EUR/JPY Long-Term Analysis: Bullish

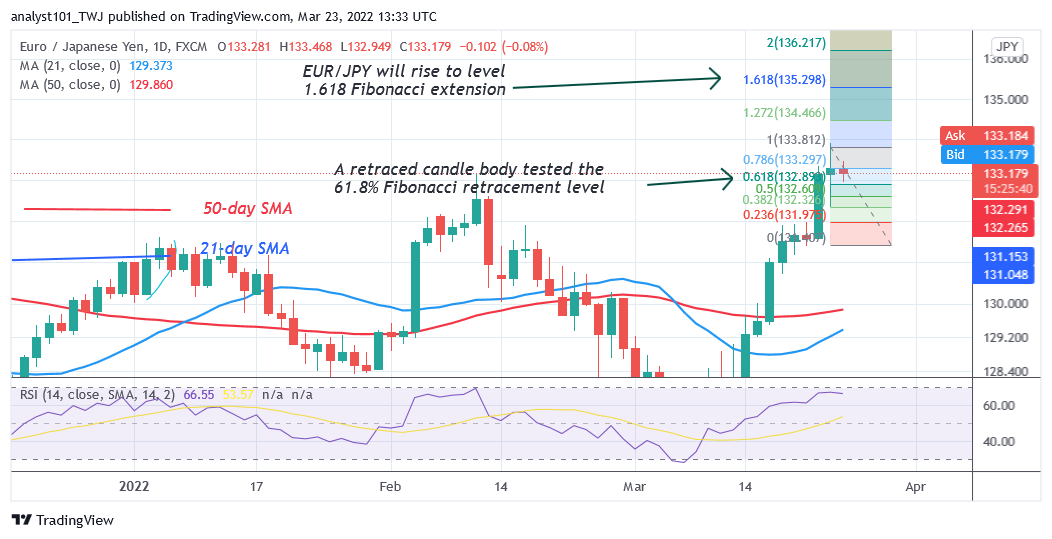

EUR/JPY pair has retested the overhead resistance at level 133.17 but may further rise. The currency pair is now trading in the overbought region. The Yen is consolidating near the overhead resistance. The currency pair may further decline or rise to another high of level 135. Meanwhile, on March 23 uptrend, a retraced candle body tested the 61.8% Fibonacci retracement level. The retracement indicates EUR/JPY will rise to level 1.618 Fibonacci extension or level 135.29. From the price action, EURJPY is consolidating above the previous overhead resistance.

EUR/JPY Indicator Analysis

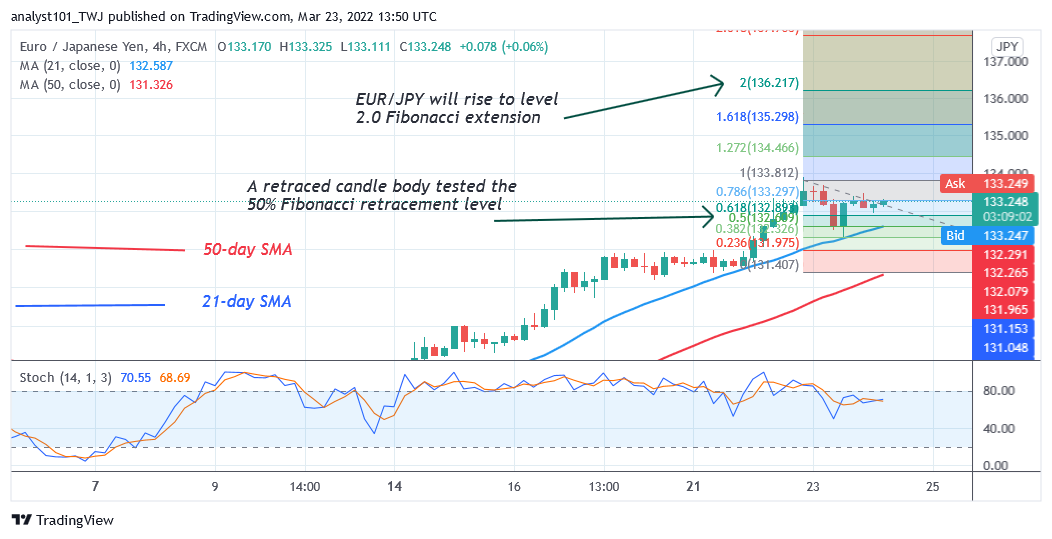

EUR/JPY is at level 67 of the Relative Strength Index for period 14. The currency pair is closed to the overbought region of the market. There is the possibility of a marginal rise. The 21-day SMA and 50-day SMA are sloping upward indicating the uptrend. The pair is above the 80% range of the daily stochastic. The daily stochastic has reached the overbought region of the market. The stochastic bands are sloping below and above the 80% range.

Technical indicators:

Major Resistance Levels – 133.00, 134.000, 135.000

Major Support Levels – 128.000, 127.000, 126.000

What Is the Next Direction for EUR/JPY?

On the 4- hour chart, the Yen has reached the high of level 133.89 but may further rise. There is the possibility of a further upward move. Meanwhile, on March 22 uptrend, a retraced candle body tested the 50% Fibonacci retracement level. The retracement indicates that EUR/JPY will rise to level 2.0 Fibonacci extension or level 136.21.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

Leave a Reply