Price Action Entry Rules: How to ‘Enter’ at the Break

Where you enter your trade can have a massive impact on whether you come out a winner or a loser.

Entering a trade straight into a key support or resistance area or where the big market players are just about to take profits is a sure way to stacking the odds against your trade and blowing your trading account up for the long run. There are ways to cut out a lot of the losses and make price action entries that are more high probability and that’s what this article is going to go through.

Using Confirmation – Taking Entry at Break

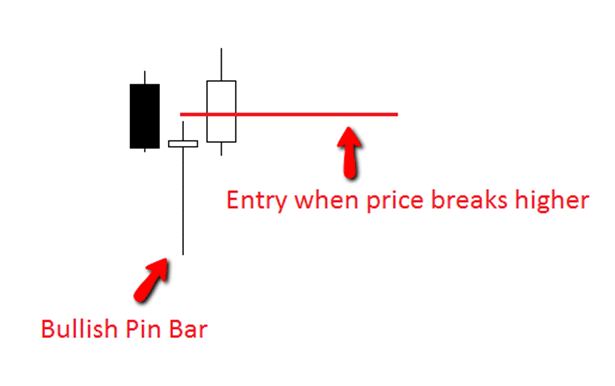

There are many powerful price action signals, but for the ease of explanations and because the pin bar is so popular among traders I am going to use the pin bar as the price action signal in the demonstrations.

The pin bar can be a really powerful price action signal when it is traded correctly. Over the last 10 years and especially the last five years, it has become a super popular candlestick for traders to use as an entry signal.

A major problem a lot of traders are running into when trying to make the pin bar profitable is that they are both trading them from the incorrect positions, which I speak about in-depth here in this tutorial: Where traders keep going wrong with the pin bar and because they are entering the pin bar before it has been confirmed which is making it really hard for them to make it a profitable trading signal.

Confirming Trades With Break Higher or Lower

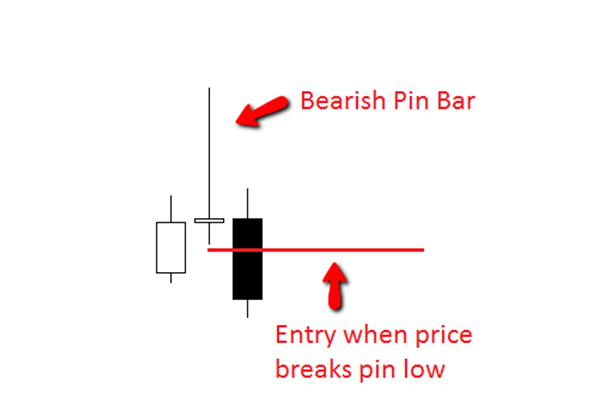

The pin bar is not confirmed until it has completely finished closing and then the next candle has gone on to break the low or high of the pin bar.

The most important rule and most basic rule that traders must follow if they are pin bar traders is that the pin bar MUST be closed before setting orders to enter. The worst thing a trader can do is try and be clever and think they will outsmart the market and get in whilst the pin bar is still forming.

If the pin bar has not finished forming the trader cannot know where the high or low is for sure and not know where they will need to set their orders for entry. This will make more sense in a minute.

After the pin bar has finished forming, the trader will then be able to work out where the high or low of the candle is and be able to work out where to set the entry.

The pin bar is not confirmed until price has broken through and moved through the low or high of the pin bar. This can often be quite confusing for new traders, so I have put pictures below to help illustrate. If you have any questions, put them in the comments below and I will answer them to clear any confusion.

Where most confusion comes in is traders often mistakenly think price has to close through the high or low of the candle and this is not the case. Price does not have to close in the next candle, it simply has to trade through the low or the high of the pin bar to activate the entry and when it does the trade entry would be opened via a pending order which will be discussed below.

As soon as price moves through the high or low of the pin bar, the pin bar is confirmed and the entry is taken. The candle does not have to close, it simple has to move past the high or low. See pictures below:

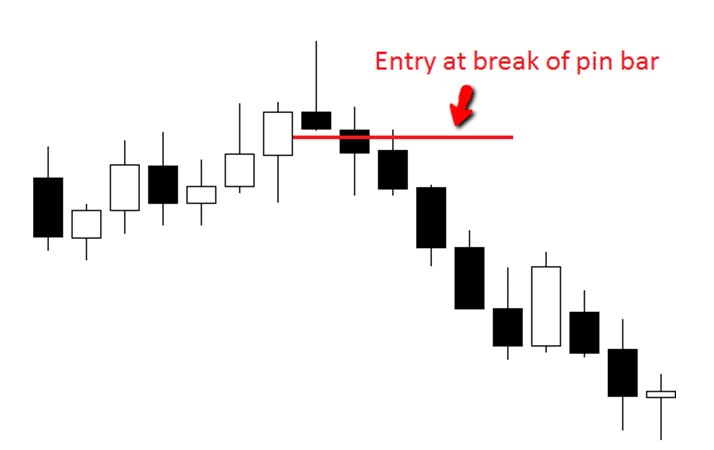

The chart below shows price breaking below a bearish pin bar. The trader taking this setup would have been entered into the trade once price moved below the low of the pin bar and confirmed the pin bar.

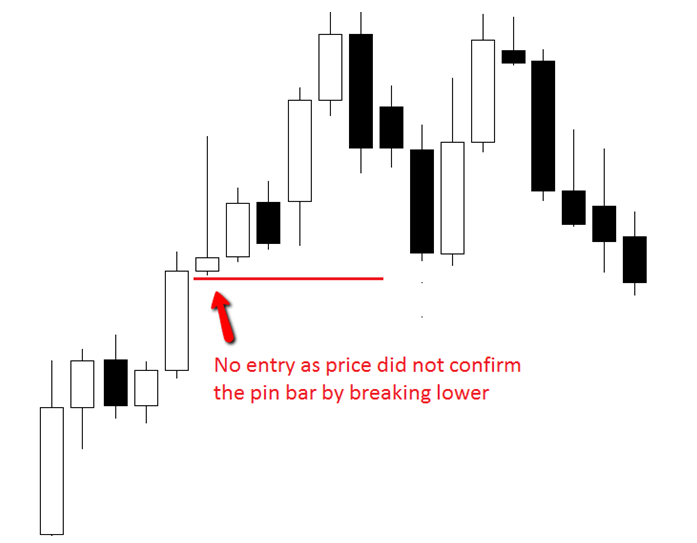

The chart below shows that price did not break below the pin bar and the trader would not have been entered into the trade and would have avoided a full loss.

How to Use Price Action Entry Rules on Other Setups

Taking the break and using confirmation is not just used for entry on the pin bar to increase win rates and cut out losses, but for many price action signals. Another very powerful price action signal where losses can be cut out and the win rate increased with taking the break is the engulfing bar.

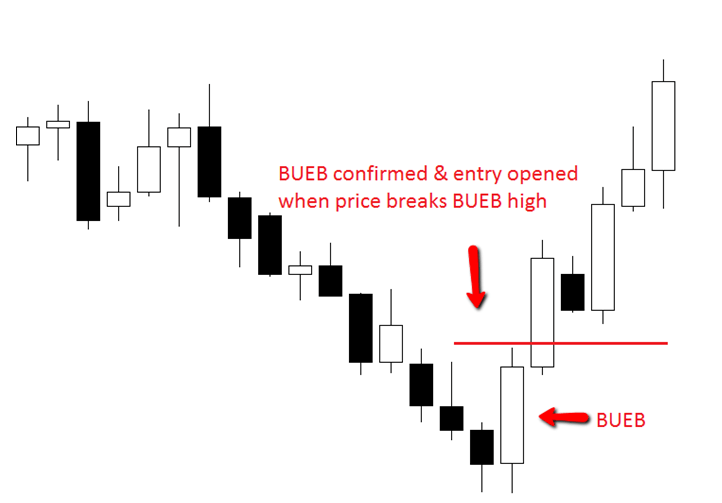

The same method applies with taking the break on the engulfing bar. See the picture below: Below a Bullish Engulfing Bar (BUEB) has formed and the trader using this method would take entry when price confirms the BUEB once price moves above the BUEB high.

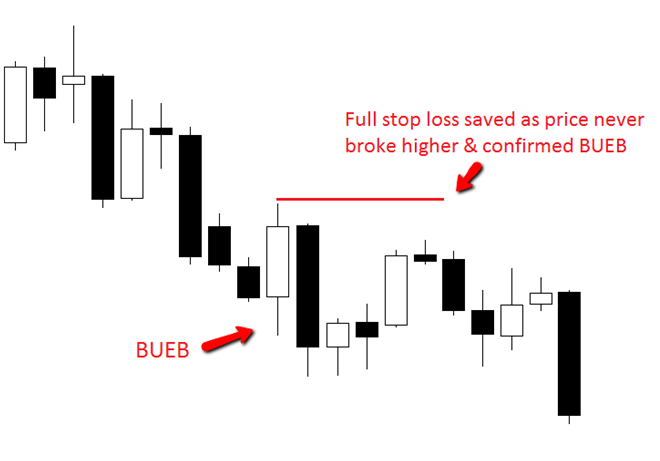

In the chart below; price does not confirm the BUEB and does not break the through the high. The trader playing this setup would be saved a full stop loss because their entry would have not been triggered.

Important Note: Price does not always go on and confirm the price action signal straight away especially with reversal signals such as the pin bar and engulfing bar.

It can sometimes take time for price to build up the required orders to push price in the opposite direction to confirm the trade.

This is often when traders will get jumpy for no reason and start looking for reasons to pull their trades and do things they wouldn’t normally.

They will start looking for excuses to over manage and micromanage their trades and to even take their entry off all together. Unless something has completely changed from when you first put your trade on, which is extremely rare, the market can take time to do what it has to do. You have to remember you put your trade on for a reason.

Setting Pending Orders

The best traders are the ones who let the market come to them and don’t stress over every little move that happens. The best orders that Forex & Futures brokers have are the “pending orders” because it allows the trader to know they don’t have to be at their computer and they can still be entered into a trade or have their stops/profits executed for them.

Setting pending orders is the best way to get into trades at the break of price action trades.

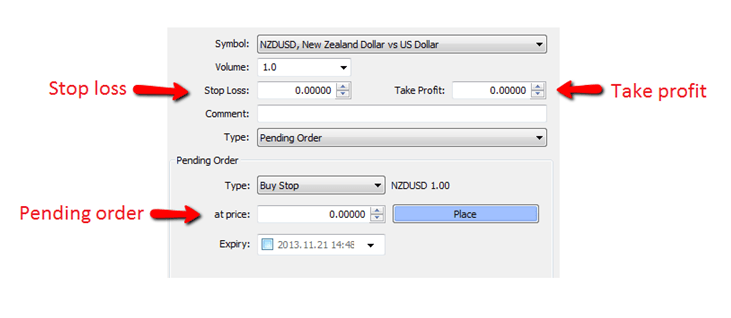

Using MT4 or MT5; traders can set up a pending order to enter a trade at the break whilst at the same time setting their profit target and stop on the same trade. The picture below shows how using MT4 a trader can set up a whole trade using pending orders.

Using a pending order the trader would wait for the price action signal to completely finish forming and then close. The close of the candle is crucial.

Nothing can be done and no orders can be set until the candle has closed. Once the candle has closed, the trader finds the high or low depending on whether the price action signal was bullish or bearish and then sets the pending order. The trader will then set the pending order for price to trigger them into the trade once price moves above or below the low or the high of the price action signal.

The trader can also set their stops and first targets whilst setting these pending orders. If the trader does not want to set any targets they need to at least set their stops in place for all trades. EVERY trade should ALWAYS have a stop in place.

When setting orders to enter trades with pending orders, the order types to enter will always be stops. If you are looking to go long with a pending order you will be buying with a “buy stop” and if you are looking to sell with a pending order you will be selling with a “sell stop”.

Risk Reward Scenarios

A question I get asked a lot when new traders are just getting their head around not taking random retrace entries and using confirmation, revolves around risk reward (Risk/Reward is the amount the trader is Risking – Risk, compared to how much they are making – Reward) ; “Won’t taking entry at the break make my risk/reward smaller?”.

Basically the answer is yes, but it will take out a lot of the losses you never should have been taking on in the first place that are eating away at your account for no reason. One of the biggest myths that go’s around the internet is about risk reward and it gets spread from one unprofitable trader to the next.

At some point each trader has to stop and ask themselves when they are not making money and they are still striving for these massive risk reward trades; what is the point of hitting really high risk reward winners if I am not a profitable trader and not making any profits at the end of it all? You can read more about the myth or risk reward here: The Myth of Risk Reward

Taking the break and using confirmation will mean your potential risk/reward will be smaller, but this is more than made up for with the increased win rate and the losses that use to cripple your account no longer occurring. In other words; when you take entries via a retracement method you are ensuring that you take every losing trade, where as if you take the break you are cutting out all the trades that never go onto confirm.

The aim in the Forex trading business is not who can hit the biggest winning trade. The one and only aim in Forex & Futures trading is to make a profit consistently.

It does not matter if you make a massive 20/1 risk/reward winning trade or a 20 times your risk winning trade. If you lose money at the end of the month or end of the year, that winning trade counts for nothing. If that massive winner still doesn’t cover your losses then your business is not making money. What does count is when you make consistent profits and you keep those profits.

Live Pin Bar Video

The video I have attached below is a live 4hr pin bar trade I played where I discuss why the trade is a A+ high probability setup, how I enter it at the break of the pin bar and how I am looking to manage it. After reading this article I recommend traders view it to cement what they have just learned. To watch the other video lessons and live trades see here: Forex School Online Videos

Recap

Entering at the break is just one entry method and something you should consider testing if you are continually entering into false breaks or are not having much success with what you are using.

The best place to try any new method or technique is on a free demo account. On a demo account you can apply and test out new techniques to see if a method works for yourself whilst at the same time getting use to using new orders on the MT4 platform.

You can download the correct free New York Close demo chart HERE.

Safe trading and all the success,

Johnathon

Leave Your Comments and Questions in Section Below;

Send me pdf on amail please

Hi Moses,

if you click the print button at the end of the post it gives you an option to save as PDF.

hello Jonathan, when trading the breaks how do you set target profits?

Hi Teboho,

checkout these; https://www.forexschoolonline.com//forex-trade-management/ and https://www.forexschoolonline.com//increasing-your-profits-with-trade-management-planning/

Johnathon

Hi Johnathan , I’m Moro and I always get to trade in the wrong direction because i sue 4hr time frame to trade 30m time frame . MY question is how do I do correct analysis using the 4hr to trade either 30m or 1hr time frame ….. reply me when you get this message .

thank you…..

Hi Moro,

checkout this lesson here https://www.forexschoolonline.com//ultimate-guide-marking-support-resistance-price-action-charts/ and let me know any questions.

Johnathon

Great article! I am sure many that many new traders will find this useful. I would also add more stuff like indicators and other tools but price action is definitely great. Good job!

TradingView likewise supplies free futures graphes, and also a comprehensive collection of

stock charts and quotes.

hello John

I want to know what the difference the “buy stop” and “buy limit” orders.

Senzo

Hello Senzo,

A Buy Limit order is an order where price is below your order placing point and in Buy Limit order, price is above your order placing point. Usually breaks of pin bars and other patterns are taken by the Buy Stop Orders. I hope I have answered your query.

Jonathan,

Thank you for creating such a fabulous website. Your strategy of waiting for A++ setups, how to trade pin bars, support and resistance, trade management, profit targets and trading psychology are truly a benefit to the trading community. Keep up the excellent work.

Hey thanks Donald!

Thank you for you on going support and really kind words!

Johnathon

Hallo

Great article. Just one question. When you look for confirmation sometimes the next candle, as still forming, finally confirn the previous signal, let’s say the pinbar, and you jump in to the trade.

And suddenly the same candle starts going to the opposite direction as still forming and the confirmation is no longer valid.. but now you are in the trade. What would you do then?

Thank you

Nikos.

Hello Nikos,

the pin bar or other price action trigger forms, you set your entry signal at the high or low depending on whether the signal is bearish or bullish and then if price breaks you are entered into the trade.

If price then retraces, it is the same as any other trade when price goes against you; you have your stop in place before you entered the trade at a strategic place enough where price can breath to give your trade space to work out and you let price do it’s thing.

Price never moves in straight lines up or down so you need to be able to let price have room to reach it next target. If you need anything else let me know.

Johnathon

Thank you Johnathon ,for your quick response.

I guess you let the stop loss order in place and if price goes against you ,you must accept your loss..it’s wrong to move your stop loss order to the next support level, to avoid hit the first stop loss order ? I ask that because i did that some times and finally i lost more money ,because i moved my stop order to the next level.

Thank you again. Your advices are really usefull and very inspired in the psycological level.

Nikos.

Hallo.

Great article..just one question. When you look for confirmation sometimes the next candle ,as still forming, finally confirm the previous signal,lets say the pinbar, and you jump in the trade.And suddenly the same candle starts go to the opposite direction as still forming and the confirmation is no longer valid.. but now you are in the trade. What you do then?

I am very confused about to putting my stop loss.I am follow this but i am don’t understand where i am put my stop loss can you help me about this please sir.

Great post and video Jonathon. I really like the way you use trading discipline and patience to wait for your high percentage trading set-up.

great article boss. great teacher j. fox, thanks a lot. i am your big fan……….

learn about strength and weakness!!!! your trading will be much better!!!

Nice article johno. Keep up the good works. one strong argument PA tutors normally put forward for taking retrace entries on PB is when the pin is very huge and large, which will require a massive stops. The logic is usually that price will often retrace before moving to the desired direction once it is taken at the correct level. Of course it sounds logical since it will tighten stops and increase rewards. I have always believed that until i started reading your articles. I still always battle with the thoughts of taking retrace entries on PB. I believe with time i will fully make adjustment psychologically as well. Many thanks for the article.

Thankx Johnathon. I was suffering from where to enter a trade. Just read your wonderful article and got all the answers. God bless you. You are helping traders, especially new traders like me.

One question:

When a confirm Price action Pin Bar forms, which one you would prefer most:

1. Pin Bar within the trend

2. Pin Bar against the trend

Which one is more reliable and profitable? I’m setting up a plan for me and planning to not go against it any how. Your answer will help me a lot to set up my plan.

With best regards

Babul Akhtar

Hello Babul,

I am always looking to trade with the trend in my favor and trending markets are the easiest to trade. This is also why we advise new trader to stick to trending markets. In saying that range and counter trend markets, whilst being trickier to trade can also be good markets to trade and traders need to be able to trade and manage trades in all types of markets.

Johnathon

CAN YOU KINDLY EXPLAIN ME THE 4Hr CHART OF GOLD AND SILVER WITH THE PIN BAR FORMED FRIDAY?

THANKS

BABU

thanks mr johnathan on article and great signal.thaks so much

Hi Johnathon,

I wonder, whether you trade Daily and 4H TF (or even 1H) separately.

Personally, I have two profiles in MT4, one with only Daily charts to trade daily setups and second with only 4H charts with levels from 4H.

So at my second profile with 4H charts, I’m trading regardless the Daily TF, I can say that I don’t care about what is happening at Daily.

The other approach I’m thinking about, is having just one profile with Daily TF with marked zones and when the market approach these zones, I can switch to 4H (or 1H) for a possible setup and try to trade the Daily trend for “better” prices.

I believe you understand what I mean.

PS. Do you care about weekly TF or even montlhy TF? I mean, whether you are counting with W or M S/R levels while trading Dailies and 4H.

Thank you,

Tom

Hello Tom,

I have one profile and the reason for that is because is because I use my daily levels to make my intraday trades. The daily key levels are the best levels to play trades on for all time frames and this is often where trades go wrong looking for intraday trades. They will go to their 4hr/8hr or even 1hr charts and look for support/resistance on these smaller charts and because there are so many more levels on these smaller charts they end up taking trades from weaker levels and end up getting into trades from horrible levels. It is far better to make intraday trades from key daily levels.

Instead of having a bunch of different profiles, you can just have the one and leave the one profile on the daily chart with the daily chart marked up with the key levels where you are hunting for trades. When price approaches these key levels you can then start to move down the time frames and start flicking through to start hunting for price action signals.

I think you will really find both of this of use: https://www.forexschoolonline.com//manage-forex-trades-using-key-price-action-time-frames/ – https://www.forexschoolonline.com//daily-routine-of-forex-futures-trader-johnathon-fox/

If you need anything else just let me know.

Johnathon

Hello Johnathon,

Do you use weekly and/or monthly TF key levels (e.g. when you trade the daily charts)?

Thanks.

Tasos

Hello Tasos,

I don’t trade the monthly charts at all and I do trade the weekly charts, but I trade them as individual charts as separate charts and individual time frames.

I am always looking for trades at key daily levels on either the daily charts or lower time frames and this is because anything longer time frame and the length of trade becomes too long.

You could use the same method to look for trades on the daily chart from a key weekly area as long as you are using the longer time frame and never a smaller time frame and as long as you never use multi time frame analysis for trends.

Trends are something that is analysed on each individual time frame because each chart has their own trend.

Johnathon

We have heard that sometime the breaks are false. So, can you guide how should we identify that this is break is for entry or it is a false break.

Hello Mohammad,

The major risk of false break comes when you are taking continuation trades i,e trades such as inside bars breaks when they break out one way and then snap back the other. The psychology is completely different with reversal trades such as pins or engulfing bars because you are entering with the false break on your side. An example is the pin bar; price moves one way and snaps back the other to create the false break and we enter back the other way in the direction of the false break to complete the false break pattern. You can read more about how the pin bar is created with order flow here: https://www.forexschoolonline.com//reading-order-flow-with-price-action/

Johnathon

Great article as always.