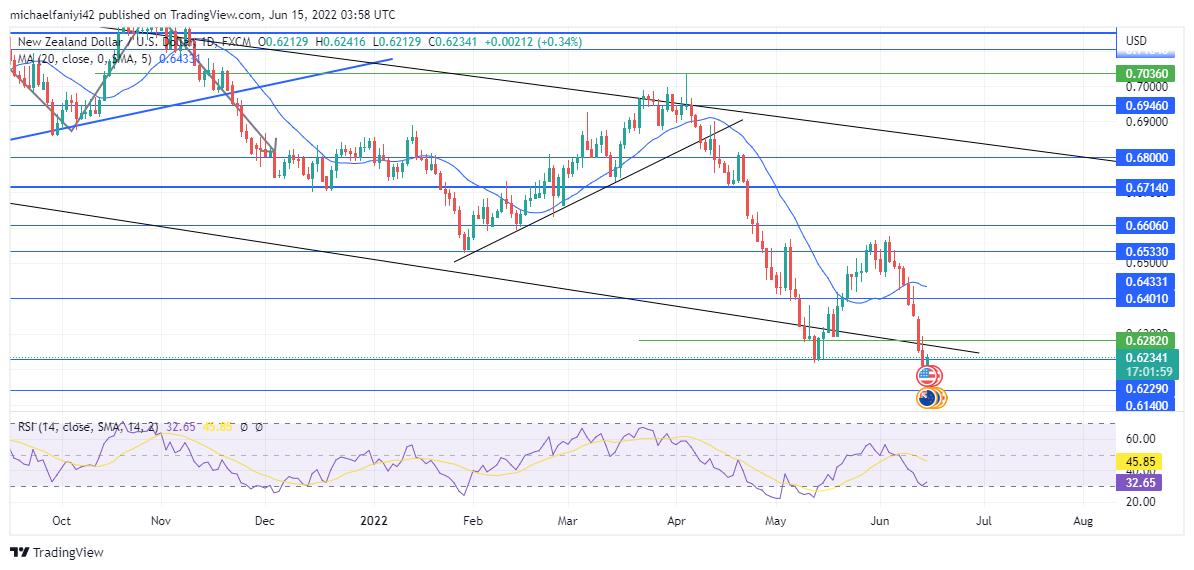

NZDUSD Analysis – Bears Increase Their Stronghold on the Market

NZDUSD bears have increased their stronghold on the market. This is demonstrated by how the price has been unable to push up the pressure to at least test the upper border of the descending channel. The market pushed up to the 0.65330 key level before it was subdued under bearish pressure. Therefore, NZDUSD has dipped back to its rallying point at 0.62290.

NZDUSD Critical Levels

Resistance Levels: 0.65330, 0.67140, 0.69460

Support Levels: 0.61400, 0.62290, 0.62820 NZDUSD has been predominantly bearish from the beginning of the year. The market has been sliding through a descending channel pattern. Therefore, the price is seen to make consistent lower lows and highs. The total level to which the currency pair has plunged since the bear took over the market amounts to a 16% price drop. The candlesticks slide downward in an undulating manner.

NZDUSD has been predominantly bearish from the beginning of the year. The market has been sliding through a descending channel pattern. Therefore, the price is seen to make consistent lower lows and highs. The total level to which the currency pair has plunged since the bear took over the market amounts to a 16% price drop. The candlesticks slide downward in an undulating manner.

In the most recent downward undulating market movement, the price has rallied from the 0.62290 support level. However, the bears are tightening their stronghold on the price so that the price cannot rise very high. The market eventually halts and turns around at 0.65330. NZDUSD has fallen back to its rallying point at 0.62290. The RSI (Relative Strength Index) line has dipped to the oversold border to highlight bearish strength.

Market Expectations

Market Expectations

The 4-hour chart shows that the candles took a lot of effort to move up from the rally point. After a be-laboured upward movement, the market falls under the weight of pressure at the 0.65330 price level. The MA (Moving Average) remains above the 4-hour candles while the RSI line has fallen deep into the oversold region. An imminent rise should be expected.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply