The ‘combo strategy’ is a highly effective strategy where price forms a reversal trigger signal and immediately follows this up with an inside bar.

The candle formations would be something like a Pin Bar, then Inside Bar. Or an Engulfing Bar + Inside Bar etc,.

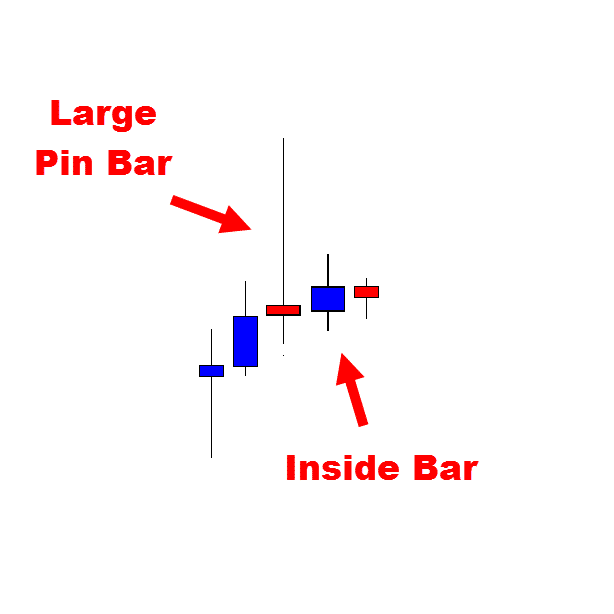

Here is a basic example of what a ‘Combo Setup’ would look like with a bearish pin bar, followed up with an inside bar;

Price Action Story!

Before moving on; if you’re not familiar with our reversals and basic high probability trading setups, then you’ll need to quickly get up to speed to get the most out of this lesson and strategy.

I highly recommend you go over to our strategy intro lesson that you can also download as a PDF for later if you like. Check it our at;

The Ultimate Introduction to Price Action Trading with 27 Page PDF Download Bonus!

The formation of the combo setup is highly effective, but what is crucial to a high probability trade setup is (as we always discuss and and try to press home to you and our members) the overall price action story.

[dropshadowbox align=”center” effect=”raised” width=”auto” height=”” background_color=”#ffffff” border_width=”1″ border_color=”#dddddd” rounded_corners=”false” inside_shadow=”false” ]The formation of the combo setup is highly effective, but what is crucial to a high probability trade setup is (as we always discuss and and try to press home to you and our members) the overall price action story.[/dropshadowbox]

The price action story is king and where the combo setup forms, it’s always got to be forefront in your mind. Of course, don’t forget everything else that goes with it, like market trend, space to trade into, is the traffic around? What about recent short term momentum? Etc.

Fear of Price Action?

I uploaded my regular ‘Charts in Focus Trade Setups’ post the other day and I discussed how traders often get jumpy and do silly things like move their stops or change targets when price does not act in line with their expectations.

This is even more the case when traders have their orders set to enter, but they are not yet in the trade and they are just holding and waiting for price to enter.

In the lesson How to Make High Probability Price Action Entries at the Break we show how traders can prevent a lot of the losses they normally make, and start entering with the momentum, rather than against it like so many traders do.

The reason this is important is because price does not move in a straight line. Yes, price can make some super strong moves higher or lower, but these are never in a direct straight line.

Whilst we see price on a chart that is full of candlesticks or bars (depending on how you watch your price action), what price is really doing is having a constant battle back and forth between buyers and sellers, or supply and demand. This battle is being fought out right on the charts for us to watch in real time.

Why is this explanation about the supply/demand and price not moving in straight lines and what price is doing behind the charts so important for traders to understand?

After setting their trade entry orders a trader will often not know what to do next. They don’t know what to look for in the price action and they are not sure what story they should be looking for. This increases doubts and breeds a lot of insecurity.

The ‘Combo’ Setup

Whilst the price action combo setup is super simple, it also has a solid price action order base from which to trade it from.

The combo setup is reliant on the trigger setup, or the high probability reversal setup. If you have a weak reversal setup, for example a rubbish engulfing bar, then adding an inside bar on top of this is just going to be adding fuel to an already terrible setup.

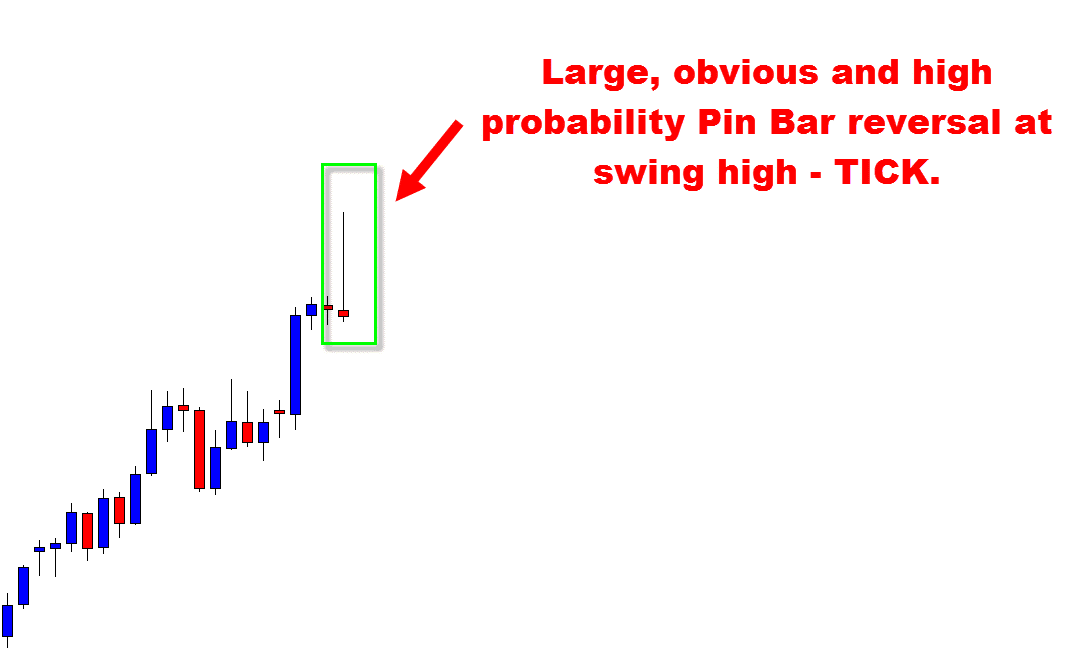

As explained above briefly, behind our charts are the buyers and sellers pushing price higher and lower. With the reversal trigger signals, for example a bearish pin bar, price would move higher into the level it is rejecting and then snap lower to form the pin bar.

See Pin Bar below:

Often however, after having formed this pin bar, price doesn’t just move lower straight away like a lot of traders expect, OR want it to. Regularly straight after the pin bar, the next candle will be an inside bar. This is a good thing as it can often show the market is preparing to change momentum.

For price to reverse from the resistance that the bearish pin bar is rejecting, the bears have to gain control over the whole market. If price can break the lows of the inside bar and trigger, that could be the trigger that the market needs to make a new move lower.

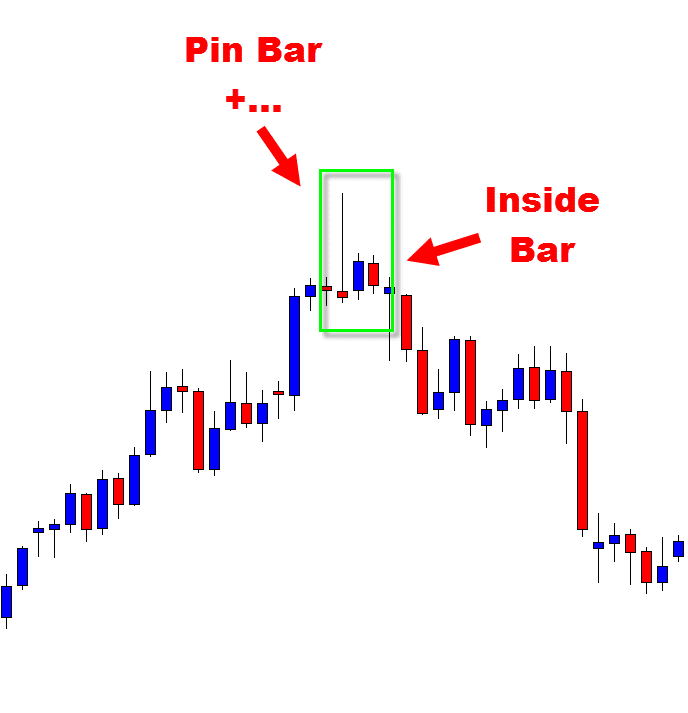

See Pin Bar + Inside Bar Combo Setup below:

Below is a chart example showing;

1st: a Pin Bar + Inside Bar Combo setup

2nd: ‘Almost a Bullish Engulfing Bar (BUEB) + Inside Bar (IB) Combo

3rd: Bearish Engulfing Bar (BEEB) + Inside Bar Combo

Check out an example of a combo setup from a setup I posted in the weekly chart ideas at JPN225 Index had fired off a Pin Bar + Inside Bar Combo Setup.

Wind Ups

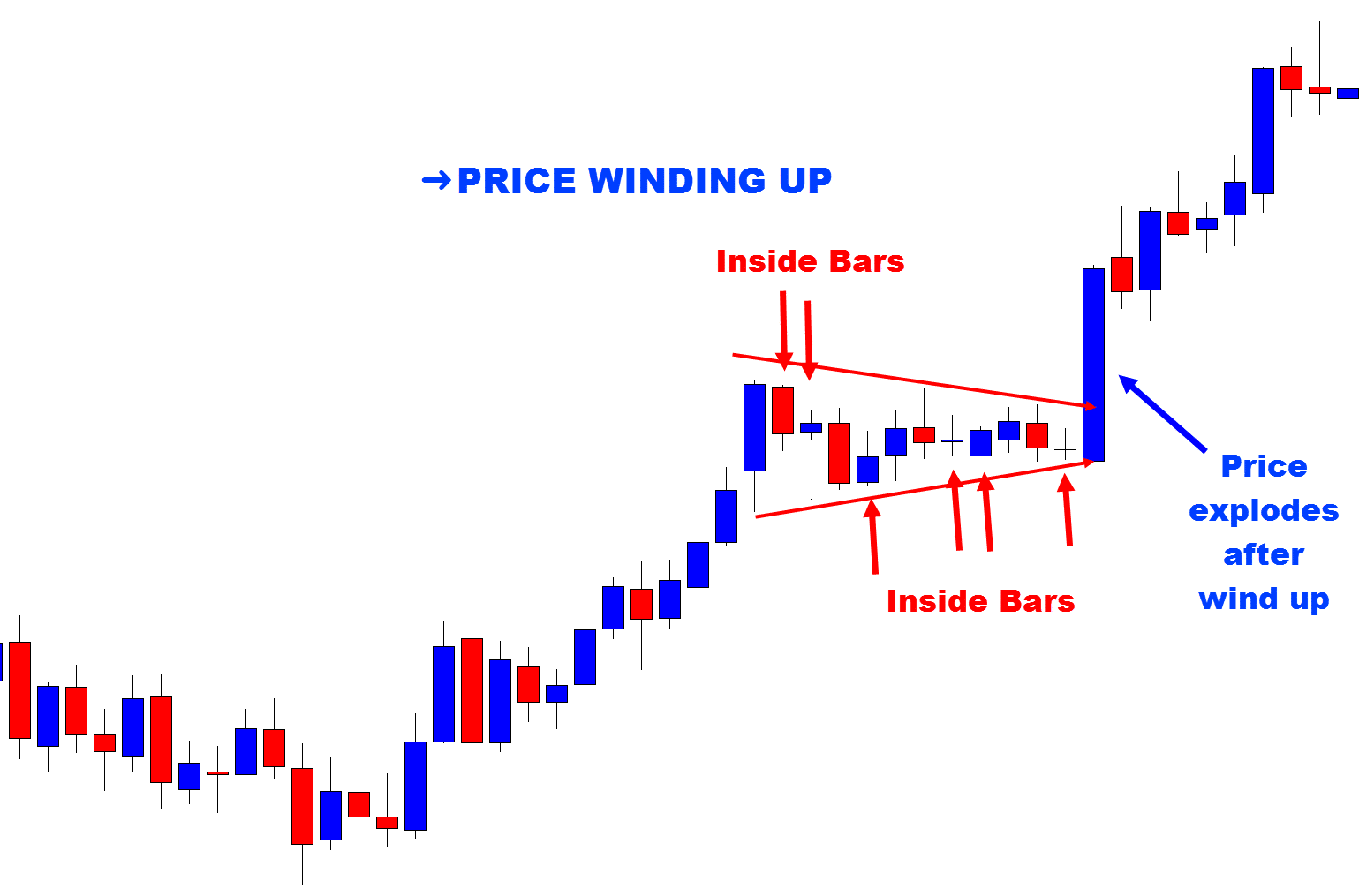

You are often going to find that you will place your entry and price will then begin to start winding up tighter and tighter.

This can often be a really good thing, depending of course on what side of the fence you’re on and which way you’re viewing the price action.

A wind up of price action super tight normally means that a breakout is on its way. The tighter and tighter it winds up, the bigger and more aggressive the breakout tends to be when it does end up eventually occurring.

Whilst not always happening in this way, the more compressed a market gets, we often find that as price builds, so does the pressure on the eventual breakout when it happens.

A chart of how price winds up and then explodes with a breakout is below. Note; the inside bars within this winding up period;

This is important for you to not only know and note, but to have written in your trading plan and rules. For example, if you have you order set to enter, and price has not been entered for 10 days, do you let price continue?

If your entry orders are still open after 10 days, but price has not been past your stop point, at what point do you cancel the entry order? These are things you cannot just make up as you go along.

Recap

It is super important with this strategy that you always take the break of the lows and do not try and take short cuts. When you try and take short cuts you always get your always get burnt.

There are no free lunches, and those who commit and are willing to go the extra yards always seem to have more luck for some reason.

If you want to speed up your learning curve, then download a Free Demo Trading Accountand practice this and all of your trading strategies.

Just like a golfer practices their putting, you can practice your Forex swing until you’re ready to go out with a group and play in a cash tournament!

If you have any other questions or you need anything else at all, just post them in the comments section below.

Safe trading,

Johnathon

As the famous golfer Gary Player once said, “The more I practice the luckier I get”!