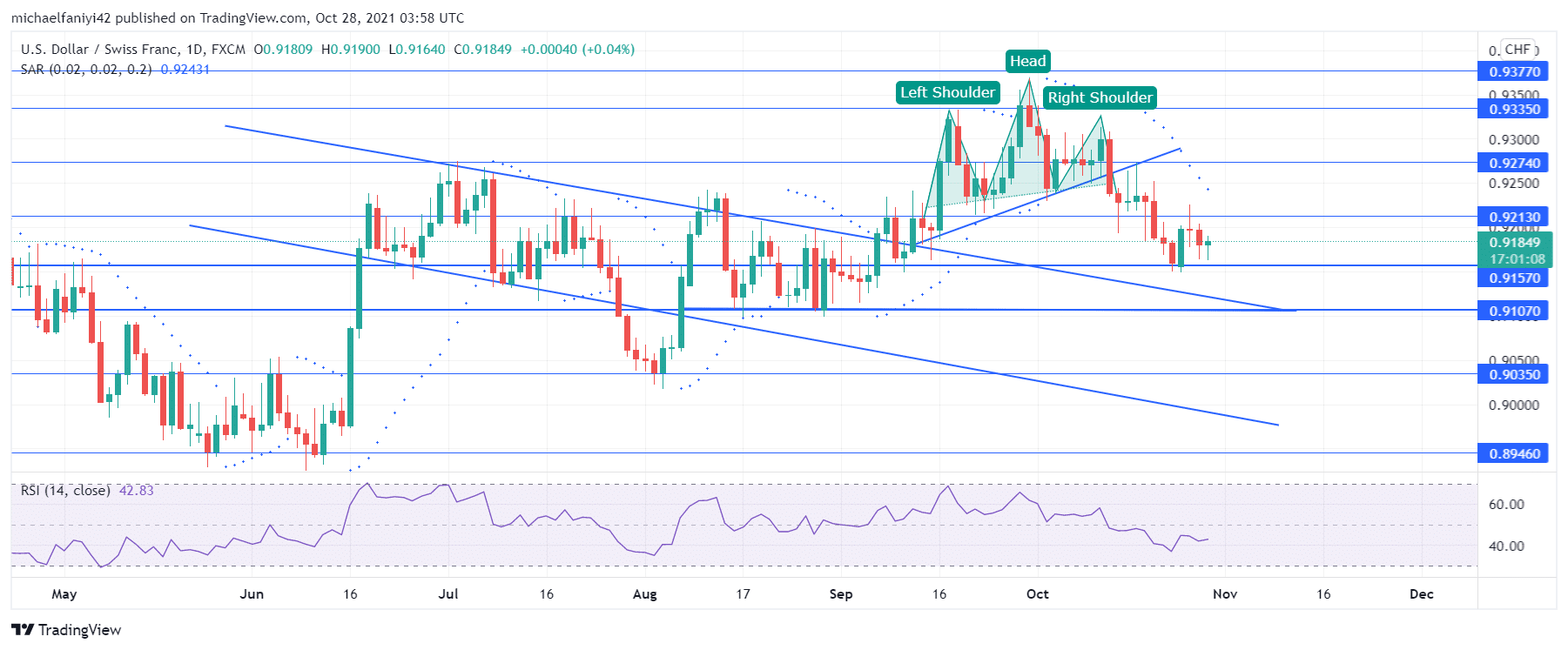

USDCHF Analysis: Price Attempts to Regain Its Upward Momentum at 0.91570

USDCHF attempts to regain its bullish momentum after bouncing off the 0.91570 significant level. The market, having dropped from a reversal formation off of an ascending trendline, now attempts to regain its bullish momentum at a significant level of 0.91570. A bearish engulfment candlestick can be seen when price touches down on the level. However, sellers remain persistent in the market and have rejected price at the immediate resistance level.

USDCHF Key Zones

Resistance Levels: 0.92130, 0.92740, 0.93350

Support Levels: 0.91570, 0.91070, 0.90350 The market broke out from a descending channel on the 7th of October and retested the upper border of the channel on its way upward. The market began bouncing upward via an uptrend line. However, the 0.93350 price level cut short the market’s upward momentum and weakens the market. Thereafter, USDCHF fails to keep up its consecutive higher high and crashes against the trendline, forming a head-and-shoulder reversal pattern.

The market broke out from a descending channel on the 7th of October and retested the upper border of the channel on its way upward. The market began bouncing upward via an uptrend line. However, the 0.93350 price level cut short the market’s upward momentum and weakens the market. Thereafter, USDCHF fails to keep up its consecutive higher high and crashes against the trendline, forming a head-and-shoulder reversal pattern.

The head-and-shoulder reversal pattern eventually led to the fall of the market below the trendline. There was a brief reprisal by the buyers above the 0.92130 level, but they were unable to climb above the confluence of the trendline and the 0.92740 resistance. Price, therefore, drops further to 0.91570 where the reprisal trend is repeating itself. All odds remain in favor of sellers as the Parabolic SAR (Stop and Reverse) remains stationed above the daily chart.

Market Expectations

Market Expectations

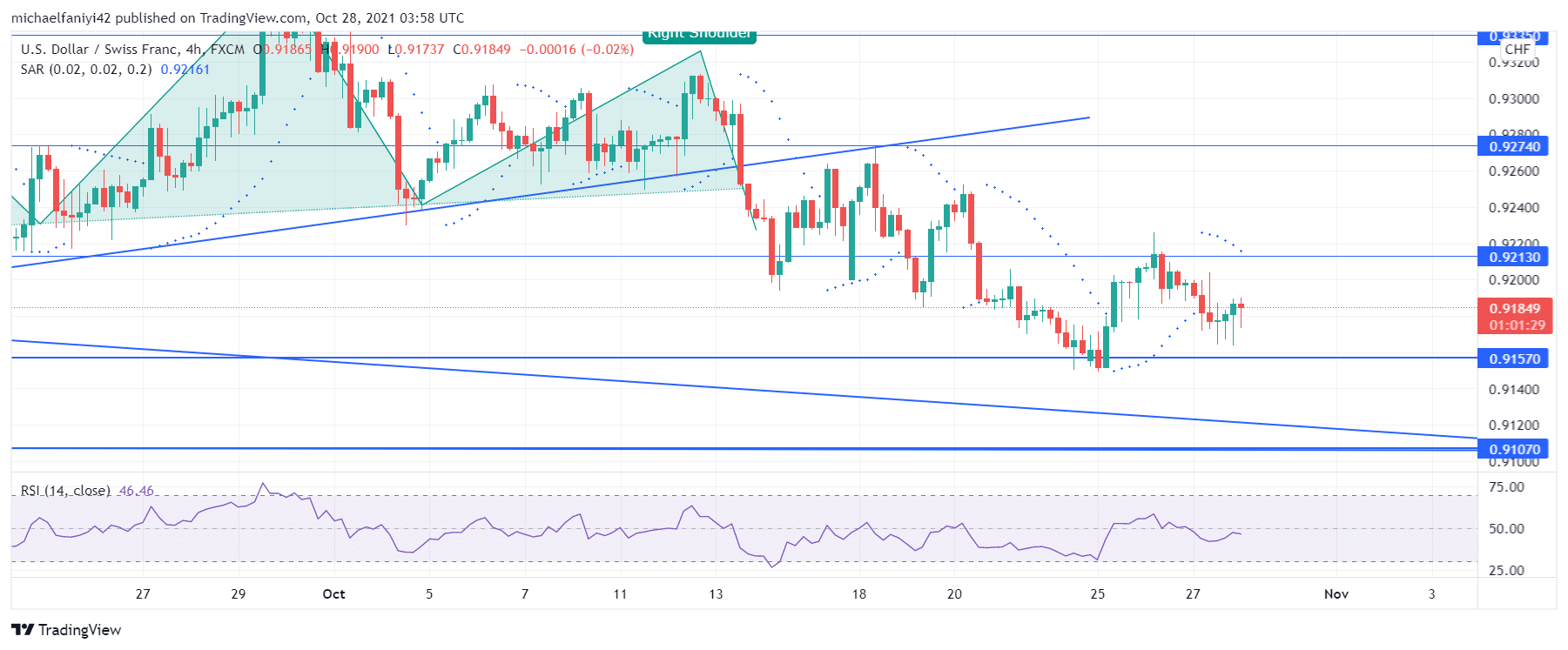

There is now rejection at 0.91230 but the market has bounced off 0.91570 as the price attempts to regain bullishness. There is an alternation of the Parabolic SAR dots around the 4-hours candles as buyers battle it out to regain the market. The RSI (Relative Strength Index), however, shows that momentum is still with sellers and the signal line abides below the 50 mark.

Price is expected to range for a while before crashing through to the next support level at 0.91070.

Note: Forexschoolonline.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Leave a Reply