with a low minimum deposit of just 50 USD, no commissions trading, and spreads that start from 0.8 pips. All trading instruments are tradable in the Standard account and a maximum leverage of 1:500 can be used when opening positions.

Prime Account – The ECN Prime account is BlackBull Market’s most popular choice since it’s the best way to experience trading with an electronics communications network. The account type has a minimum deposit of 2,000 USD, clearly for more experienced traders with more equity to invest. The spreads start at 0.1 pips and a commission fee of 6 USD per lot is charged. Maximum leverage remains at 1:500.

Institutional Account – The Institutional account lets users have large portfolios as the minimum deposit for these accounts is $20,000. This account type is built for users who want the full institutional trading experience where they can make the most bang for their buck in terms of trading costs. The account comes with complimentary VPS access, dedicated 24 hour tech support, and spreads starting from 0.

Islamic Account – Muslim traders need to follow the Sharia Law when opening accounts. This means that they cannot pay or receive interest as it is prohibited in Islam. BlackBull Market offers an Islamic account which can be in the form of their Standard or Prime accounts that complies with all the needs of Muslim users. These accounts are swap-free, have all tradable assets available, and also allow for up to 1:500 leverage in trading.

BlackBull Markets Payment Methods

Before any BlackBull Markets trader can start live trading, they’ll have to first deposit funds into their account. Luckily the broker offers many different payment methods for this. BlackBull Markets payment methods include: Credit Cards, Neteller, fasapay, UnionPay, Skrill, and Bank Transfer.

BlackBull Markets Customer Service

The BlackBull Markets support team can answer any inquiries through their live chat channel on a 24/6 basis. Aside from this, BlackBull Markets also provides various research and educational material for users to consume to better understand current market conditions as well as certain platform features.

How to Get Started With BlackBull Markets

After going through the user experience, features, and fees of the BlackBull Markets broker, let’s get into a step by step guide to start trading with the broker.

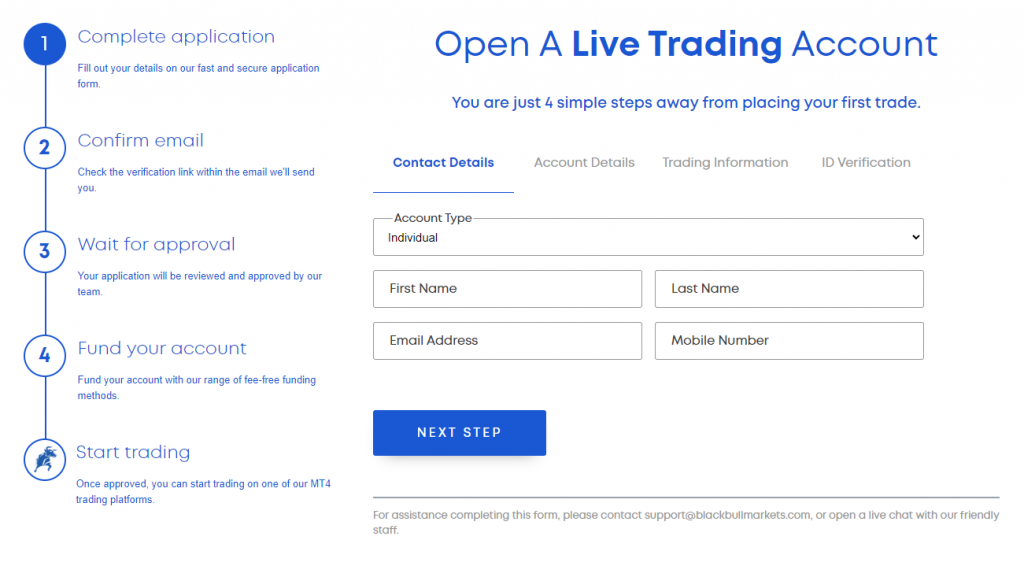

Step 1: Complete BlackBull Markets Registration

Log on to the BlackBull Markets official website and click on ‘Sign Up’ which can be found in the navbar. For registration, users will need to select their account type, the base currency, how much equity they will invest, and the amount of leverage they want to use. Contact details must also be added to finish the registration process.

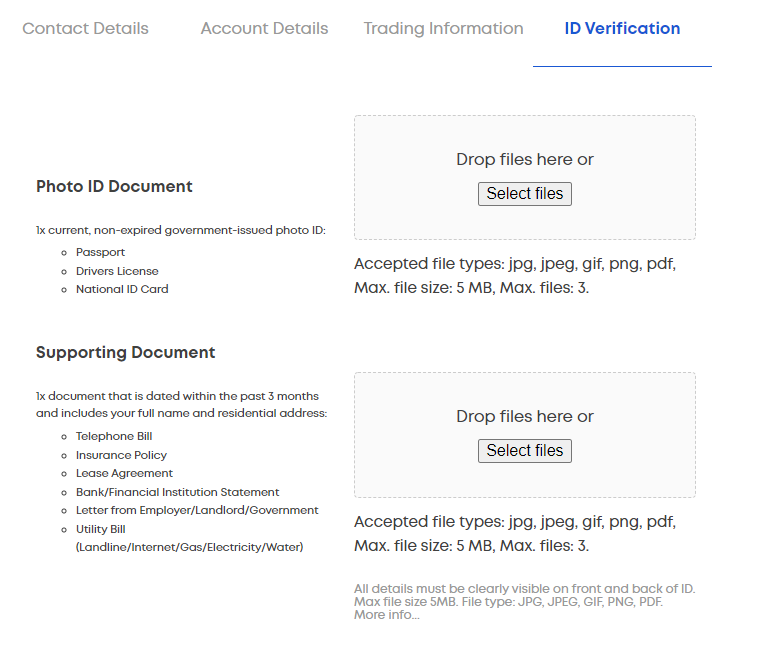

Step 2: Verify Your Account

BlackBull Markets requires users to upload valid documents to verify that the traders are real and trading within their respective region. In the account verification step, users will need to upload a valid ID which can be a passport, national ID card, or driver’s license. The next document to upload is to verify the user’s address which can be in the form of a utility bill, bank statement, insurance policy, etc.

Step 3: Deposit Funds

Before live trading, users will have to deposit funds into their accounts. As touched on earlier, BlackBull offers Neteller, fasapay, UnionPay, Skrill, Credit Card, and Bank Transfer for payment options. The minimum deposit for the Standard account is $50.

Step 4: Trade A Live Account

BlackBull Markets traders can start trading through an MT4 or MT5 platform. They simply need to find the instrument to trade, configure the trading parameters, and click on ‘buy by market’ or ‘sell by market’ to open a position.

Your capital is at risk.

The Verdict

BlackBull Markets has a lot to offer as a multi-asset and MT4-compatible broker. With tight spreads, over 26,000 tradable assets, and a maximum leverage of 1:500, the broker has been able to continue adding value to its users since 2014. On top of this, BlackBull Markets is the winner of Best ECN Broker of 2022 from BrokerTested and for good reason.

We also can’t overlook the amount of customer support that BlackBull Markets has put into its product. 24/6 responsive service and a plethora of market news and guides make the broker easily usable for traders of all skill levels. If you’re in the market for a broker with low spreads, thousands of tradable assets, and high leverage, check out the BlackBull Markets broker in the link below.

Your capital is at risk.

FAQs

BlackBull Markets is a legit broker and is the trade name of Black Bull Group Limited. It is a regulated and licensed broker under the Financial Markets Authority.

BlackBull Markets offers over 26,000 financial instruments and is an award-winning broker with 24/6 customer service. It’s BrokerTested.com’s Best ECN BRoker of 2022.

Black Bull Group Limited is a registered company in Seychelles. It’s a Securities Dealer that’s authorized by the Financial Services Authority.

Depending on the account, BlackBull Markets can have no commissions and high spreads or low spreads with a 6 USD per lot commission fee.

BlackBull Markets clients can open demo accounts that let them trade up to 100,000 USD of virtual equity. Is BlackBull Markets trustworthy?

Is BlackBull Markets good?

Is BlackBull Markets licensed?

Are BlackBull Markets fees high?

Does BlackBull Markets offer demo account trading?