5 Forex Risk Management Tips You Can Use Now

Understanding and being able to use Forex risk management strategies is crucial to helping you minimize your losses and take advantage of the profits when they come.

If you don’t have a full understanding of how you should manage your trading money and risk, then you could face the issue of losing large chunks of your account. You also run the risk of not making profits even after making really nice winning trades.

To be consistently profitable you obviously need to be able to make more money than you lose overall. However; if you make some fundamental mistakes, then this becomes very hard. For example; if you are not position sizing your trades you could be risking far more on your losing trades. This would make it extremely hard to be profitable and would also mean you could lose more than you intend.

#1: Never Risk What You Cannot Afford to Lose

This is the simplest tip of all, but is not always followed.

Whilst it is common sense to never trade with money you cannot afford to lose such as you rent money or money from a credit card, it also has other impacts.

There is an old saying that “scared money is lost money”. This basically means when trading and risking money you cannot afford to lose you are at a huge psychological disadvantage.

When trading with money you really do not want to lose you will trade differently and give that money a different amount of value. You will make mistakes in the markets like hold your losers too long and take profits too quickly because you don’t want to lose.

#2: Be a Trader Not a Gambler

There is a distinct difference between a trader who has an edge over the market and a gambler.

Someone who is gambling in the Forex markets is making bets (trades) and they don’t have any idea if they will make money overall.

Whilst the gambler will make winning trades and can go on winning streaks, they really don’t know if what they are doing is profitable and they will eventually lose.

A trader understands their risks. They have practiced and worked out their strategies. The trader knows that whilst they will have losses and losing streaks their trading method will make profits at the end of the month and year.

Having confidence in what you are doing and knowing that it will work is extremely powerful.

#3: Position Size Your Trades

Each trade you enter will be on a different Forex pair, different market and will have a different size stop loss.

If you were to use the same size trade entry on all of your trades you would be risking vastly different amounts of money.

A very basic example is of a trader always entering with a set 100,000 trade. If the first trade has a stop loss of 20 pips and the second has a stop loss of 10 pips, then they could risk twice as much money on the first trade.

The simplest way to solve this and ensure you are risking the same amount of money or percent of your account each and every trade is to position size your trades before entering.

If you work out your position size and how large your trade should be, it will allow you to keep the same amount of risk each trade whether using a 20 pip or 100 pip stop loss.

#4: Use a Forex Risk Management Calculator

Making sure you position size your trades will allow you to either risk a small percentage of your account each trade, for example; 2% or a fixed dollar amount each trade.

This will keep your losses in check and allow you to live to trade another day.

After you have decided whether to risk a small percentage or a fixed dollar amount, you can begin working out your risk for each trade.

The easiest way to do this is with a lot size calculator.

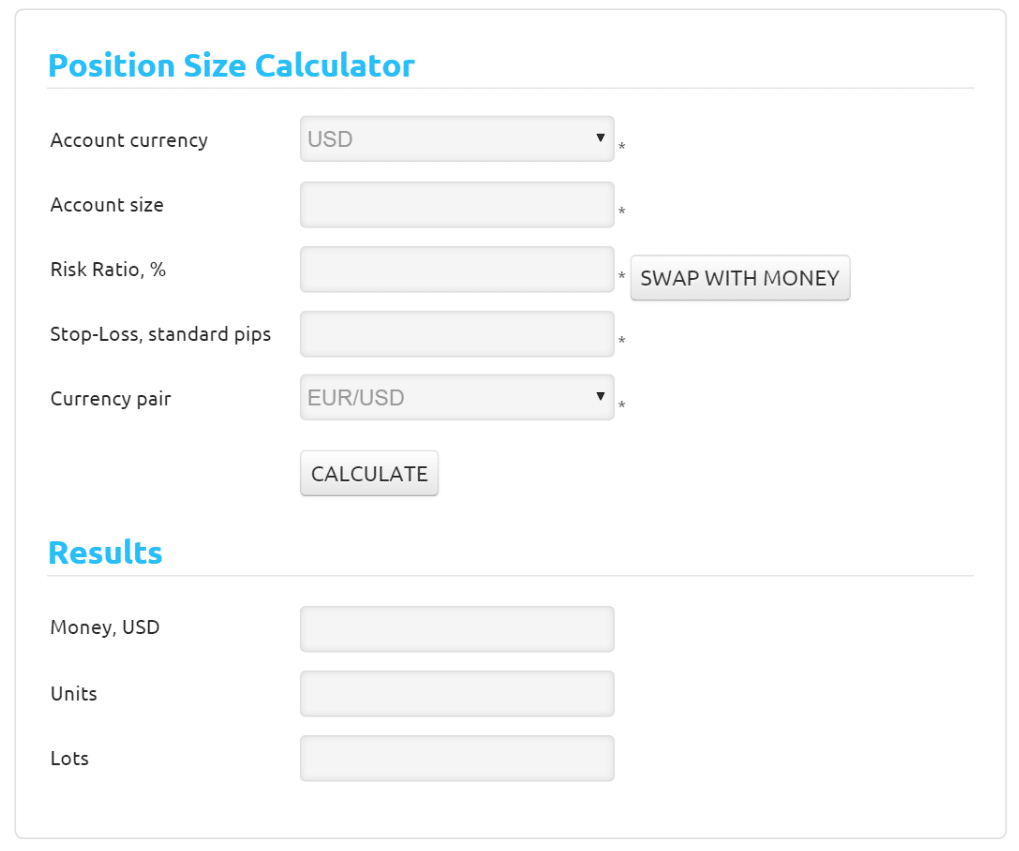

The lot size calculator will ask questions such as your account currency, size of your account, how much you want to risk in either percentage or money, how large your stop loss is and what pair you are trading.

After completing the fields, you will be given the amount you should trade with to fit your risk requirements. The results include how much money you are risking and how big the trade is in units and lots.

A picture of what the position size calculator looks like below:

You can find a lot size calculator below;

–Lot Size Calculator for MT4 and MT5

#5: Work Out Your Risk Reward

Risk reward is the equation for how much you are risking compared to how much you could potentially gain.

For example; if you are risking 20 pips on a trade and could make a potential profit of 40 pips, then you have a 1:2 risk reward. That is you are risking 1 to make 2 x times your risk.

You have most likely heard the theory that you should always aim for positive risk reward. A lot of traders like to aim for 1:2 risk reward so that they have to make less winning trades to remain profitable.

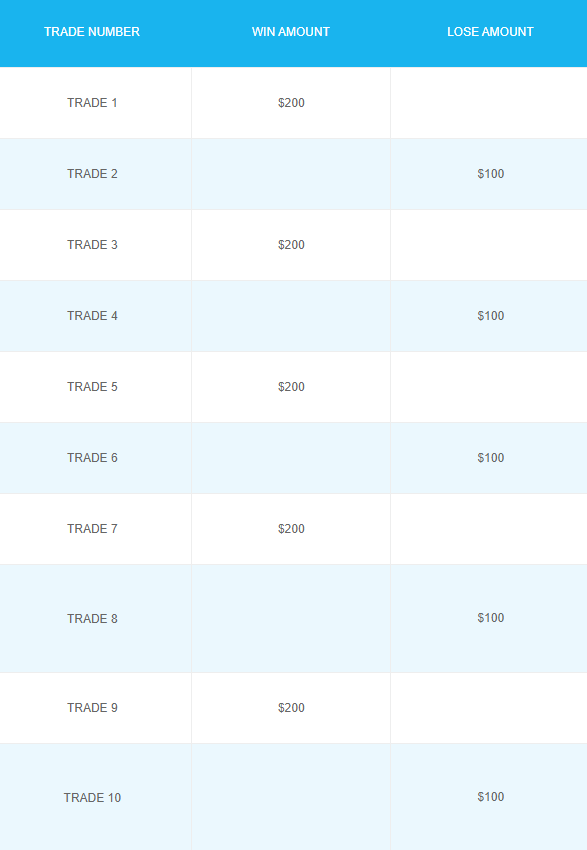

Have a look at the image example below showing how when risking $100 each trade and using a 1:2 risk reward you would make $1,000 and lose $500, making a $500 profit overall by only winning every second trade.

This is a sound theory because the higher your risk reward, the less winning trades you need to be profitable. However, aiming for and achieving high risk reward is not always practical and does not suit everyone.

The higher the risk reward targets you aim for, the more chance you have of price reversing and stopping you out. This is not a problem as long as you realize it and are profitable overall. However; to achieve higher risk rewards you will often have to have a lower win rate.

Lastly

Whilst being a Forex trader is entering and managing trades, it is also managing money and risk.

A lot of traders focus solely on where to find the next great trading strategy. Yes, a good strategy is going to help you make winning trades, but it will not help you manage your risk.

Being able to manage your trading risks and minimize your losses will ensure you can take advantage of the big winners when they come. It will also help you to live to trade another day when you have a string of losing trades.

Please leave questions or comments in the comments section below;

Hello MR fox thank you for this online school i learned a lot becouse i struggled with the charts but i am learning slowly your the best keep it up i believe soon ill be a profitable trader.

Thanks, Fox I am new and my account is $100,00. I am looking forward to grow it. My difficult part now is that this is my daily job and a source of my income. Sometimes I feel that I need to grow it faster. Thanks again

Hi Solomon,

it can be very easy to feel that way and to try and make trades when they may not be there to trade to try and grow an account faster.

All the success,

Johnathon