Options trading is one of the most flexible trading strategies that you can use.

With options trading you have the ability to use many different features that are simply not available with simple buy and sell contracts or even CFD trading.

In this post we go through exactly what options are and how you can start using them in your trading.

What is an Option?

An option contract gives you the ‘option’ to buy or sell an asset at a price that is pre-determined when entering into the contract.

With an option contract the seller of the option will charge the buyer a premium.

Options will have a set contract expiry date. If at the end of this date the price of the asset is unfavourable, then the option contract will expire worthless and the buyer does not have to do anything other than pay the premium.

If the option is at a favourable price, then the buyer may choose to exercise the option and the seller then has to hand over the asset.

For this reason the seller of the option takes on greater risk, whereas the buyer is only risking the upfront premium if price does not go their way.

What is a Call Option?

Options are divided into two main types. Call and put options.

With a call option the buyer enters into the contract with the right, but not the obligation to buy the agreed asset at the set price. There is a set expiry date and a premium is charged by the seller.

The option can be taken out over many different assets from bonds to stocks and commodities.

With this option the buyer will make a profit if the price increases.

What is a Put Option?

A put option is an option type that gives the owner the right, but not the obligation to sell a certain asset at a set price.

A put option is used if you are bearish in a particular market or asset and think that price will go lower.

You can use this option type to speculate that the price will make a move lower and if it does, then you can make a profit.

Example of an Options Trade

Options trades can be a little complicated to understand at first so I am going to try and make this example as simple as possible. If you still have questions just put them in the comments below.

On January 1st the price of the stock XYZ is $20 and the option has a premium of $1. The expiration is for the 3rd Friday of March.

The ‘strike’ price would be $21 ($20 stock price plus the $1 premium).

The total price for this option contract would be the $1 premium x 100 or $100. Most options contracts start with 100 shares.

The strike price is the price where the options contract is at breakeven. If the price of the asset moves to $22, then the option contract is profitable. If it moves to $20, then it is not.

If in this example price moves higher to $25, that means that your option contract would be profitable and has risen $4 above the strike price.

This would give you a profit of; 100 x $400 = $400.

The Difference Between Cash Settled and Deliverable Options

A cash settled option contract simply means that the difference between the strike price and expiry price will be settled in cash (if the option contract is profitable).

For options contracts that are deliverable, that means that the transfer of the underlying asset such as a stock must be transferred.

What are the Risks to Trading Options?

There are some risks to using and trading options that you should be aware about before you consider using them. These include;

- If you are an option writer, then you can be exposed to large losses. As the option writer you are obligated to sell an asset at a specified price and within the set time frame of the original contract.

- There is a set time frame for the option to work out. Whilst there are different options time frames, options trading is normally on the shorter term end of investing.

- If you are using options you will often run into extra costs and trading commissions that you will not face with other forms of trading.

Why You Would Want to Trade Options

There are a lot of benefits to using options. Some of these include;

- As an options trader you have the ability to use large leveraging power. This can help you enter into larger positions.

- You can lower your risks and downside potential. With experience using options can be far less risky than outright owning stocks.

- Many options trading strategies you can have a much larger potential return on your investment.

Some of the Popular Options Trading Strategies

There are many different options trading strategies. Some of them are extremely complicated and you will need a long time to master. However, some of the more popular strategies include;

Covered Call Options Trading Strategies

When using a covered call strategy you are looking to generate an income whilst at the same time reducing your risk of being ‘long’ in an asset or stock.

If using this strategy you would buy an asset whilst at the same time writing a call option on the same asset.

Bull Call Spread Strategy

This strategy is using two call options. You will be buying calls at one price and at the same time selling the same number of calls at a higher price. These options are on the same asset and should have the same expiry date.

Bear Put Spread Strategy

With this strategy you are using put options. At the same time as you are buying put options you are selling the same number of put options, but at a lower price. The options need to be on the same asset and with the same expiry date.

Married Put Strategy

If you are using this options strategy, then you are buying an asset or stock whilst at the same time buying the same amount of put options.

The Best Options Trading Platform and Broker

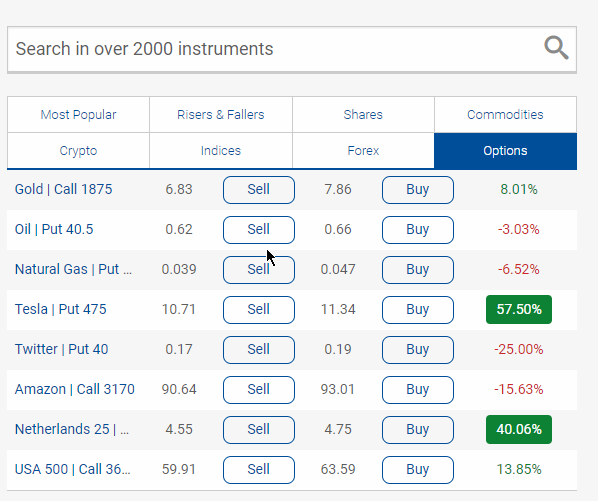

One of the best options platforms is provided by Plus500.

This platform is built and run by Plus500 and is very easy to use. You have the ability to quickly make trades, see your risk and your overall portfolio.

The Plus500 platform offers advanced risk management tools such as stop loss and trailing stop loss and you can also use guaranteed stop losses.

You can test Plus500 Options Trading Free Here.

Finally

Finally

Using options in your trading will give you the flexibility that other types of trading cannot offer.

Options are more advanced and can take a little more time to become comfortable with, but after some practice you will quickly get the hang of it.

Whilst there are many benefits to options trading you must also keep in mind the downsides and the potential risks. Make sure you thoroughly test out any new strategies before ever risking real money.

Leave a Reply