Reading Order Flow with Price Action

For many traders they flick on their charts and will see candles moving up and down.

A deeper look into price action shows us that what we are actually watching is not just candles moving up or down, but market order flow taking place.

Price Action is the direct result of what has happened with order flow. In other words what the big guys are doing can be seen directly through price action on our charts. It is said that “price action is the foot print to the money” and this is true because through the price action on our charts (the foot prints) we can see what the market order flow is and more importantly where it is likely to lead.

Price Action and Indicators

All indicators including the commonly used indicators such as moving averages and Bollinger bands are built using the information that price gives us. It is also true that all indicators will lag due to the fact that they first have to process what old price has done before trying to predict the future.

The reason price action trading is so successful and used by most professional traders is because you are reading the order flow from the market as it is continually printed onto your chart in real time.

Obviously being able to assess the market in real time with the use of price action is a lot more useful than looking to indicators which are lagging behind.

How Can We Use Price Action Order Flow?

Order flow is being printed on your charts every second the market it is open. You can simply look at any chart to see price moving up or down to see what the market is doing.

Being able to use this information and to trade with it profitability is the next step in the process.

The reason a few key patterns in the market can be very profitable time after time is because they are showing key signs of market order flow and market dynamics.

One very simple example is the Pin Bar.

Pin Bar Reversal

The Pin Bar is a very simple one candle pattern that is especially good at changing the market direction and creating a reversal.

To read about the basics of the Pin Bar please read this article: The Pin Bar

The nose of the Pin Bar is telling a lie and setting a trap that will stop out many traders. To understand why the Pin Bar is successful we must look at the order flow behind the pattern to understand how we can do the trapping and not become the trapped.

As the Pin Bar is being formed many traders are trading and looking for a break out trade. They are entering in the direction of the Pin Bar nose and looking for price to continue. For the Pin Bar to be created one of two things needs to happen;

-

- The buyers/sellers must come in with more pressure to reverse the price or,

- Traders begin taking profit which leads to price reversing.

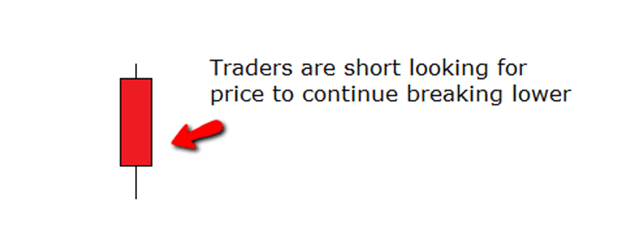

The two charts below explain how the Pin Bar is created with order flow. In the example below we have a bullish Pin Bar. Originally traders would have been short looking for a breakout lower. Chart one show’s how price would have looked as price was breaking out. People were selling and looking for price to continue moving lower.

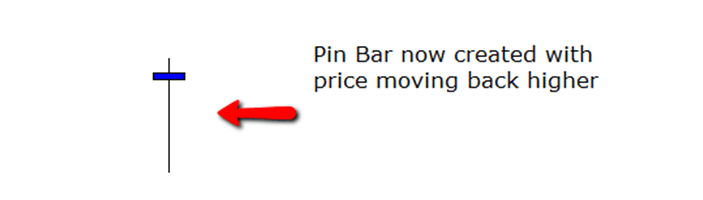

At some point traders either started taking profit or a fresh wave of buyers came in that pushed price higher. Chart two shows the Pin Bar which has now been created after this fresh push higher.

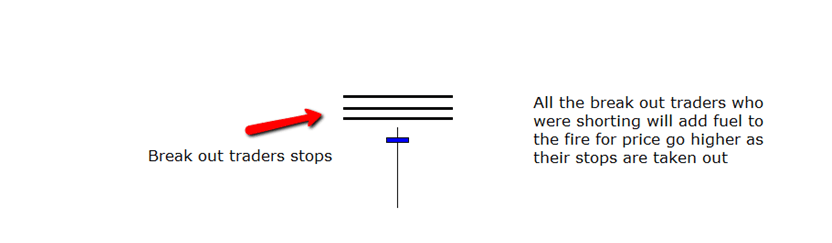

For the Pin Bar to work and be a successful trade price must move higher to complete the trap. It is here that a lot of stops will give fuel to help price bounce higher.

All the traders who traded for the breakout have been successfully trapped. The breakout traders will have a lot of their stops above the Pin Bar high hoping price does not break higher as they will be stopped out and effectively trapped. It is for this very reason that the Pin Bar will get its next push higher due to stopping out the break out traders. See the chart below for a detailed look;

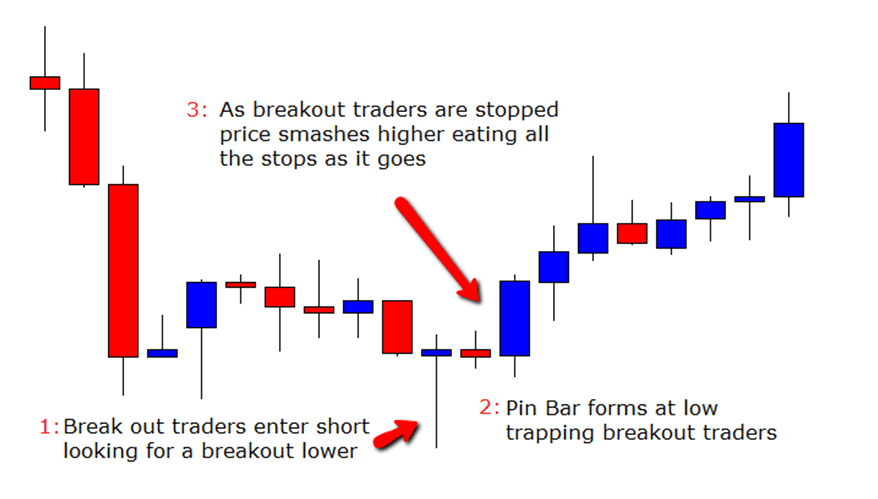

A clean price action chart below shows how this works on a real chart. This chart highlights how the Pin Bar is formed and then how it takes out the stops to move higher.

Recap

The reason a few key price action signals work time after time and repeat themselves, is because they are showing traders the signals of order flow and tipping them off to where orders sit in the market. The traders who trade these patterns can learn to make sure they are on the correct side of the order flow, and not being trapped by the big guys.

In the Forex Price Action course you are taught the key price action patterns that indicate market order flow. You will learn the patterns that repeat themselves, and also how you can best position yourself to take advantage of them.

I hope you have enjoyed this article.

Safe trading all the success,

Johnathon Fox

Thank you for the education

I still not convinced my account had a knock because of the news outbreak and i also noticed if is bad or god the is movement of market but if ordinary no movement

Hi Andrew,

I am really not sure what you are trying to say, so as much as I would like to try and comment and help answer or comment, I can’t do so with 100% clarity.

Are you saying you are not sure if it was news that made price push your positions or something else?

Safe trading,

Johnathon

Just discovered your training Johnathan. Makes sense. Will check out more from you then likely see you in the members area if the free stuff keeps making sense. Thx. G.

Hey Greg,

great to have you around with us. Just let us know if you need anything at all or if you get any questions.

Johnathon

Very interesting to read this article……tq.

Clear explanation Johnathan, we should not be looking just at the candlesticks but at the price action that formed them. Thanks

This is very good site to learn forex completely.

thanks………………….

Thanks that is a nice one

this is a very good article for us, thanks.

Thanks for the informative insight.

very informative article.

Thanks a lot…. interesting and intutive!